Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Bitwise says a 5% capital rotation from gold to Bitcoin could send BTC to $242,391

Source: Bitcoin Archive @BTC_Archive

The performance gap between $QQQ and $BTC is widening again, and this time more dramatically.

Usually BTC and QQQ are mostly correlated until recently. Something has to give. Will QQQ go down to play catchup? Will BTC go up to play catchup? Will it be a blend of both? Source: Heisenberg @Mr_Derivatives

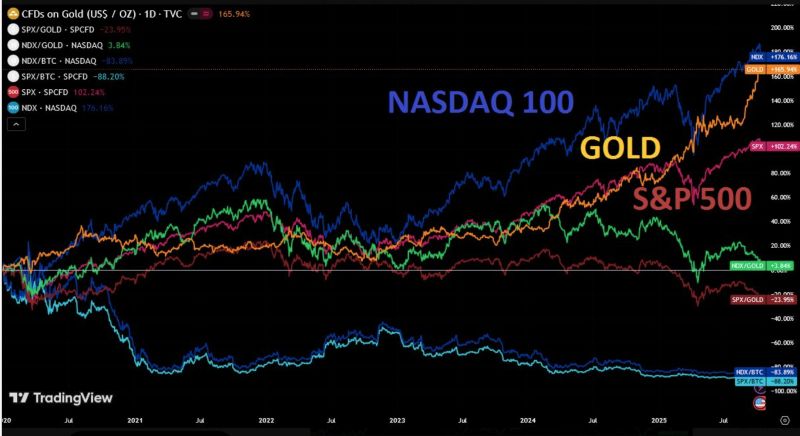

The "debasement trade", the decline in the purchasing power of USD, in one chart since 2020:

Bitcoin: +1400% Silver: +182% Nasdaq 100: +176% Gold: +166% S&P 500: +102% In gold: NDX +4%, SPX -24% In Bitcoin: NDX -84%, SPX -89% Source: Global Markets Investor @GlobalMktObserv

Investing with intelligence

Our latest research, commentary and market outlooks