Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

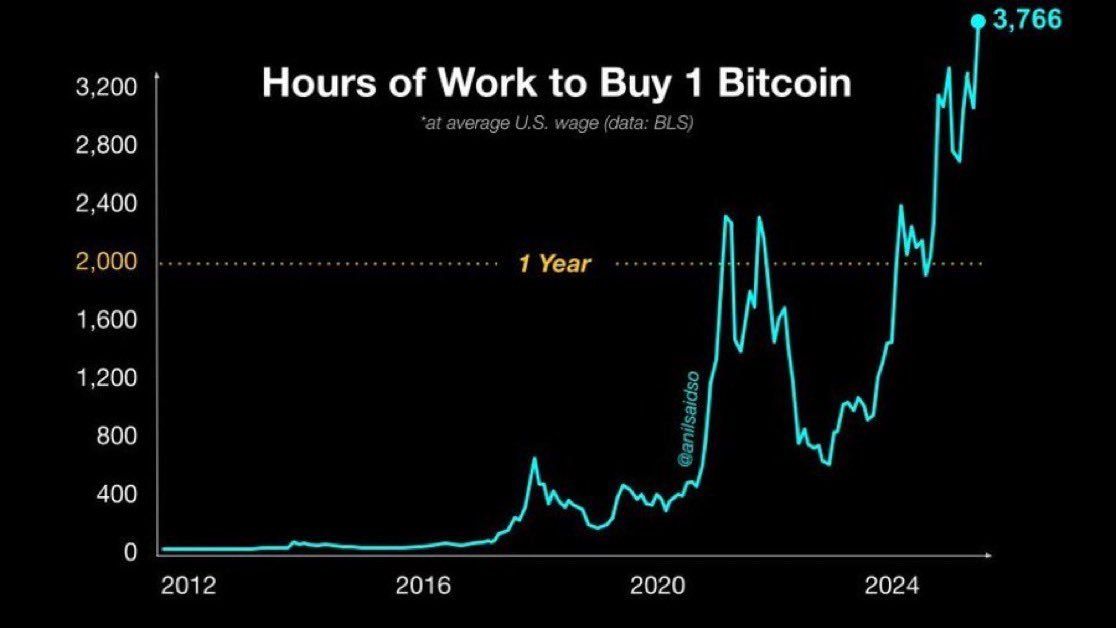

The average american now needs to work nearly two full years to buy a single Bitcoin

Source: Documenting Saylor @saylordocs on X

Bitcoin $BTC price will go up if there are more buyers, says Citi - couldn't agree more...

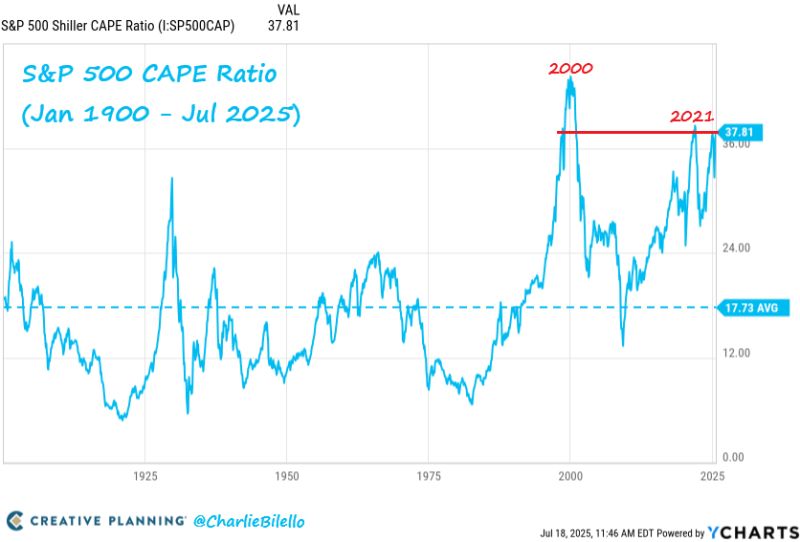

"A bitcoin is worth what the next person will pay for it," the FT journalist, Bryce Elder, writes. "The same can be said of a lot of assets." Spot on! This is correct and accurate reporting indeed. And that's how investors need to think about markets, whether it's Bitcoin (BTC), shares of Apple (AAPL), or the direction of Gold.

