Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- assetmanagement

- ESG

- Middle East

- UK

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

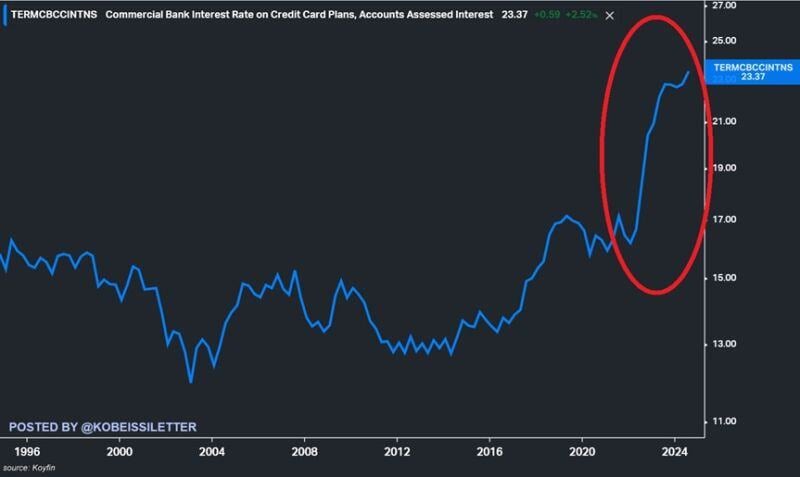

US credit card interest rates hit 23.4% in August, a new record.

Over the last 2 years, rates have soared by 7 percentage points. US consumers now have a record $1.36 trillion in credit card debt and other revolving credit meaning they pay a massive $318 billion annual interest. To put this into perspective, Americans paid just half of that in 2019 at ~$160 billion. Meanwhile, credit card serious delinquency rates are at 7%, the highest level since 2011. Source: The Kobeissi Letter

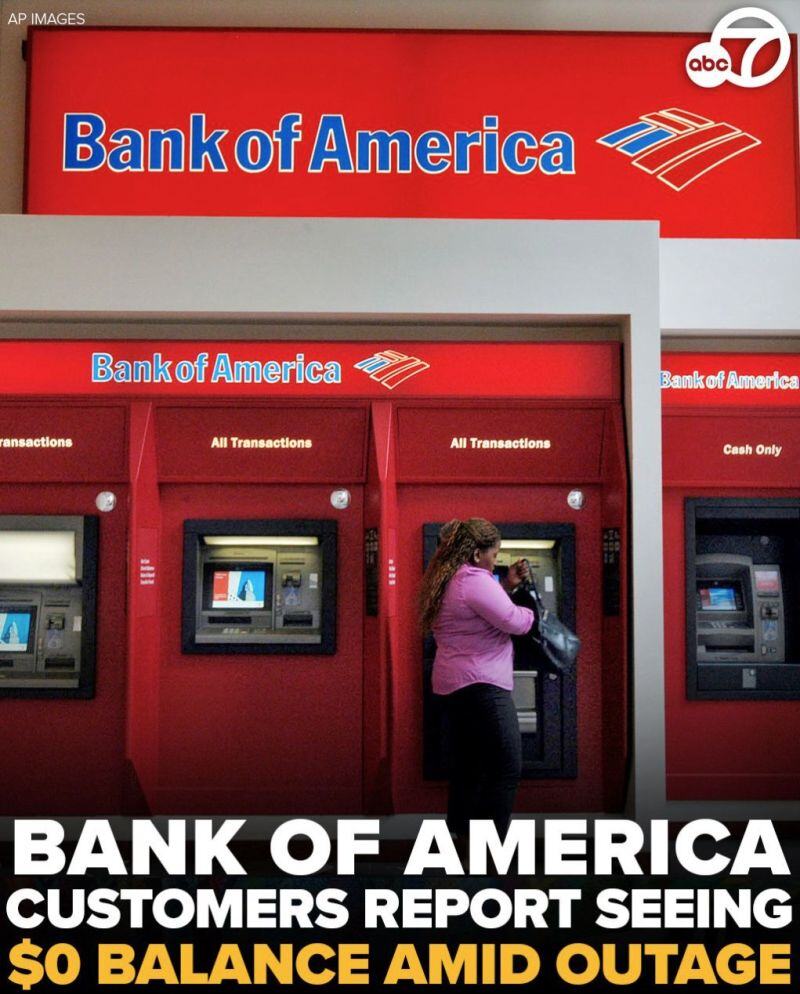

🚨 BANK OF AMERICA OUTAGE LEAVES CUSTOMERS UNABLE TO ACCESS ACCOUNTS, SPARKS PANIC🚨

Bank of America customers experienced a major outage on Wednesday, with many unable to access their accounts or seeing $0 balances. The issue, reported on Downdetector, began around 12:45 pm ET. While the bank's app stated accounts were "temporarily unavailable," users flooded social media with concerns. Bank of America has yet to clarify the cause or confirm if funds were at risk. Source: Downdetector thru Mario Nawfal

