Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Musk takes advantage of new accounting rule to book for tesla a $600 million profit on bitcoin

Elon Musk's Tesla (TSLA) appeared to take advantage of a new accounting rule allowing for holdings of digital assets to be marked-to-market each quarter. The company's fourth quarter earnings report shows its 9,720 bitcoin valued at $1.076 billion as of the end of 2024. That's up from what had been $184 million for several quarters prior. Alongside that change, Tesla also recorded a GAAP income boost of $600 million on its digital holdings. For perspective, the company had overall GAAP income of $2.3 billion in the fourth quarter. A new rule from the Financial Accounting Standards Board (FASB) requires corporate holders of digital assets to begin marking those assets to market each quarter, no later than the first quarter of 2025. Companies could take advantage of the new rule prior to that at their own discretion, which Tesla has appeared to do. Prior to this new rule, corporate holders of digital assets were required to report those holdings at what was their lowest valuation during the time of ownership. Tesla overall reported adjusted EPS of $0.73 in the fourth quarter, missing estimates for $0.76. The gain on its bitcoin holdings was for GAAP purposes and would have had no effect on adjusted EPS. Shares are higher by 3.5% in after hours trading. Source: Coindesk

Czech Central Bank Plans Bitcoin Reserve

Source: Bloomberg thru Willem Middelkoop

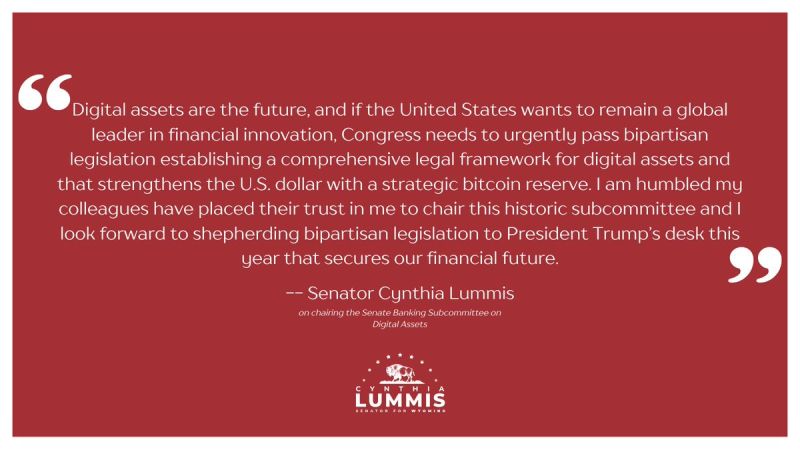

JUST IN: Senator Cynthia Lummis appointed as chair of the Senate Banking Subcommittee on Digital Assets.

She wants to "urgently pass" legislation for a Strategic Bitcoin Reserve Source: Bitcoin Magazine

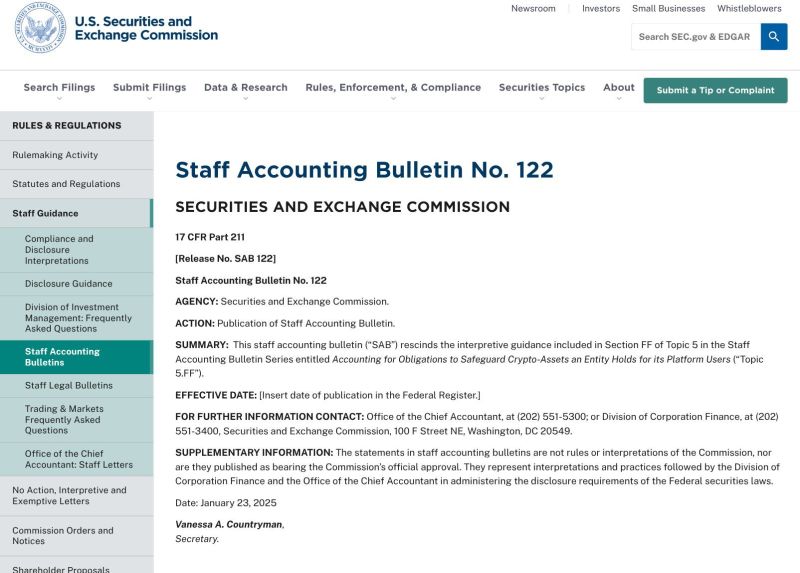

United States banks can now officially hodl Bitcoin.

The SEC's Accounting Bulletin No. 121 required banks to treat Bitcoin as a liability, making it costly and impractical. Today’s repeal means banks can buy and custody Bitcoin, like other assets. Source: Documenting Bitcoin

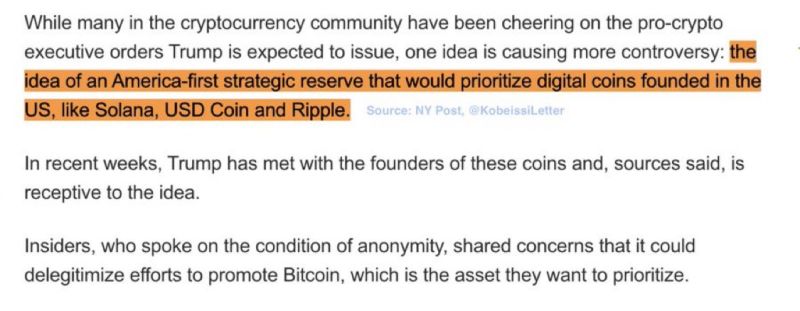

Will the National Digital Asset Stockpile only be denominated in bitcoin?

One week ago, the NY Post reported that President Trump is considering "prioritizing digital coins founded in the US.” This would include coins like Solana, USDC, and Ripple. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks