Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The case for a 2% Bitcoin allocation into multi-assets portfolios by Blackrock:

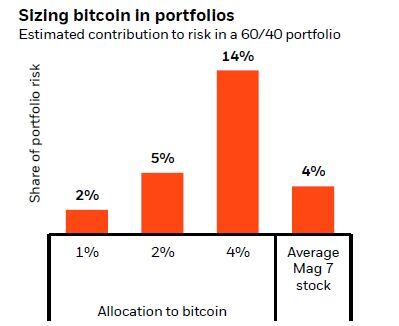

"So how can investors think about a bitcoin allocation? We take a risk budgeting approach: sizing the allocation based on how much it would contribute to total portfolio risk – measured by its long-run volatility and correlation to other assets (...). But from a portfolio construction perspective, it has some similarities with the “magnificent 7” group of mostly mega-cap tech stocks. Their market value – averaging $2.5 trillion in December 2024 – is similar to bitcoin’s (...) In a traditional portfolio with a mix of 60% stocks and 40% bonds, those seven stocks – if held at their current weights in the MSCI World – each account for 4% of the overall portfolio risk on average. That’s about the same share a 1-2% exposure to bitcoin would represent: Even though bitcoin’s correlation to other assets is relatively low, it’s more volatile, making its effect on total risk contribution similar overall. A bitcoin allocation would have the advantage of providing a diverse source of risk, while an overweight to the magnificent 7 would add to existing risk and to portfolio concentration. Why not more than 2%? A larger bitcoin allocation means its share of overall portfolio risk rises sharply. This effect is small when the allocation is small, but above 2% bitcoin’s share of total portfolio risk becomes outsized compared with the average magnificent 7 stock (...) . In an extreme case, should there no longer be any prospect of broad bitcoin adoption, the loss could be the entire 1-2% allocation. We think this is much less likely to happen to a magnificent 7 stock given these companies generate major cash flow and have tangible underlying assets. The upshot? By allocating no more than 2% to bitcoin, investors would: 1) introduce a very different source of return and risk; and 2) manage risk exposure to bitcoin".

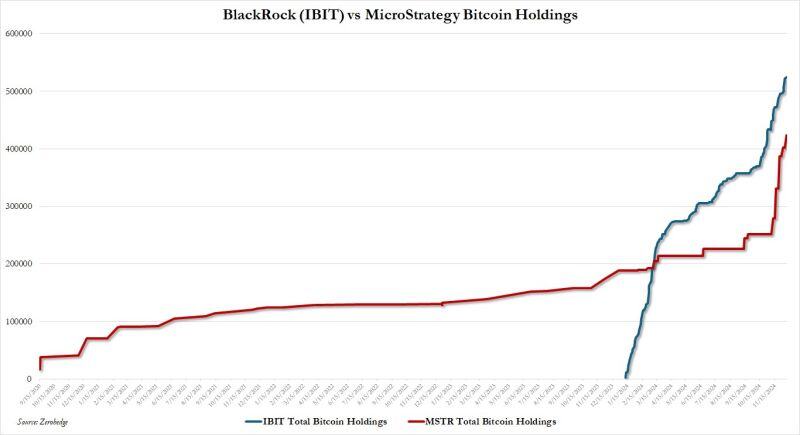

JUST IN: MICHAEL SAYLOR AND MICROSTRATEGY $MSTR BOUGHT 15,350 MORE BITCOIN $BTC

MicroStrategy spent ~$1.5 billion to buy the 15,350 at an average price of ~$100,386 per Bitcoin, boosting total holdings to 439,000. $MSTR 📈 +3.50% in pre-market. Source: Michael Saylor Tracker

TEXAS GOES ALL IN ON BITCOIN WITH STATE RESERVE PLAN!

Texas just made a bold crypto power move! State Rep. Giovanni Capriglione has filed a bill to create a Strategic Bitcoin Reserve, setting the stage for Texas to lead the Bitcoin revolution. This is a visionary step toward making Texas the ultimate Bitcoin hub. Source: Watcher Guru, @VoteGiovanni thru Mario Nawfal

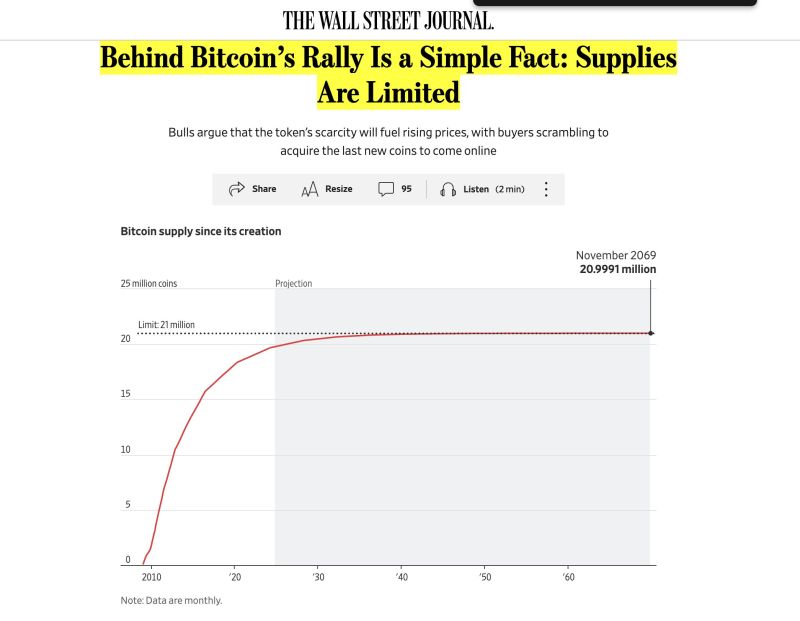

The front page of WSJ 🔴 The Wall Street Journal telling its readers there will only ever be 21m Bitcoin‼️

Source: Bitcoin Archive

⚡️ JUST IN: Bitcoin balances on exchanges have dropped to their lowest point ever.

Source: Cointelegraph @Cointelegraph

Blackrock (524,571) and MSTR (423,650) collectively own almost 1 million bitcoin (out of 21 million) between just the two.

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks