Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

⚠ Swiss National Bank Says NO to Bitcoin!

SNB President Martin Schlegel confirms no plans to buy BTC or any crypto, citing volatility & regulatory concerns. Source: Roi Market @RoiMarkett

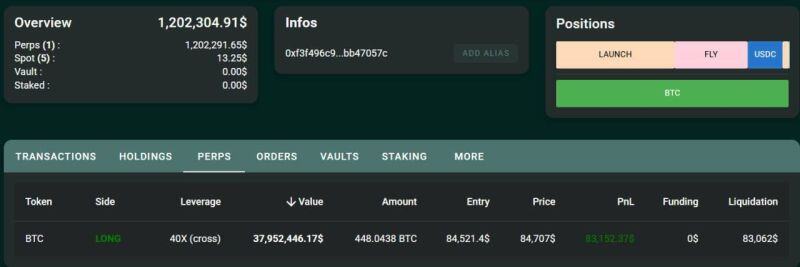

🔴 BREAKING: THE 40X SHORT WHALE IS NOW 40X LONG WHALE ‼️

HE OPENED A $37.9 MILLION BTC LONG WITH LEVERAGE. ENTRY PRICE $84,500 AND LIQUIDATION AT $83,000. Source: Ash Crypto on X

GLOBAL M2 IS EXPLODING.

WILL BITCOIN FOLLOW SOON 🚀 ??? Source: Vivek⚡️@Vivek4real_

Trump officially signed an executive order to create a Strategic $BTC Bitcoin Reserve.

How $BTC's market cap evolved over time👇 Source: Investing visuals @ZeevyInvesting

➡️ 🚨 BREAKING: TRUMP SIGNS EXECUTIVE ORDER CREATING U.S. BITCOIN RESERVE. BITCOIN PRICE FALL

Trump has officially established the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, marking a major shift in U.S. crypto policy. The reserve will be funded using Bitcoin seized in criminal and civil forfeitures—no taxpayer money involved. The U.S. is estimated to hold around 200,000 BTC, but there’s never been a full audit. Unlike past sales that lost taxpayers $17 billion, this Bitcoin won’t be dumped—it’s being stored as a digital Fort Knox. The executive order also directs a full accounting of U.S. digital asset holdings, aiming to maximize value and solidify America as the crypto capital of the world. Bitcoin plunged approximately 6% after US President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve. Market participants had hoped the government would announce a plan to buy more Bitcoin, but Trump’s crypto tsar David Sacks said on X it would only use the Bitcoin it already holds from criminal cases — though it will look to develop “budget-neutral” strategies to acquire additional Bitcoin. The White House is also set to host a Crypto Summit today, led by @DavidSacks, with industry leaders including Coinbase's Brian Armstrong. ockpile, making Bitcoin an official part of U.S. financial strategy. Source: Mario Nawfal on X, www.cointelegraph.com

BLACKROCK "if every millionaire in the US asked their financial advisor to get them 1 bitcoin, there wouldn’t be enough."

Source: Bitcoin Archive

Updated technical chart on bitcoin by J-C Parets.

👉 102 level is the big one. 155 is next. 242 after that. Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks