Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

New research published in the The Journal of Cleaner Production reports

"The findings of this study show that bitcoin mining can be used as an efficient alternative to extract added profits from various planned renewable energy facilities in the US." Source: Documenting ₿itcoin

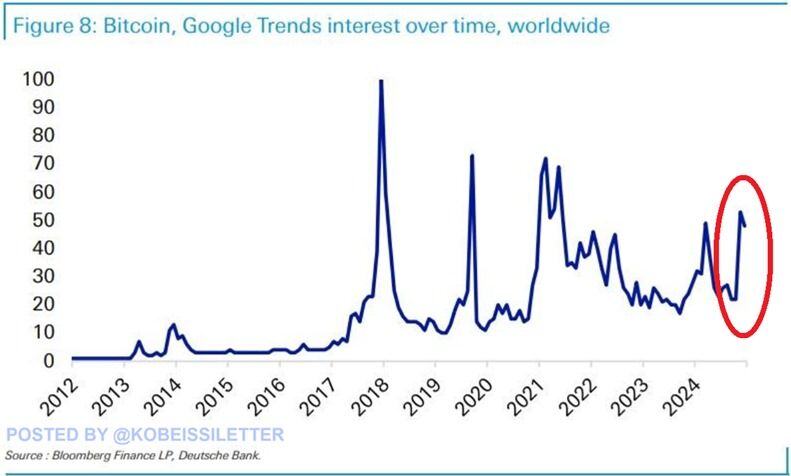

BREAKING: Google Trends interest about bitcoin are currently at their highest level since 2021.

Worldwide searches for the Bitcoin have doubled over the last several weeks. However, search interest is still below the December 2017 peak and spikes seen in 2019 and 2021. Since November 1st, Bitcoin prices have surged 42.5% and are trading near $100,000. Source: The Kobeissi Letter

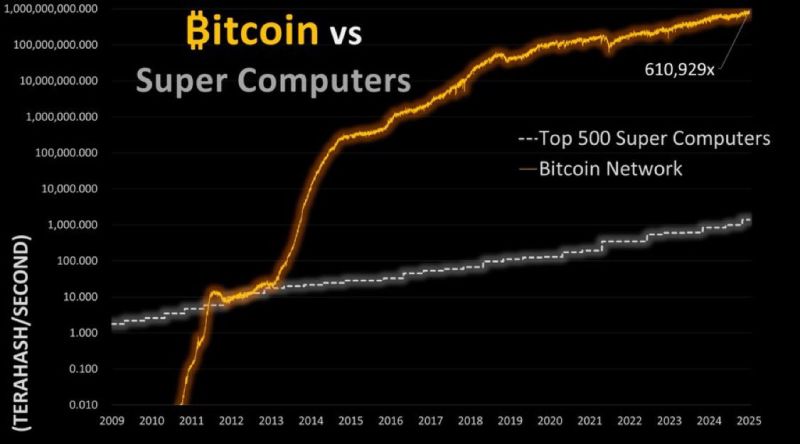

The Bitcoin network has 610,929x more hashing computational power than the combined total of the world’s top 500 supercomputers.

Source: Documenting Bitcoin

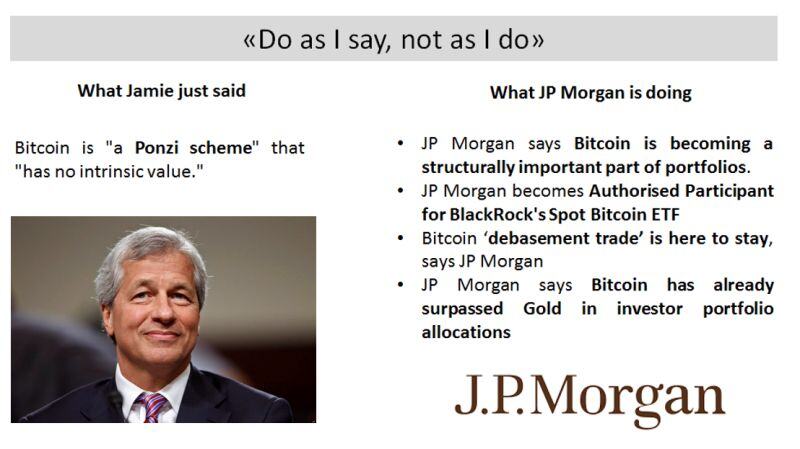

$JPM CEO Jamie Dimon just said that $BTC is "a Ponzi scheme" that "has no intrinsic value."

Meanwhile, the bank he runs is progressively adopting cryptos… Jamie Dimon, CEO of JPMorgan Chase, reiterated his harsh criticism of bitcoin. Despite his negative stance, Dimon concedes that cryptocurrencies might have a role in the future of finance. His views on Bitcoin have fluctuated over time, highlighting a pattern of inconsistency. And his own bank seems to be ignoring what he is saying...