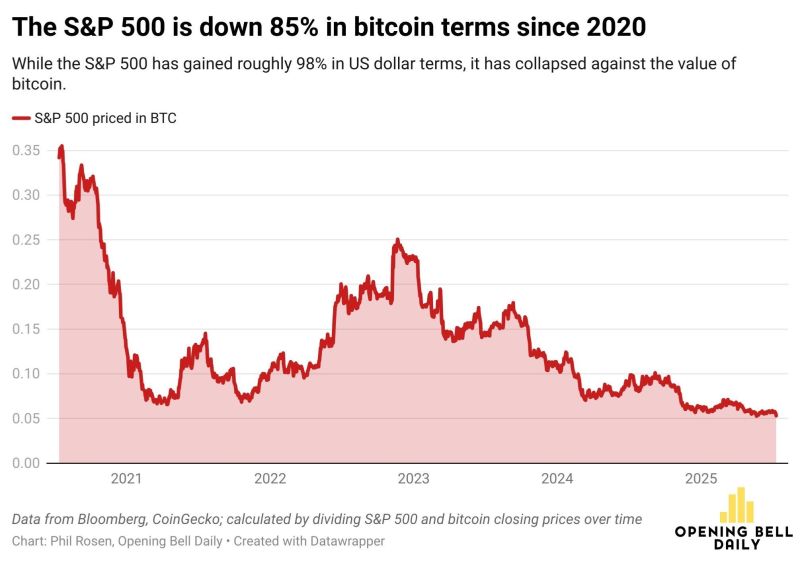

BREAKING: The S&P 500 is down 85% in Bitcoin terms since 2020.

Source: Bitcoin Archive @BTC_Archive

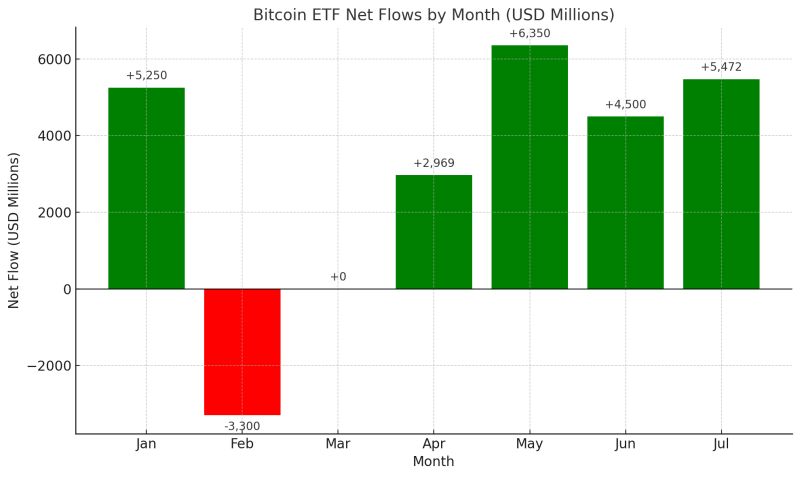

Bitcoin ETF Flows are still 2x the flows from MSTR and other Bitcoin Treasury companies.

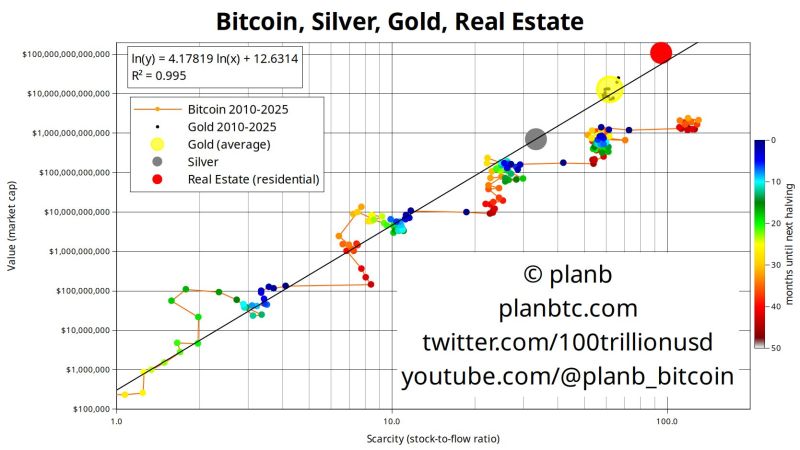

If nothing changes, these together will generate $50 billion in new demand for BTC (without taking into account new bitcoin treasury companies being created, sovereign demand, new institutional demand, etc.) We now the supply variable in the equation. What we do NOT know is how much the whales will offload their bitcoin as the price keeps moving higher. But net net it looks like the supply-demand context remains rather favourable... Source chart: Fred Krueger

Ether $ETH relative to bitcoin $BTC is breaking out after a multi-month consolidation.

Is this bearish for bitcoin? No. It just means that we might be at the beginning of the so-called "altcoin season" where other cryptos start to outperform bitcoin. But it does NOT mean that bitcoin is heading south. The new all-time highs in Coinbase, Robinhood and other crypto-related stocks and assets like Galaxy Digital are additional evidence that the crypto bull market might actually gathering speed. Source. J-C Parets NB: this is not an investment recommendation. Do your own research

Investing with intelligence

Our latest research, commentary and market outlooks