Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

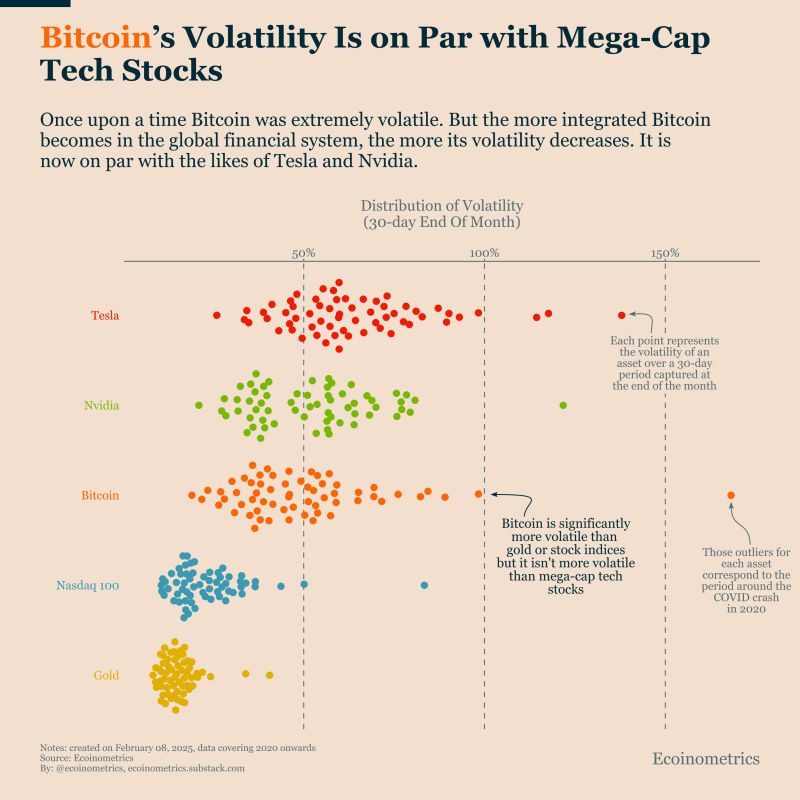

The price of Bitcoin is now as stable as the largest technology company stocks like Tesla and Nvidia.

Source: Documenting Bitcoin

The 2nd largest pension fund in the US now owns nearly $100 million bitcoin via MSTR

Source: The Bitcoin Historian on X

GameStop surged +20% on news it is considering buying Bitcoin with its $4.6 BILLION cash balance.

Source: Radar 𝘸 Archie

Investing with intelligence

Our latest research, commentary and market outlooks