Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 Some interesting perspectives on bitcoin by Blockware shared by Robert @reedlove on X.

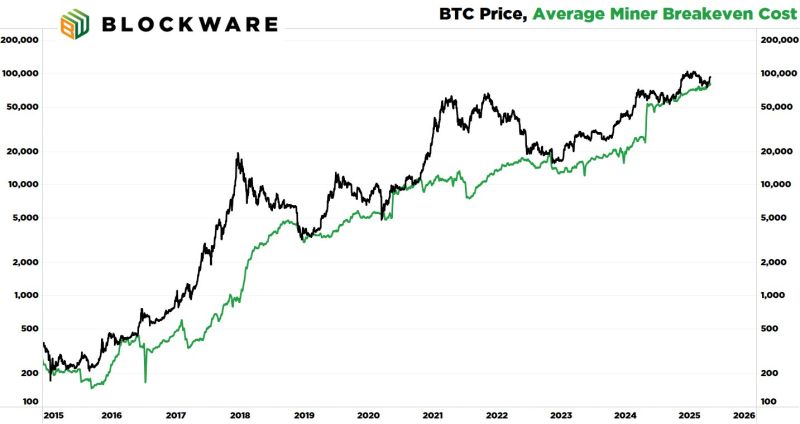

▶️ Bitcoin is up 25% from its April 9th low and there’s a handful of indicators that show a major bull market around the corner. Starting with the Average Miner Cost of Production. ▶️ In a rational economy, assets rarely trade below their cost of production. Now, what it costs to “mine” a Bitcoin is different for every miner – machine type, electricity cost, and uptime all play a role — but the analysts @BlockwareTeam have aggregated data to create a metric called the “industry average”. ▶️ This metric has timed each of the past 6 Bitcoin bottoms: September 2024 November 2022 September 2020 March 2020 December 2018 April 2016 ▶️ This metric is signaling a bottom right now.

Michael Saylor said Strategy is doubling their fundraising to raise $84 billion to buy more Bitcoin

Source: Bitcoin Magazine

BREAKING: Cantor Fitzgerald, SoftBank, Tether, and Bitfinex are pooling $3 billion to create 21 Capital, a Bitcoin investment firm.

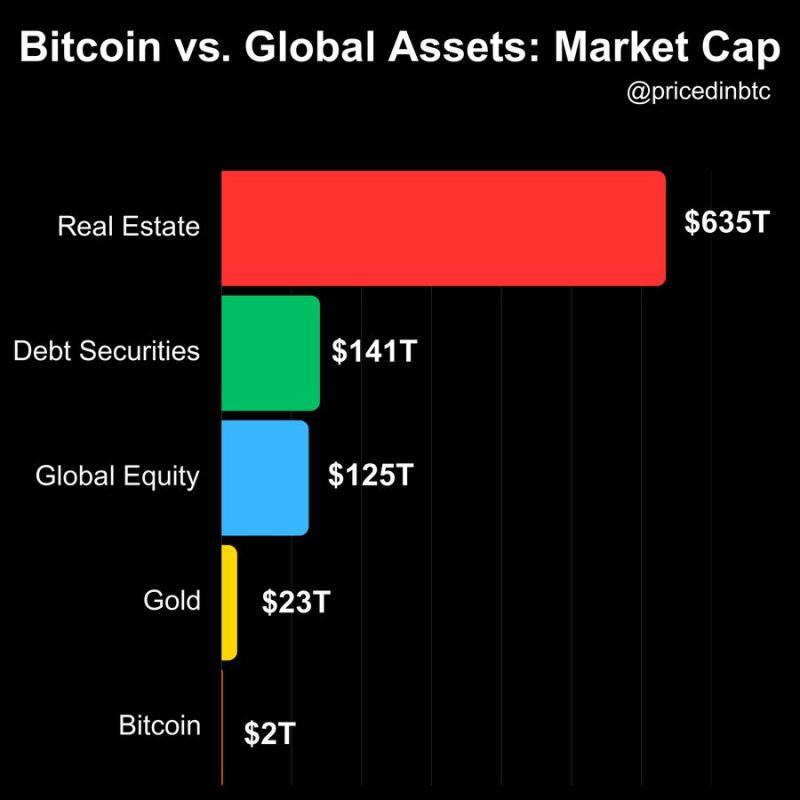

The initiative mirrors Strategy's Bitcoin plan, with contributions from Tether ($1.5 billion), SoftBank ($900 million), and Bitfinex ($600 million). Brandon Lutnick, current chair and CEO of Cantor Fitzgerald and son of former CEO Howard Lutnick, is at the helm of this venture. The initiative will utilize funds from Cantor Equity Partners, a special purpose acquisition company (SPAC) that raised $200 million earlier this year. The investment contributions to 21 Capital are substantial, with Tether expected to provide $1.5 billion in Bitcoin. SoftBank will contribute $900 million, while Bitfinex plans to supply $600 million worth of the crypto. This collaboration aims to mirror the investment approach pioneered by Michael Saylor's Strategy, which has seen significant success in the Bitcoin market🔥 The report highlights that the Bitcoin holdings from these companies will eventually be converted into shares of 21 Capital, valued at $10 per share, suggesting a valuation of $85,000 per Bitcoin. Additionally, Cantor's vehicle plans to raise $350 million through a convertible bond and an additional $200 million via private equity placements for further Bitcoin acquisitions. The Financial Times notes that an official announcement regarding this venture is expected in the coming weeks, although details may still be subject to changes or cancellation. Source: The Bitcoin Historian @pete_rizzo_

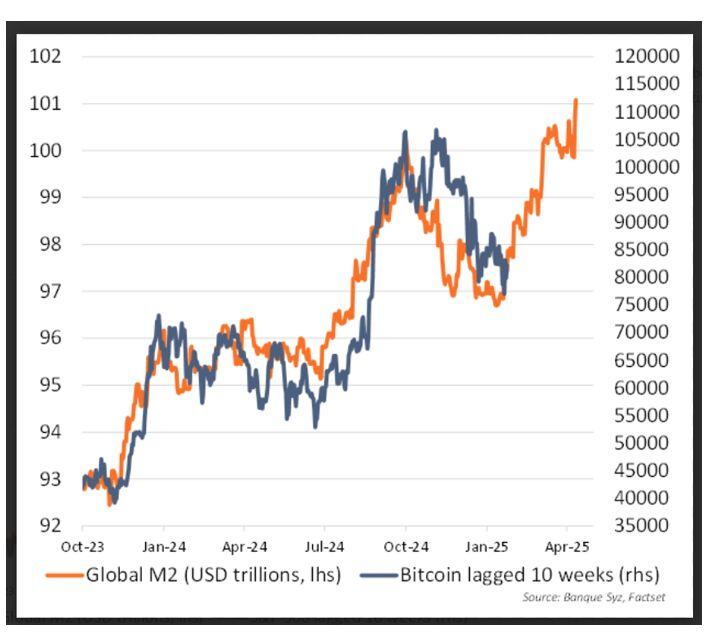

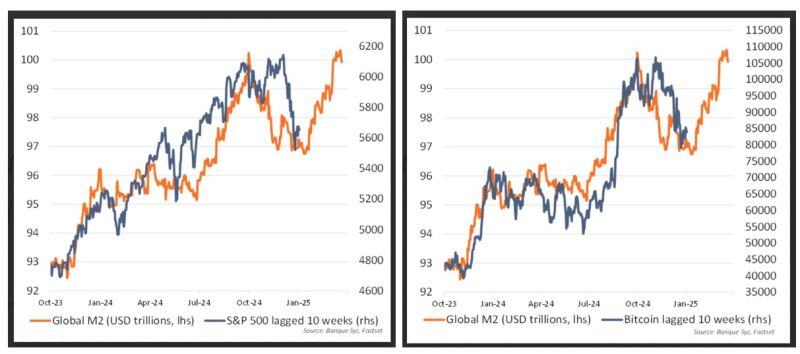

Global M2 (in orange) vs bitcoin lagged 10 weeks (in blue)

M2 proxy vs BTC continues to hold. Could the surge in Global M2 push $BTC to new highs?

VanEck confirms that China and Russia are settling energy trades in Bitcoin.

Has De-dollarization already started?

At over 500,000 bitcoin, MSTR has a larger bitcoin treasury than any company on earth today.

Source: @Saylor on X

As our proprietary charts of M2 proxy (10 weeks advance) vs BTC and S&P500 suggested on Friday

The bottom could be near for risk assets as the lagged effects of a weaker dollar on global liquidity will provide a support to stocks and BTC Yesterday's advance seem to corroborate these findings. Source: Bank Syz

Investing with intelligence

Our latest research, commentary and market outlooks