Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

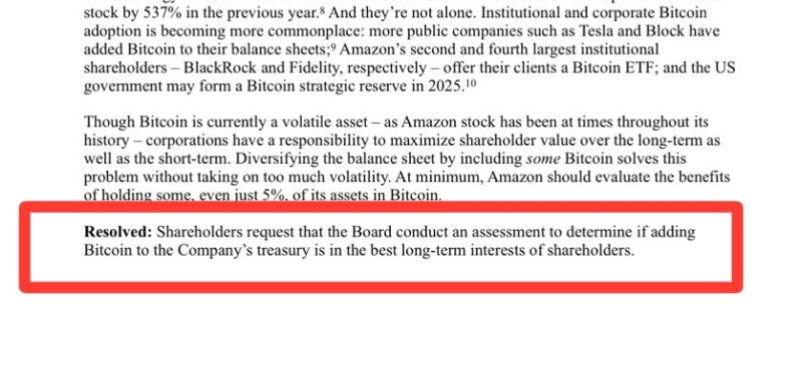

BREAKING: Amazon shareholders request the company explores adds Bitcoin to its treasury.

REMINDER: Microsoft shareholders are set to decide on the firm’s Bitcoin investment proposal this Tuesday, December 10. Source: Dennis Porter @Dennis_Porter, Bitcoin Archive @BTC_Archive

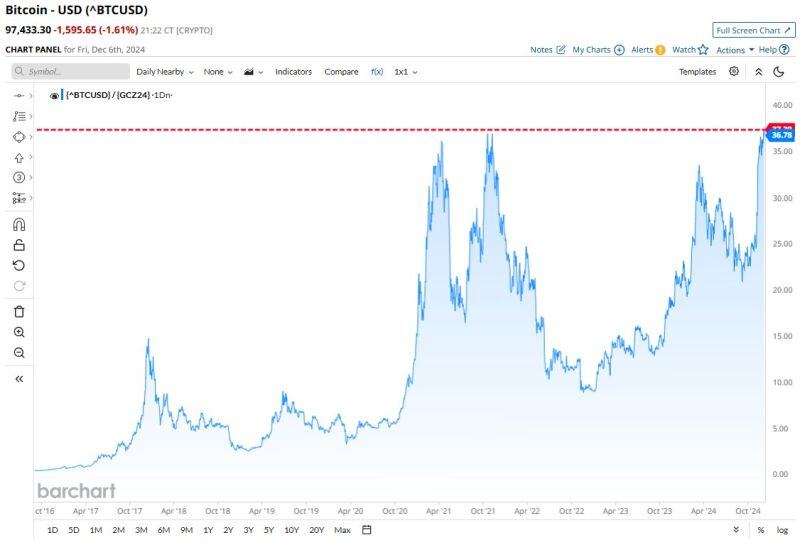

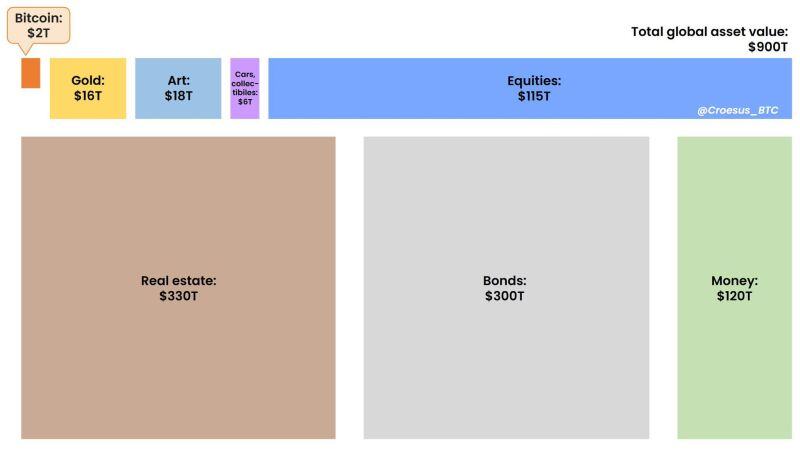

Bitcoin is still just 0.2% of global asset value.

Here is the latest update of this chart, which you may have seen in Microstrategy CEO Michael Saylor's presentations. With Bitcoin's price over $90k and ~$2T in market value, it may feel like you're late to Bitcoin... but it is still a tiny bucket in the global asset ocean. Source: Jesse Myers (Croesus 🔴) @Croesus_BTC

Investing with intelligence

Our latest research, commentary and market outlooks