Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

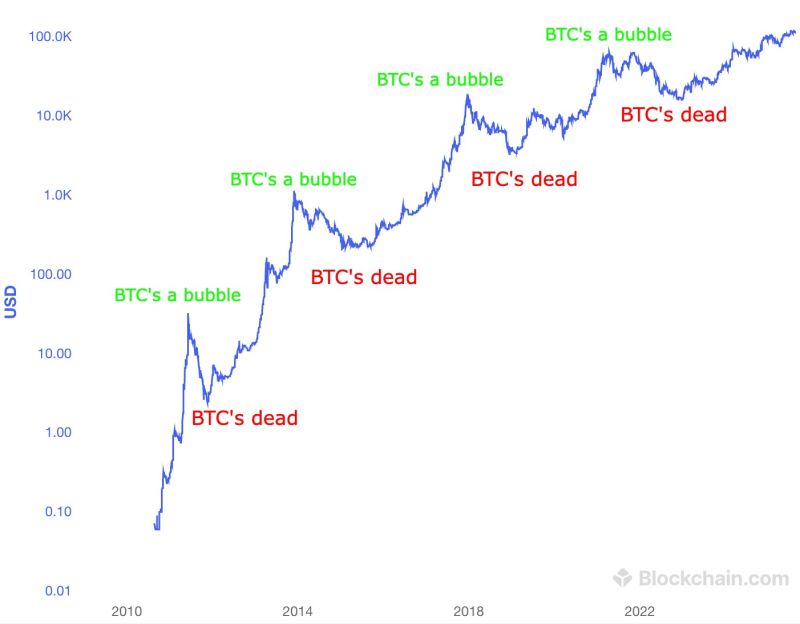

JPMorgan analysts believe Bitcoin ($BTC) is trading below its fair value as its price volatility falls to historic lows, narrowing the asset's risk-adjusted gap with gold.

Volatility in Bitcoin has slid from nearly 60% earlier this year to roughly 30%, the lowest level on record. Analysts led by Nikolaos Panigirtzoglou said this dynamic implies a fair value near $126,000, a target they expect could be reached by year-end, according to The Block. A major driver of the decline in volatility has been corporate treasuries, which now hold over 6% of Bitcoin's total supply. JPMorgan compared the phenomenon to the post-2008 bond market, where central bank quantitative easing dampened swings by locking assets into balance sheets. Source: Yahoo Finance, Coindesk

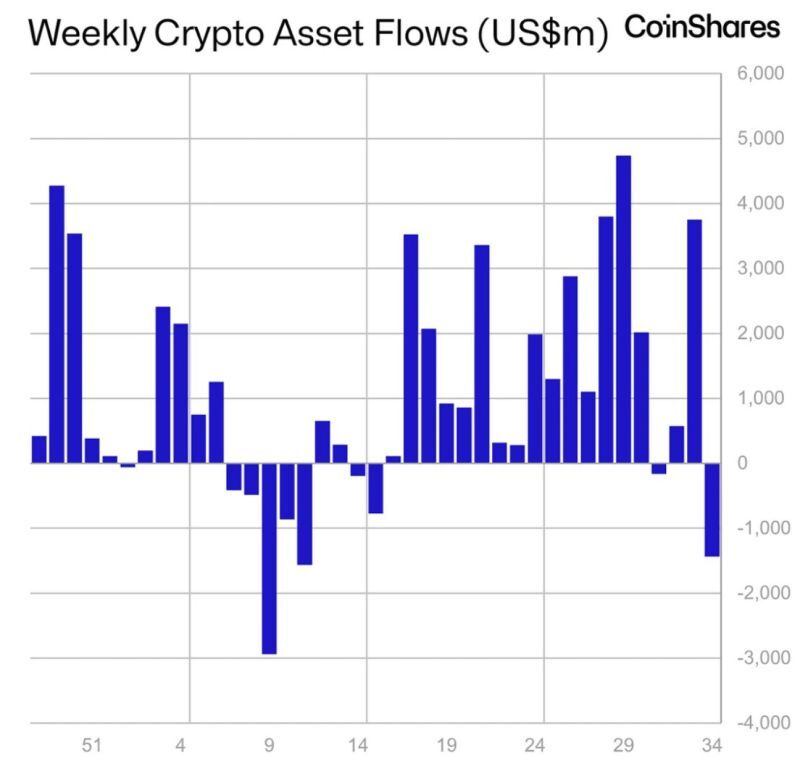

About bitcoin seasonality...

Good news for all Bitcoin holders: August is typically a weak month for crypto, so don’t panic if prices dip – it’s seasonal. The bad news? September tends to be even worse, with Bitcoin historically averaging a 5% decline in value. Source: HolgerZ, Bloomberg

A friendly reminder of bitcoin seasonality

Source: Ryan Rasmussen @RasterlyRock, Bitwise Asset Management

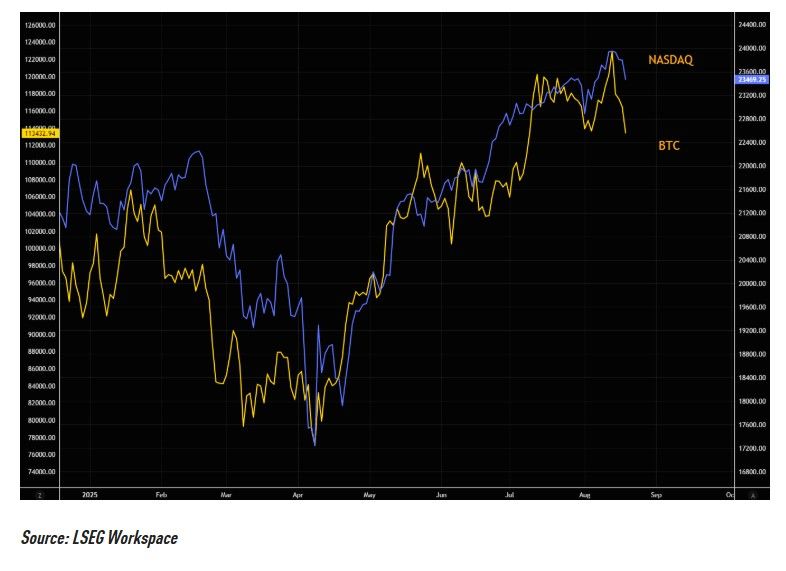

Nasdaq and Bitcoin often trade in the same direction

Source: www.zerohedge.com, LSEG workspace

Bitcoin fell below $119,000 on Thursday after US Treasury Secretary Scott Bessent said the government will not make new BTC purchases to fund a Bitcoin reserve.

▶️ Treasury secretary Scott Bessent says the US will not be buying any bitcoin ▶️They will hold the $15-$20 billion in bitcoin they already have and confiscate more ▶️The statement contrasted with President Donald Trump’s earlier executive order directing the government to develop “budget-neutral strategies” for increasing Bitcoin holdings. ▶️In April, Bo Hines, who at the time was a part of the Presidential Council of Advisers for Digital Assets, said the administration was exploring funding options for Bitcoin acquisitions, including tariff revenue and a reevaluation of the Treasury’s gold certificates. ▶️In a silver lining to the sentiment-dampening statement, the Bessent did confirm that the US does not plan to sell any of its existing Bitcoin holdings ▶️Bessent’s comments echo White House AI and crypto czar David Sacks, who said a Bitcoin reserve would be “a digital Fort Knox for the cryptocurrency,” and the US wouldn’t sell any Bitcoin it put in the reserve. Source: cointelegraph

Investing with intelligence

Our latest research, commentary and market outlooks