Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Swiss central bank faces call to hold bitcoin in reserves

Swiss citizens are advancing a new initiative to integrate Bitcoin into the financial reserves of the Swiss National Bank (SNB). This proposal has entered the official signature collection phase, aiming to secure 100,000 signatures within 18 months. If successful, the initiative will proceed to a national referendum to amend the Swiss federal constitution. The Swiss citizens initiative is an attempt to include Bitcoin in Article 99 (Clause 3) of the Swiss constitution which presently requires some amount of the country to be stored in gold. Bitcoin enthusiasts have suggested that Bitcoin should be considered as an instrument similar to gold. However, the initiative encounters numerous challenges even though the interest has been escalating. Switzerland being a neutral country does not often make changes to its constitution and the process is quite long and complicated. The proposal has to be supported and getting 100,000 verified signatures within the time limit is rather a challenging feat. source : coingape

Bitcoin monthly candle closes soon...

Will the december monthly candle look like that? $BTC Source: Trend Spider

DOGE lead Vivek Ramaswamy’s fund, Strive files for “Bitcoin Bond” ETF 🤯

👉 Strive Asset Management is launching a new ETF that will provide exposure to Bitcoin through convertible securities, primarily focusing on MicroStrategy’s holdings. 👉The Strive Bitcoin Bond ETF will invest at least 80% of its assets in “Bitcoin Bonds” and related derivative instruments, including swaps and options. 👉The actively managed fund will hold both direct positions in Bitcoin-linked convertible securities and derivatives, with allocation decisions based on cost and return potential. 👉The fund will maintain cash positions in short-term US Treasury securities and may invest in other Bitcoin-focused investment vehicles. 👉As a non-diversified fund, it can concentrate holdings in single issuers like MicroStrategy and allocate more than 25% of assets to software and technology sector companies. 👉Operating under a “manager of managers” structure, the ETF will be advised by Empowered Funds, LLC, which can appoint and replace sub-advisers without shareholder approval. 👉The fund’s shares will trade on the New York Stock Exchange and be held through the Depository Trust Company. Source: Vivek⚡️on X, Cryptobriefing

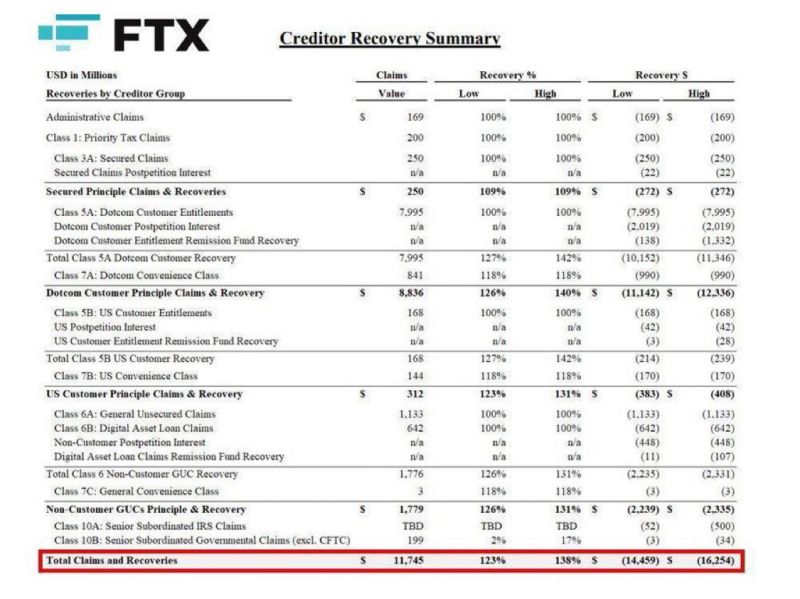

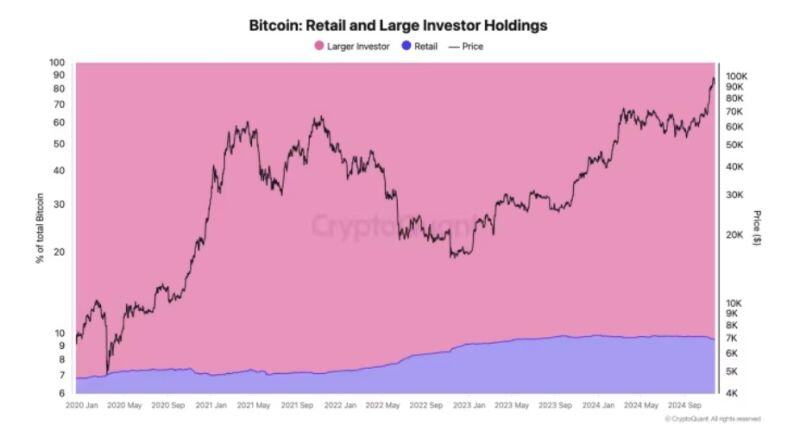

On-chain analytics reveal that retail investors (holding less than 1 BTC) own 9.5% of total bitcoin, while large investors control the remaining 90.5%.

Notably, retail ownership has grown significantly—from 6.8% in 2020 to a record high of 9.85% in December 2023. Quarterly reports from crypto exchange Coinbase provided data on transaction volume on its platform and broke down whether this volume came from institutions or consumers (retail). Although retail investor volume grew in 2024 compared with 2023, so did institutional volume — and at much higher levels. source : criptoquant

Historical Bitcoin prices on Christmas Eve

2013 - $666 2014 - $323 2015 - $455 2016 - $899 2017 - $13,926 2018 - $4,079 2019 - $7,323 2020 - $23,736 2021 - $50,822 2022 - $16,822 2023 - $43,665 2024 - $98,400 Source: Bitcoin magazine

Investing with intelligence

Our latest research, commentary and market outlooks