Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Swiss National Bank (SNB) halved its interest rate with 50bps cut,

in the current context of weak inflation, upward pressures on the Swiss franc and worrying dynamics in neighboring European countries. The 50bp rate cut is half-a-surprise for financial markets, that were not fully convinced of the possibility of such large movement and were rather pricing a 25bp rate cut. swiss franc initially weakened 0.5% vs the Euro. But it is already back to 0.93. OUR TAKE (based on our Chief Economist Adrien Pichoud views) 👉 Swiss CPI inflation has slipped below 1% in the 4th quarter of 2024 (+0.7% in November) and it is expected to slow further in 2025. The SNB expects inflation to hover just above zero (+0.2%/+0.3%) for most of next year before picking up slightly as 2026 draws near. By averaging +0.3% in 2025, the inflation rate would be at the very bottom of the 0-to-2% range that the SNB targets. 👉 As the Swiss economy faces headwinds from the strength of the Swiss franc and the weakness of economic activity in Germany and most other European economies, monetary policy has no reason to be restrictive and had to be adjusted. After today’s rate cut, the monetary policy stance is about neutral (with a real short-term rate close to 0%). 👉 Looking ahead, more rate cuts are to be expected in 2025. We expect the CHF short-term rate to be lowered to 0.0% by June next year, with 25bp rate cuts at the March and June meetings. 👉 Will Switzerland move back to NEGATIVE RATES? This is not our scenario at this stage, even if it wasn’t ruled out by Mr Schlegel recently. Potential undue upward pressures on the CHF will then likely be addressed with interventions on the FX market and a possible expansion of the SNB’s balance sheet size. It would require a significant deterioration in global growth and inflation dynamics next year for the SNB to be pushed back into negative interest rate policies. Source chart: Bloomberg

BREAKING: Switzerland passes legislation to study how Bitcoin mining can balance the grid and use wasted energy

[Dennis Porter] - Bitcoin Archive

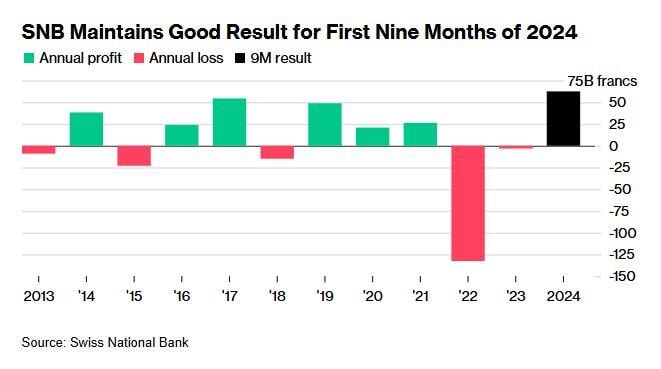

The Swiss National Bank made a solid nine-month profit on rising equities, bonds and gold prices, increasing the chances for a restart of profit distributions after a two-year break.

Switzerland’s central bank notched up a gain of 62.5 billion francs ($72 billion) for the first nine months of the year, it said on Thursday. Although the strong franc ate into the results, the SNB extended its profit during the July-September period. Source: Bloomberg

UBS is ahead of schedule on cost savings according to CEO S. Ermotti

Source: Reuters

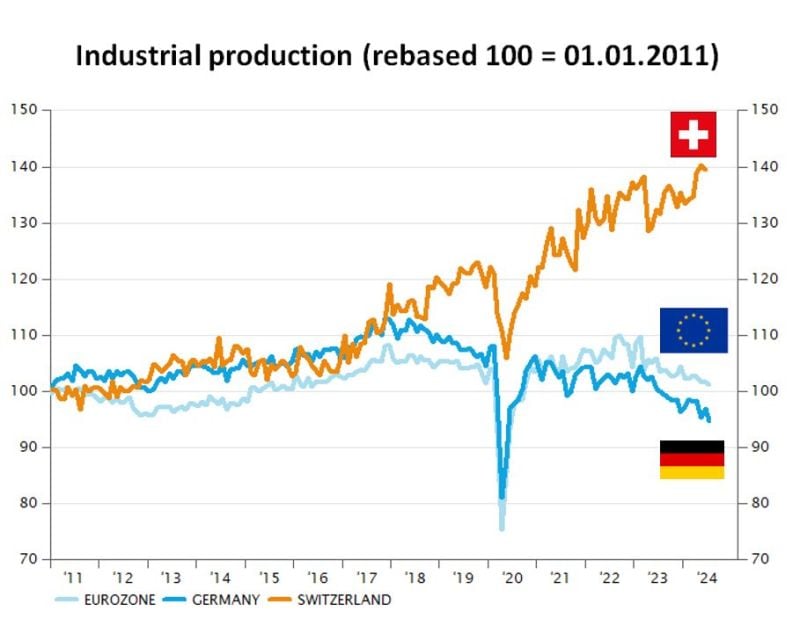

😱 The "shocking chart" of the day !!! 😱

Since 2011, the swissie is up more than 25% against euro. Despite this, industrial production growth in switzerland has INCREASED by 40% while it has DECREASED by 5% in germany and is roughly flat in the eurozone. Note the huge trend divergence since covid... HOP SCHWEIZ ! Source: Syz research

Saud Central Bank Secretly Bought 160 Tonnes Of Gold In Switzerland - www.zerohedge.com.

According to Jan Nieuwenhuijs via Money Metals (and published on zerohedge), the Saudis have joined other Asian countries in ditching their long-term sensitivity to the gold price. Evidence suggests the Saudi central bank has been covertly buying 160 tonnes of gold in Switzerland since early 2022, contributing to the current gold bull market.

Switzerland is considering imposing a tax on large inheritance targeting the super-rich

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks