Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

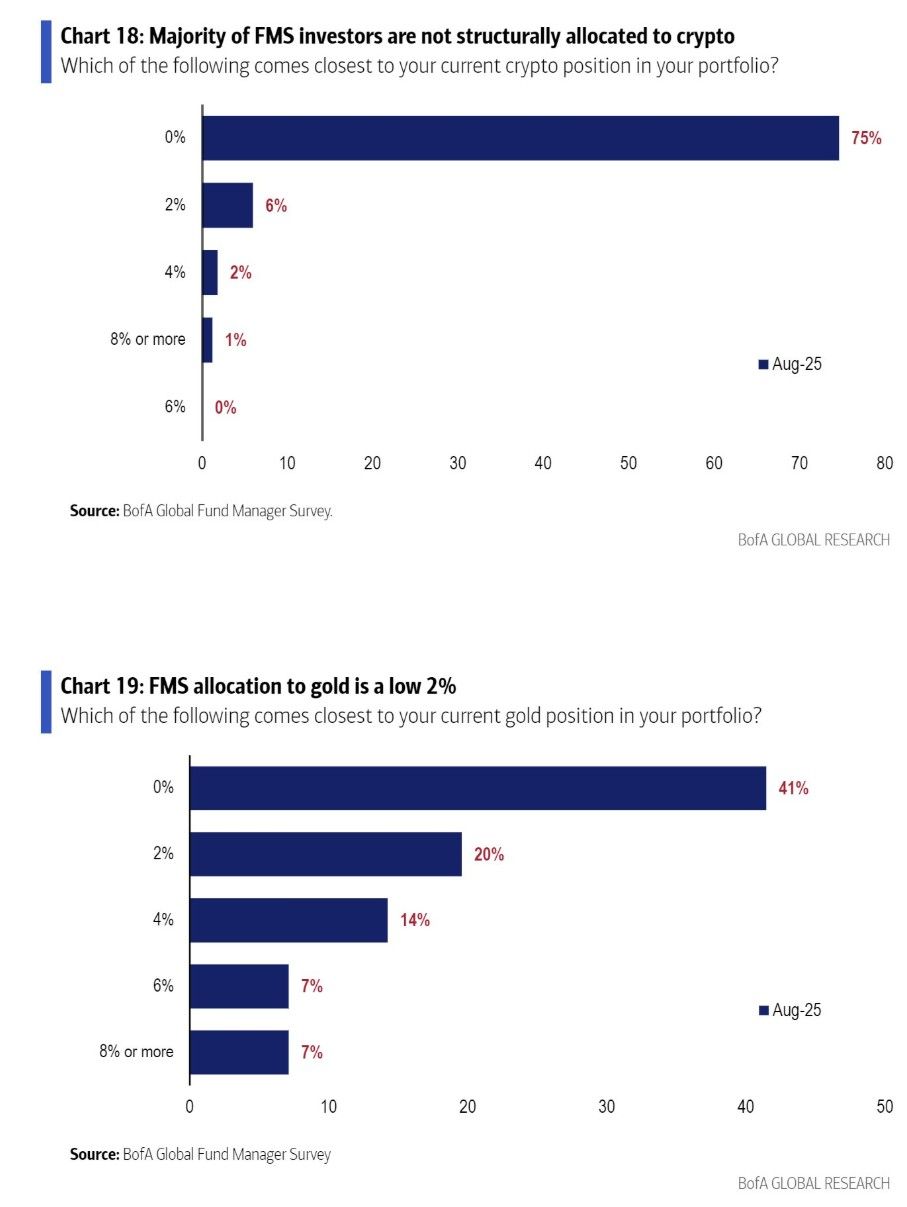

Incredible charts by BofA...

Bitcoin and gold are the two best best performing assets YTD and over the last few years... However, fund managers are massively under-exposed to those 2 store of values... Indeed, 75% of fund managers have no exposure at all to cryptos. And even more surprisingly, 41% of fund managers have no exposure at all to gold... The least we can say is that they don't look as crowded trades... Source: BofA thru Callum Thomas

Investing with intelligence

Our latest research, commentary and market outlooks