Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Historical Bitcoin prices on Christmas Eve

2013 - $666 2014 - $323 2015 - $455 2016 - $899 2017 - $13,926 2018 - $4,079 2019 - $7,323 2020 - $23,736 2021 - $50,822 2022 - $16,822 2023 - $43,665 2024 - $98,400 Source: Bitcoin magazine

BREAKING: There is now a 77% chance of at least one Magnificent 7 company buying Bitcoin in 2025.

The odds of a Magnificent 7 company buying Bitcoin before 2026 have jumped from 49% to 77%, according to @Kalshi .This comes as Michael Saylor has called on Microsoft, $MSFT, and other technology giants to buy Bitcoin. Prediction markets see more Bitcoin adoption ahead. Source: The Kobeissi Letter

- >>&summary=In a jaw-dropping 3-minute video, BlackRock just challenged Bitcoin's most sacred promise. The world's largest asset manager suggests the unthinkable: "There's no guarantee that Bitcoin will maintain its 21 million coin limit." They’re right—there’s no guarantee. If everyone decides to change the supply cap, then it will be changed. But that’s highly unlikely. See some comments below on X&source=https://blog.syzgroup.com/syz-the-moment/todays-bombshell-' target="_blank">

Today's bombshell >>>

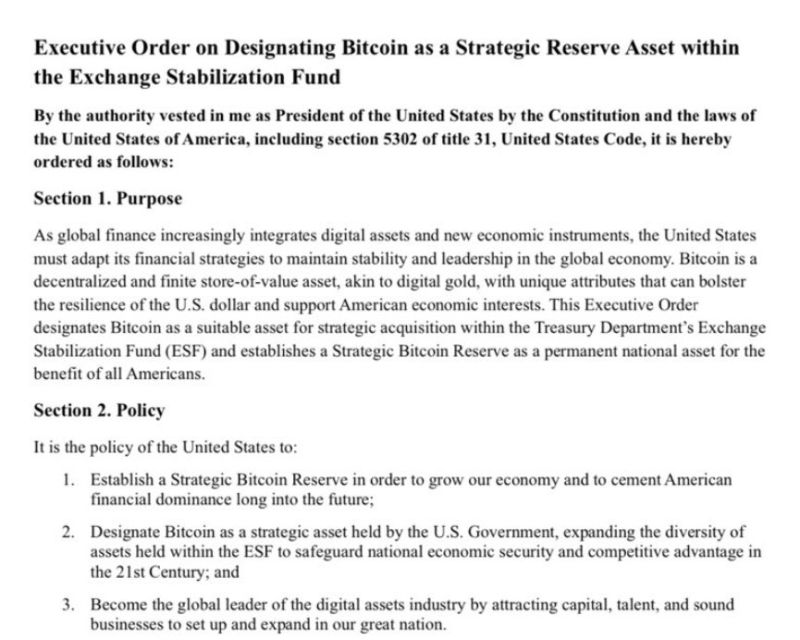

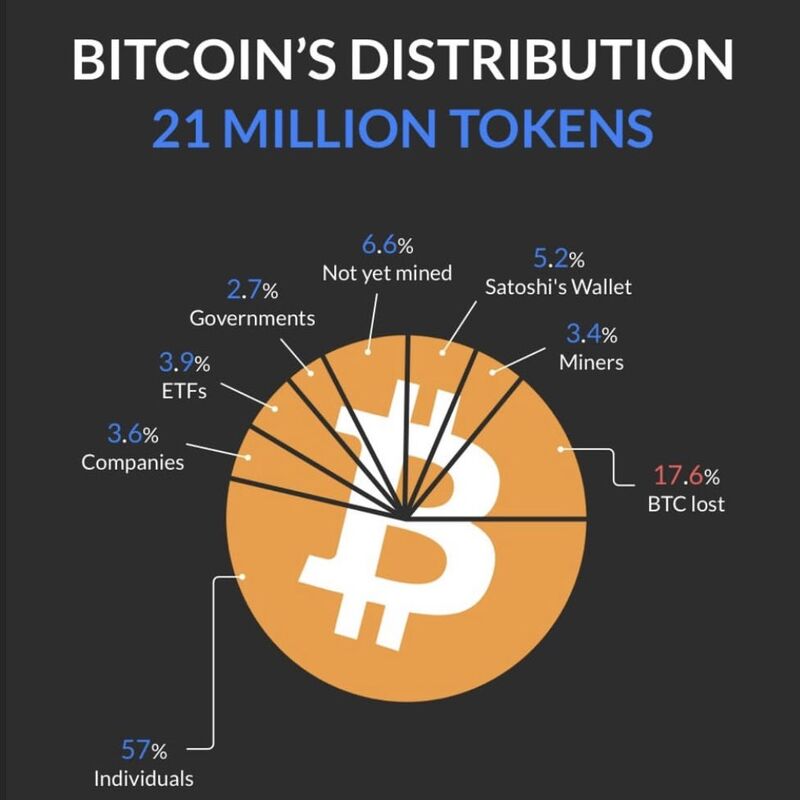

In a jaw-dropping 3-minute video, BlackRock just challenged Bitcoin's most sacred promise. The world's largest asset manager suggests the unthinkable: "There's no guarantee that Bitcoin will maintain its 21 million coin limit." They’re right—there’s no guarantee. If everyone decides to change the supply cap, then it will be changed. But that’s highly unlikely. See some comments below on X

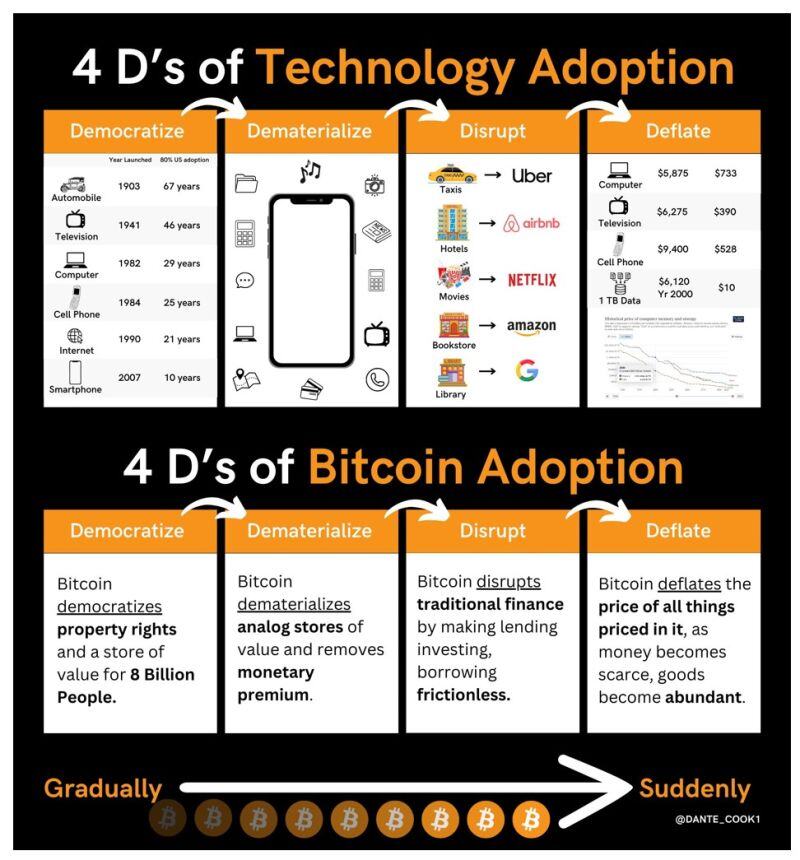

The 4D's of Bitcoin Adoption are happening:

- Democratization Bitcoin democratized property rights. - Dematerialization Capital is moving from analog capital->digital capital. - Disruption Finance is shifting -> Bitcoin. - Deflation All goods are being repriced by this. Source: Dante Cook

Investing with intelligence

Our latest research, commentary and market outlooks