Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Will the -500 days / + 500 days hashtag#trading strategy on bitcoin work again this time?

At the time of this writing, hashtag#Bitcoin 500 day strategy is still on track. 1) Buy Bitcoins 500 days Before Halving 2) Hold & Do Nothing 3) Sell 500 Days After Halving 4) Repeat Last halving was on April 20th. This would imply an intermediary top on the 17th of August 2025. Source: Mags @thescalpingpro

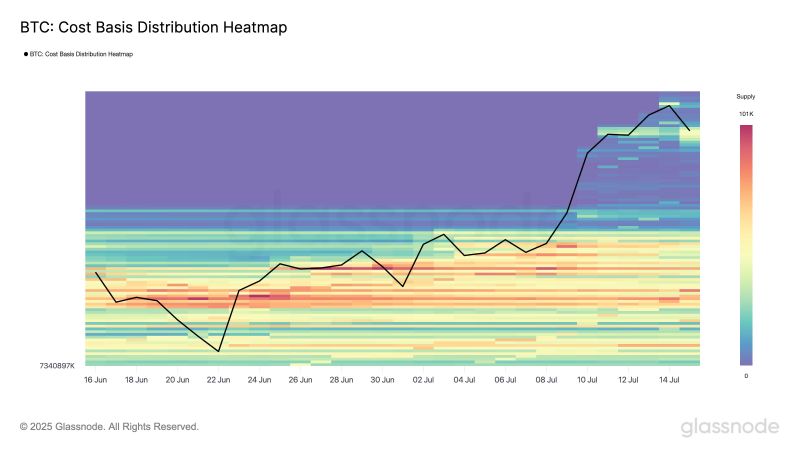

Cost Basis Heatmap shows investors stepped in aggressively on the dip

They accumulated ~196.6K $BTC between $116K–$118K. That’s over $23B in value added near the local top, signalling strong conviction and possible positioning for further upside. Source: Glassnode

Cantor Fitzgerald close to $4 billion SPAC deal with Adam Back "to buy billions of dollars" of Bitcoin.

FT >>> "Brandon Lutnick, son of US commerce secretary Howard Lutnick, is nearing a roughly $4bn deal with an early bitcoin supporter to buy billions of dollars in the digital tokens using a vehicle backed by Cantor Fitzgerald. Cantor Equity Partners 1, a blank cheque vehicle that raised $200mn in cash in an initial public offering in January, is in late-stage talks with Adam Back, founder of crypto trading group Blockstream Capital, to buy more than $3bn in the digital currency, according to two people briefed on the talks. The deal, which mirrors a $3.6bn crypto buying venture Brandon Lutnick struck with SoftBank and Tether in April, would advance Cantor Fitzgerald’s strategy of using publicly listed shell companies to buy bitcoin as it aims to take advantage of a surge in digital currency prices amid US President Donald Trump’s deregulatory push. Howard Lutnick handed control of Cantor Fitzgerald to his children in May. Back is in discussions to contribute as much as 30,000 bitcoin to Cantor Equity Partners 1, worth more than $3bn. It would be part of a broader deal with the blank cheque company in which it would raise as much $800mn in outside capital to make further purchases of the digital currency, putting the overall deal at more than $4bn". Source: FT

Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

Source: Bitcoin archive

Our Global M2 proxy continues to point to supportive liquidity dynamics for risk assets in the weeks ahead, even if the charts suggest a potential pause in the upward trend for the short-run.

➡️ Liquidity continues to be injected, not only in the US (with M2 reaching a new all-time high in May), but also in Europe and China, and the USD weakness is supportive of global liquidity conditions. ➡️ The link between our Global M2 proxy and the Bitcoin, but also the S&P500 and the MSCI World, continues to hold quite well! This is NOT an investment recommendation. Many factors influence the price of assets. Do your own research. Source: Adrien Pichoud

Investing with intelligence

Our latest research, commentary and market outlooks