Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Swiss Watch Exports Dip Again in February

After a brief rebound in January, the downward trend for Swiss watch exports resumed last month. According to the Federation of the Swiss Watch Industry, overall exports fell 8.2%, with 102,000 fewer watches shipped . The decline was broad-based across key markets and price segments: Mid-range watches (CHF 500–3,000): -15.4% High-end watches (> CHF 3,000): -7.3% Entry-level watches (< CHF 200): The only category to post a positive result. source : swissinfo

➡️ The Swiss National Bank snb lowered its key policy rate by 25bp to 0.25% today, as it was widely expected.

This rate cut follows the slowdown in inflation observed in the recent months, down to +0.3% in February. Low ongoing inflationary pressures, and the fact that inflation is now at the very bottom of the 0-to-2% target range of the SNB, warranted this additional decline in short-term interest rates. Indeed, with the SNB key rate at 0.25%, short-term real rates are brought down a marginally negative level that will help alleviate deflationary pressures and upward pressures on the Swiss franc. As such, monetary policy can be described as moderately accommodative, a stance appropriate to the combination of low inflationary pressures and moderate economic growth in Switzerland. ➡️ Looking ahead, expected developments on inflation and economic activity suggest that the rate cut cycle initiated a year ago is now completed. The 150bp decline in CHF short term-rates over 12 months, in parallel of the decline in inflation, has helped supporting economic activity and stabilizing the level of the Swiss franc. Inflation is now expected to stabilize in the coming months and even slightly pickup at the end of the year (toward +0.6%) and in 2026 (+0.8%). In the meantime, economic activity is projected to gradually improve, supported by higher real income for households due to the low level of inflation, and by more accommodative financing conditions. The stabilization and even slight pullback of the Swiss franc also removes a headwind for Swiss exporters. ➡️ However, the outlook is currently extremely uncertain for Switzerland and for the global economy: Potential tariffs on US imports from Switzerland and other European countries could significantly impact economic activity and confidence. They could also possibly revive upward pressures on the Swiss franc. Such scenario would eventually lead the SNB to further lower its key rate down to zero. The possibility of a return to negative interest rates cannot be ruled out in case of pronounced downward pressures on growth, along with upward pressures on the currency. However, such possibility would in our view require a significant deterioration in the economic environment. Moreover, the SNB is more likely to resort to interventions on the Forex market as a first option in case of unwarranted upward pressures on the CHF. Conversely, ongoing developments in the neighbouring Eurozone, and more specifically the prospect of a huge fiscal stimulus in Germany, could have a significant positive impact for Switzerland. and fuel firmer inflationary pressures, possibly paving the way for the SNB to adjust its key rate upward in consequence in 2026. ➡️ Our take >>> Today’s rate cut is likely to be the last of this monetary policy easing cycle for the SNB. However, we will continue to monitor both downside and upside risks to this scenario. Adrien Pichoud

Swiss Government Lowers Growth Forecasts Ahead of SNB Decision

The Swiss government has trimmed its economic growth outlook for 2025 and 2026, citing global trade tensions. SECO now expects: 📉 2025 GDP: 1.4% (previously 1.5%) 📉 2026 GDP: 1.6% (previously 1.7%) While growth remains below the long-term average of 1.8%, Switzerland is still expected to avoid a recession. This adjustment comes just before the Swiss National Bank’s policy decision on Thursday—a key event to watch. source : reuters

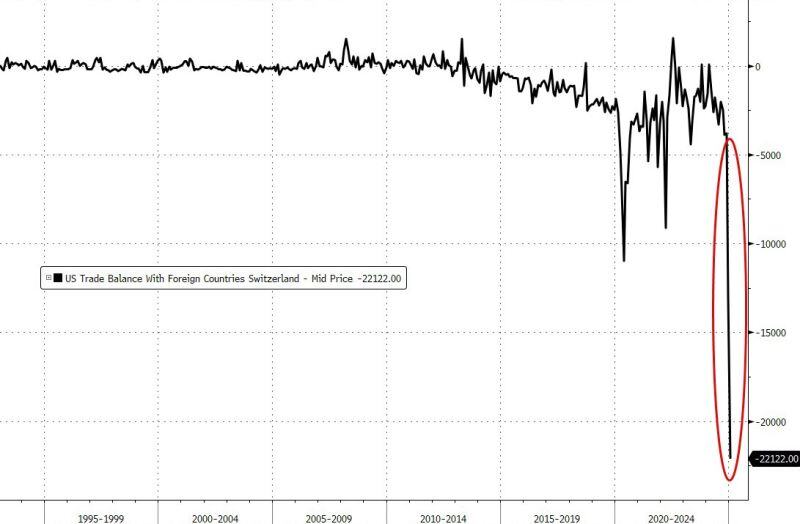

BREAKING: 85% OF SWISS GOLD EXPORTS NOW HEADING TO THE USA.

