Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Swiss inflation vs. German inflation.

The inflation rate in Switzerland is already well below the target of 2%. At 1.7%, it is a full 2ppts lower than the German rate. Source: Bloomberg, HolgerZ

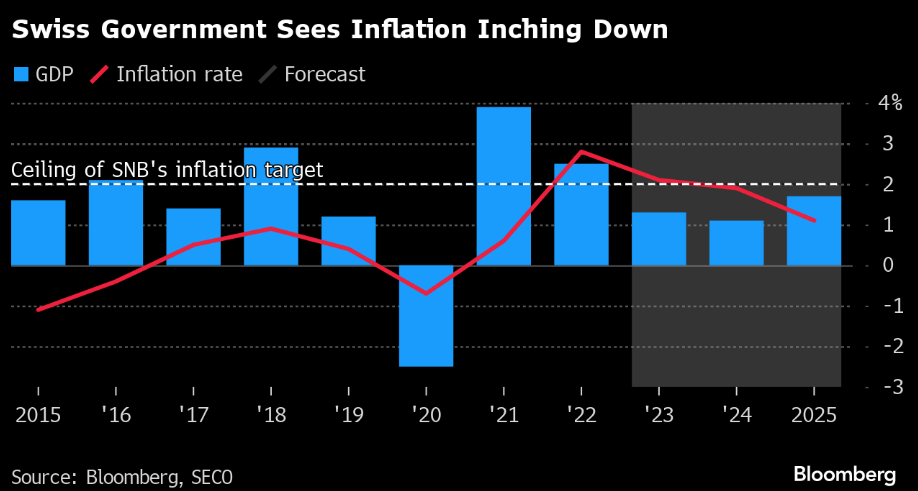

Switzerland’s inflation forecast backs SNB rate staying on hold

Switzerland’s government sees next year’s

inflation within the central bank’s target range, the latest evidence supporting a likely hold from policymakers this week. Consumer prices will grow at an annual 1.9% in 2024, in line with the previous forecast, the State Secretariat for Economic Affairs said on Wednesday.

Source: Bloomberg

The 10 Biggest Swiss Watch Brands 🏆by revenues

Source: Morgan Stanley

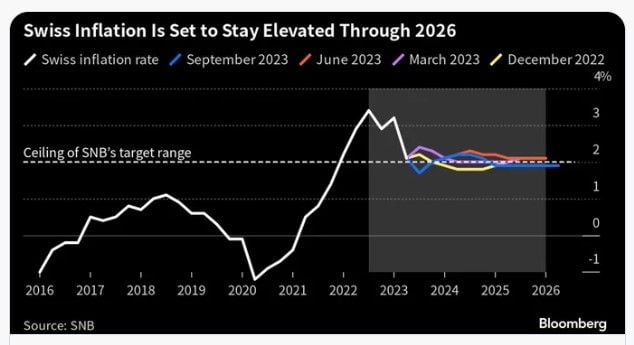

The Swiss National Bank pauses its monetary tightening, defying expectations of another interest-rate hike to avoid adding constriction on a stalled economy

- The SNB left today its key rate unchanged at 1.75%, debunking market expectations of an additional 25bp hike - The slowdown in inflation, the magnitude of the monetary policy tightening already implemented (CHF short term rates were still negative a year ago) and rising risks surrounding the global outlook underpin this decision. - Indeed, as inflation is within the SNB target (1.6%, in the 0%-to-2% target), economic activity is slowing down (0% GDP growth in Q2 2023) and the Swiss franc remains firm, the case for further tightening had turned much less compelling in the past few weeks. Unlike the ECB, forced to hike last week due to an inflation rate still much above its target, the SNB had very good reasons to pause today and adopt a cautious stance. - The SNB doesn’t rule out additional hikes in the future if warranted, but the combination of slowing growth in Europe (likely to dampen underlying price pressures) and of the strength of the currency are highly likely, in our view, to keep Swiss inflation dynamics in check in the months ahead.

SNB unexpectedly leaves policy rate unchanged at 1.75%.

The Swiss national bank unexpectedly leaves its policy rate unchanged at 1.75%. Market was estimating the probability of a 25bps hike at more than 70% yesterday.

USDCHF broke the 200 daily moving average of 0.9036 and now trading higher over 0.9060.

EURCHF also trading higher at 0.9650.

Credit Suisse bond investors plot lawsuit against Switzerland

A group of international bond investors is drawing up plans to sue Switzerland in the US courts for expropriation over the losses they suffered after the state-orchestrated rescue of Credit Suisse. The case is being brought together by law firm Quinn Emanuel, according to people familiar with the matter. Quinn Emanuel is already suing Switzerland’s financial regulator, Finma, over its decision to wipe out $17bn of Credit Suisse bonds when the bank was taken over by UBS six months ago. Lawyers at Quinn Emanuel are laying the groundwork to sue Switzerland in the US, where they believe there is a greater chance of convincing a judge to waive the country’s sovereign immunity rights. The suit could be filed by the end of the year, though it is not certain to proceed, according to people involved in the discussions.

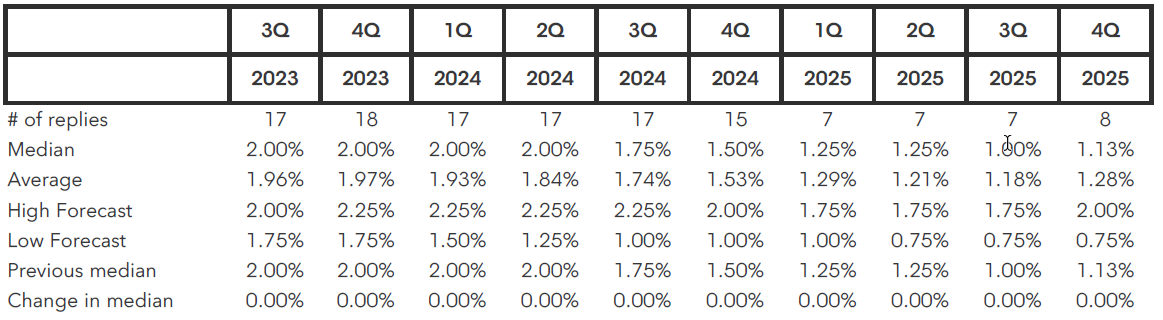

SNB Policy rate at 2.00% by end-Q3 2023 - Survey

The following table shows economists’ forecasts for Switzerland’s benchmark central bank rate as surveyed by Bloomberg News from Sept. 1st to Sept. 7th. All figures are as of the end of the quarter.

Current SNB Policy Rate: 1.75%

Sourcce: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks