Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

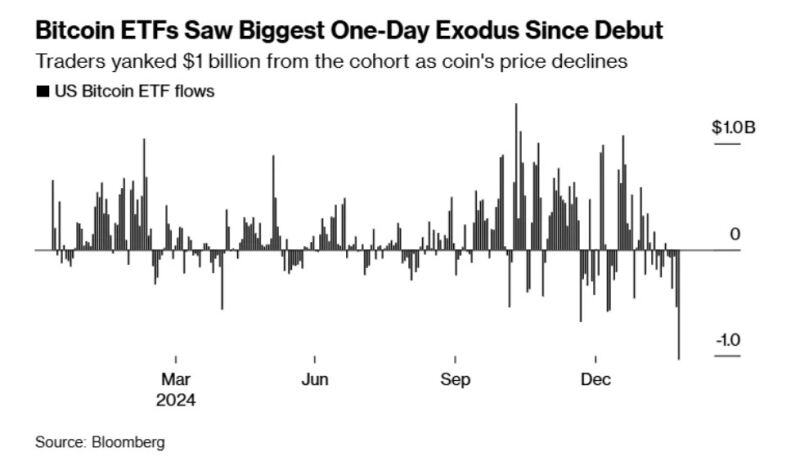

Bitcoin ETFs are hit by a record $1 billion outflow in one day

Investors yanked more than $1 billion from spot Bitcoin exchange-traded funds Tuesday, marking the biggest one-day outflow since the cohort’s debut last January. Fidelity Wise Origin Bitcoin Fund (ticker FBTC) posted the steepest outflows among these funds, followed by the iShares Bitcoin Trust ETF (IBIT), according to data compiled by Bloomberg. As a group, the Bitcoin funds shed roughly $2.1 billion over six consecutive days — the longest stretch of outflows since last June. source : yahoo!finance, bloomberg

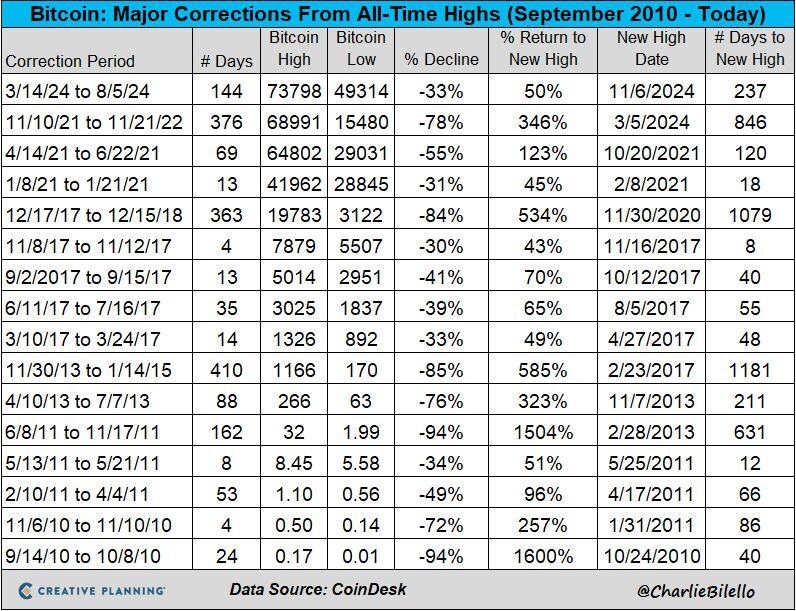

At $80,000, Bitcoin is now down around 27% from its all-time high of $109,000.

Is that a big drawdown for Bitcoin? No... Source: Charlie Bilello

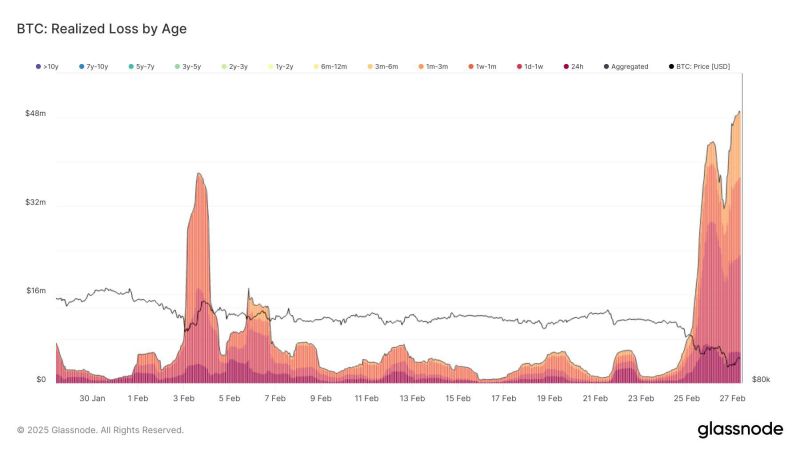

🚨74% of bitcoin losses came from holders who bought in the last month

🚨Newcomers are getting shaken out. Source: Quinten | 048.eth @QuintenFrancois on X, Glassnode

Bitcoin and TQQQ (3x QQQ) have moved in tandem for a long time.

Looks like BTC wants "this" even lower. Source: The Market Ear

Bitcoin under $90k...

here's a compilation of the best crypto liquidation memes on X

It's the liquidity stupid...

Bitcoin $BTC is finally catching up with the drop of liquidity (with a 10 weeks lag). The good news is that Global M2 is accelerating again (but due to the lag risk assets should resume uptrend later on - all other things being equal of course...) Source: Bloomberg, Joe Consorti

Strategy $MSTR, formerly known as MicroStrategy, has plummeted 48% since its November 21 all-time high 🚨

That's a total market cap loss of roughly $70 Billion

Investing with intelligence

Our latest research, commentary and market outlooks