Gold exports from Switzerland rose year on year in January as supplies to the United States soared to the highest in at least 13 years and offset lower deliveries to top consumers China and India, Swiss customs data showed on Thursday. Switzerland, the world's biggest bullion refining and transit hub, alongside Britain which is home to the world's largest over-the-counter gold trading hub, saw a surge in gold transfers to the U.S. in recent months as President Trump readies wide-reaching import tariffs that some market participants fear could affect gold deliveries. The concern has widened the price premium between U.S. gold futures and London spot prices, attracting massive deliveries to Comex gold inventories. According to the Swiss data, gold exports from the country to the U.S. rose to 192.9 tons in January from 64.2 tons in December. This was the highest monthly amount of exports in the customs data going back to 2012. Trump has not mentioned precious metals are likely to be targeted at all, but since late November, when he pledged to impose tariffs on imported products from Canada and Mexico, 20.4 million troy ounces (636 metric tons) of gold worth $60 billion at current prices were delivered to Comex-approved warehouses. These deliveries raised Comex gold stocks by 116% to 38.0 million ounces, the highest since March 2021, and tightened liquidity in the London OTC market. Source: Yahoo Finance, Make Gold Great Again on X

UBS Group AG profit for the final quarter of 2024 beat expectations, aiding the Swiss bank in boosting buyback plans for this year to $3 billion.

Net income for the three months to December came in at $770 million, compared with a forecast for $486 million. Source: WSJ

On this day of 2015, the SNB (Swiss National Bank) discontinued the minimum exchange rate of 1.20 EUR/CHF...

This "quasi-peg" level never got revisited. Meanwhile, the 0.95 new support level does not seem to hold. Today we trade at 94 cents and many traders do have 90 cents in mind. And even much lower levels... Good luck... Source chart: Brian Reutimann

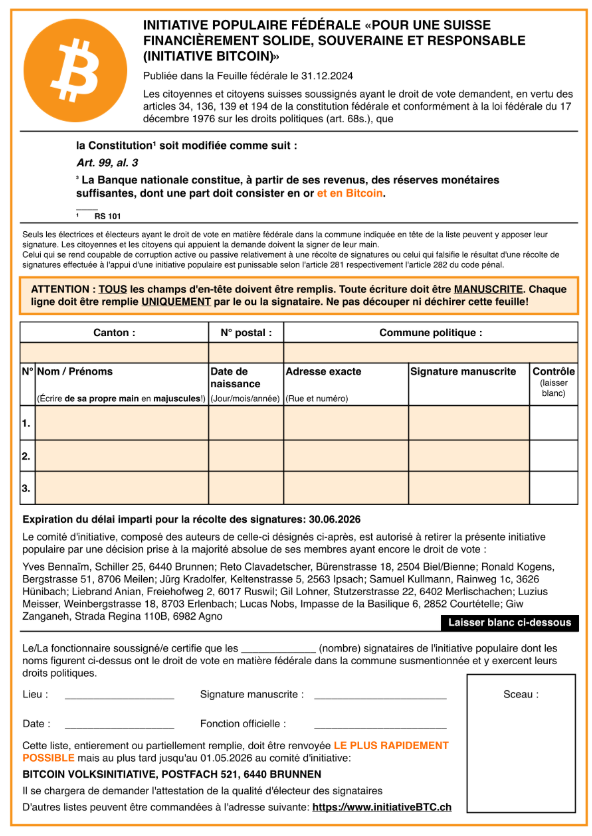

Swiss Bitcoin Initiative: Proposal Seeks to Add Bitcoin to National Reserves - see below some explanations by @BraveNewCoin

🔴Efforts are underway in Switzerland to amend the Swiss Federal Constitution to mandate the Swiss National Bank (SNB) to hold Bitcoin alongside gold as part of its monetary reserves. This ground breaking initiative, officially registered in the Federal Gazette on December 31, 2024, seeks to position Switzerland at the forefront of global Bitcoin adoption ‼️ 👉 The Proposal and Its Architects The initiative, titled “For a financially sound, sovereign, and responsible Switzerland,” was spearheaded by Giw Zanganeh, Tether’s Vice President of Energy and Mining, alongside Yves Bennaïm, founder of the Swiss Bitcoin nonprofit think tank 2B4CH. Eight additional Bitcoin advocates collaborated on the proposal, which requires 100,000 signatures by June 30, 2026, to trigger a national referendum. This threshold represents roughly 1.12% of Switzerland’s population of 8.92 million. 👉 If successful, the proposed amendment would revise Article 99 Paragraph 3 of the Swiss Federal Constitution to state: “The National Bank builds up sufficient monetary reserves from its own earnings; part of these reserves are made up of gold and Bitcoin.” 🚨 The official PDFs (and instructions) are here 👇 : if you are Swiss you can sign and send it back to BITCOIN VOLKSINITIATIVE, POSTFACH 521, 6440 BRUNNEN

Investing with intelligence

Our latest research, commentary and market outlooks