Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

➡️ Our Global M2 proxy continues to point to supportive liquidity dynamics for risk assets in the weeks ahead.

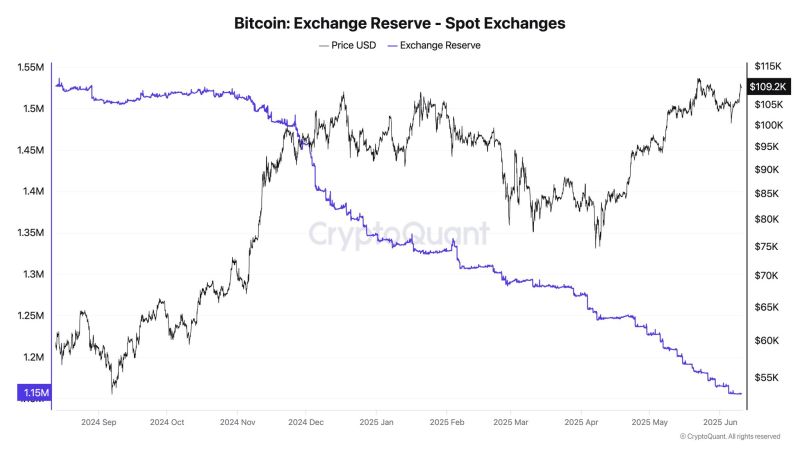

➡️ The link between our Global M2 proxy and the Bitcoin continues to hold remarkably well and to point to still more short-term upside potential for the BTC. ➡️ Interestingly, our Global M2 proxy suggests a pause in the upward trend for Equities and Bitcoin in the second half of June (taking into account the 10-week lag). But the recent resuming of the M2 upward trend, if extended, would point to a resuming of positive market dynamic for July. NB: This is NOT an investment recommendation. Liquidity is one among the numerous indicators that need to be considered Source: Syz Research

Investing with intelligence

Our latest research, commentary and market outlooks