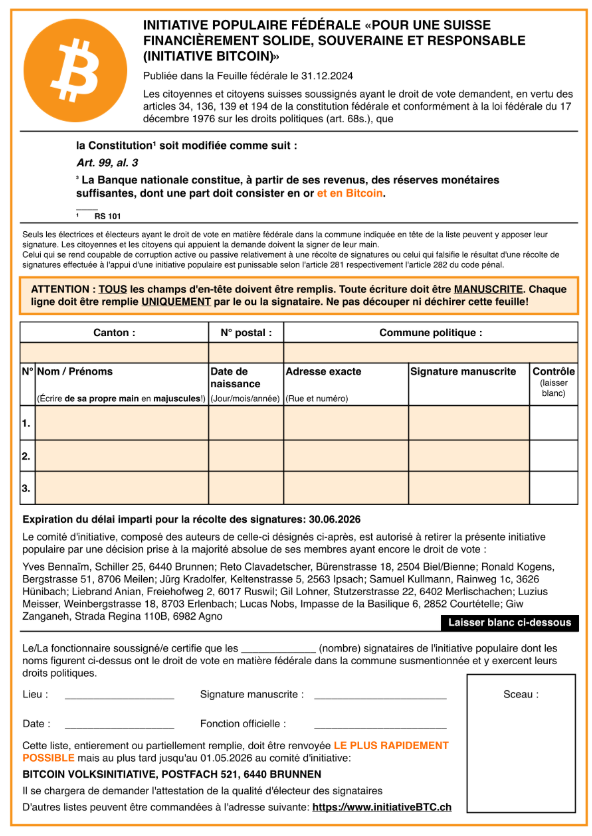

Swiss Bitcoin Initiative: Proposal Seeks to Add Bitcoin to National Reserves - see below some explanations by @BraveNewCoin

🔴Efforts are underway in Switzerland to amend the Swiss Federal Constitution to mandate the Swiss National Bank (SNB) to hold Bitcoin alongside gold as part of its monetary reserves. This ground breaking initiative, officially registered in the Federal Gazette on December 31, 2024, seeks to position Switzerland at the forefront of global Bitcoin adoption ‼️ 👉 The Proposal and Its Architects The initiative, titled “For a financially sound, sovereign, and responsible Switzerland,” was spearheaded by Giw Zanganeh, Tether’s Vice President of Energy and Mining, alongside Yves Bennaïm, founder of the Swiss Bitcoin nonprofit think tank 2B4CH. Eight additional Bitcoin advocates collaborated on the proposal, which requires 100,000 signatures by June 30, 2026, to trigger a national referendum. This threshold represents roughly 1.12% of Switzerland’s population of 8.92 million. 👉 If successful, the proposed amendment would revise Article 99 Paragraph 3 of the Swiss Federal Constitution to state: “The National Bank builds up sufficient monetary reserves from its own earnings; part of these reserves are made up of gold and Bitcoin.” 🚨 The official PDFs (and instructions) are here 👇 : if you are Swiss you can sign and send it back to BITCOIN VOLKSINITIATIVE, POSTFACH 521, 6440 BRUNNEN

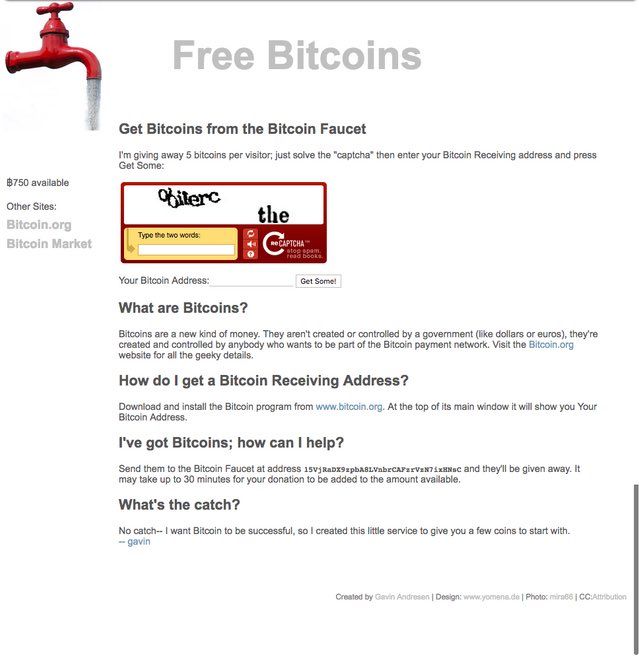

This website gave away 5 free bitcoin to everyone who completed a simple CAPTCHA back in 2010.

In total, the website gave away 19,700 BTC for free or $1,970,000,000 at the current exchange rate. Source: Documenting ₿itcoin @DocumentingBTC on X

Investing with intelligence

Our latest research, commentary and market outlooks