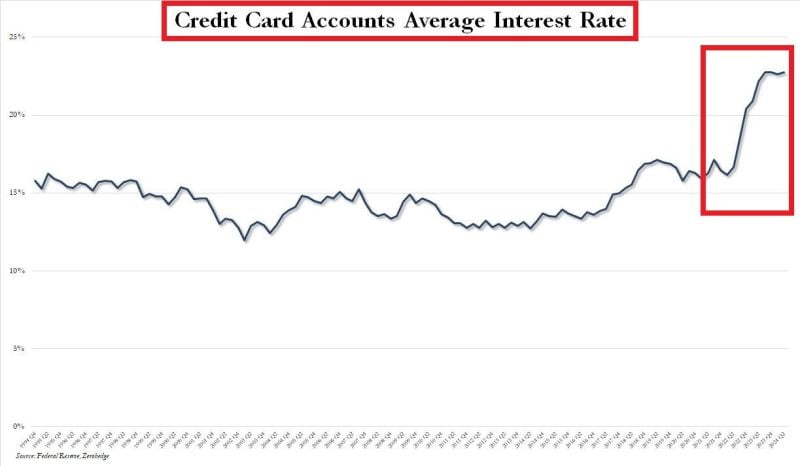

US CREDIT CARD INTEREST RATES ARE AT ALL-TIME HIGHS

US credit card rates remain at record highs of ~22%. US credit card debt is now ~$1.14 trillion, also at an all-time high. This means Americans pay ~$250 billion in average interest payments on credit cards a year. Source: Global Markets Investor

UBS is ahead of schedule on cost savings according to CEO S. Ermotti

Source: Reuters

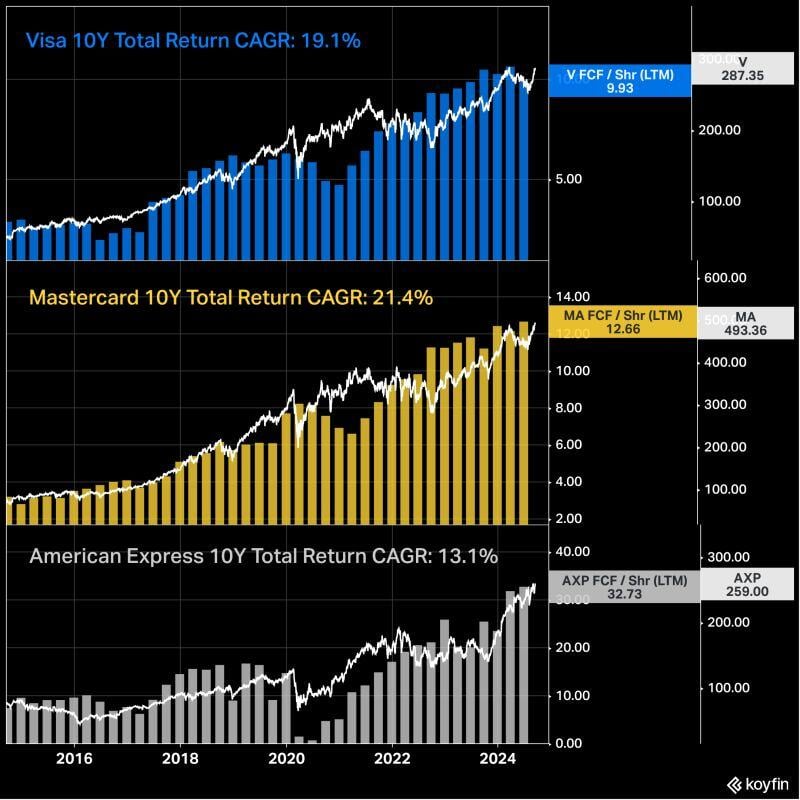

Visa, Mastercard, and American Express' FCF per share and share price over the last decade.

10Y Total Return CAGR: $V Visa: 19.1% $MA Mastercard: 21.4% $AXP American Express: 13.1% Source: @KoyfinCharts

Keep this one for the difficult times...

Source: Andreas Steno Larsen, FT

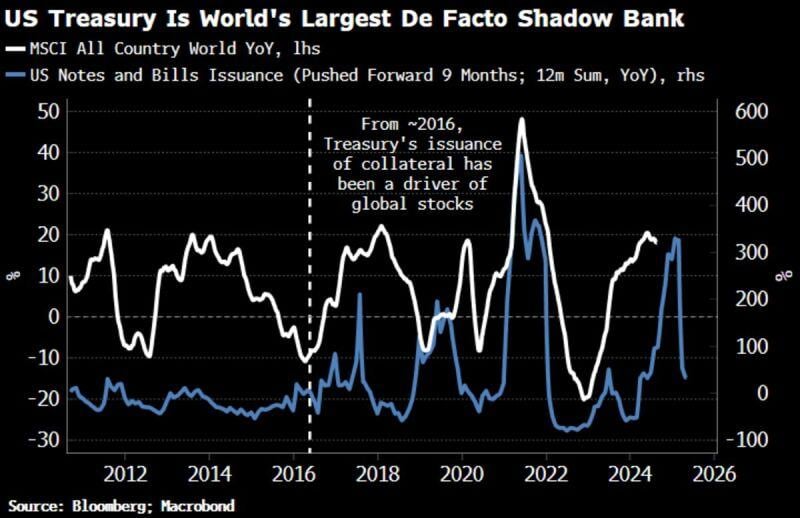

The US Treasury has become a key driver of stocks and other asset markets through its pro-cyclical issuance of debt and the increasing depth and liquidity of repo markets

Writes net treasury issuance leads global equity prices by about 6-9mths due to repo markets. The rise in the volume of collateralized lending, i.e. repo, facilitated by the increase in the supply of USTs is increasingly influential for the behavior of asset prices. Source: HolgerZ, Bloomberg

BREAKING 🚨: Chinese Banks

40 Chinese Banks vanished during a single week in June Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks