Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

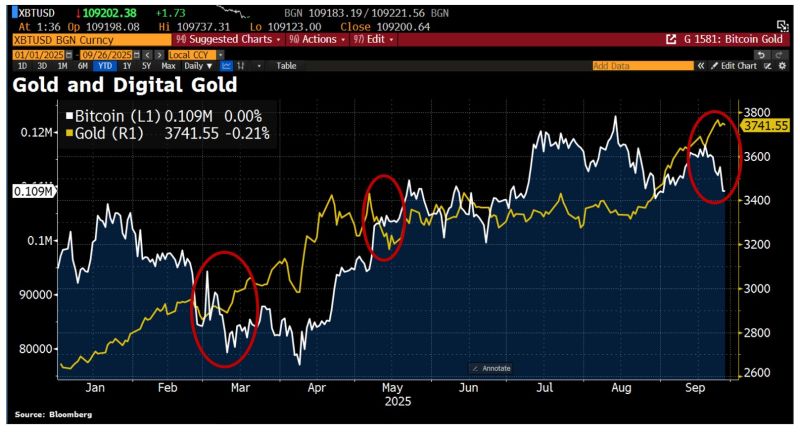

JUST IN: Swedish Parliament introduces proposal for a strategic bitcoin reserve 🚀

Another one 🔥

"MAYBE WE’LL PAY OFF OUR $35 TRILLION HANDING THEM A CRYPTO CHECK, A LITTLE BITCOIN"

Source: Documenting Saylor @saylordocs

JUST IN:

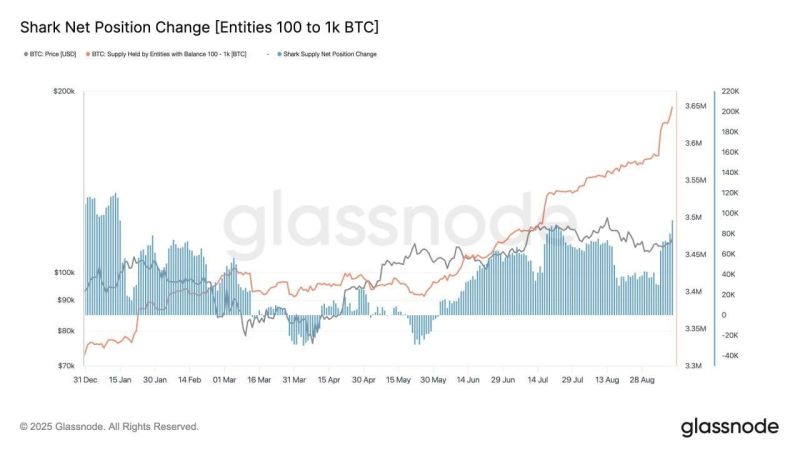

🦈 Bitcoin sharks (100–1k BTC wallets) added 65,000 BTC in the past 7 days. They now hold a record 3.65M BTC. Source: Glassnode, Bitcoin archive

BREAKING >>> U.S. CONGRESS HAS GIVEN THE TREASURY 90 DAYS TO MAP OUT AMERICA’S BITCOIN RESERVE PLAN!

Source: @ByCoinvo

Investing with intelligence

Our latest research, commentary and market outlooks