Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

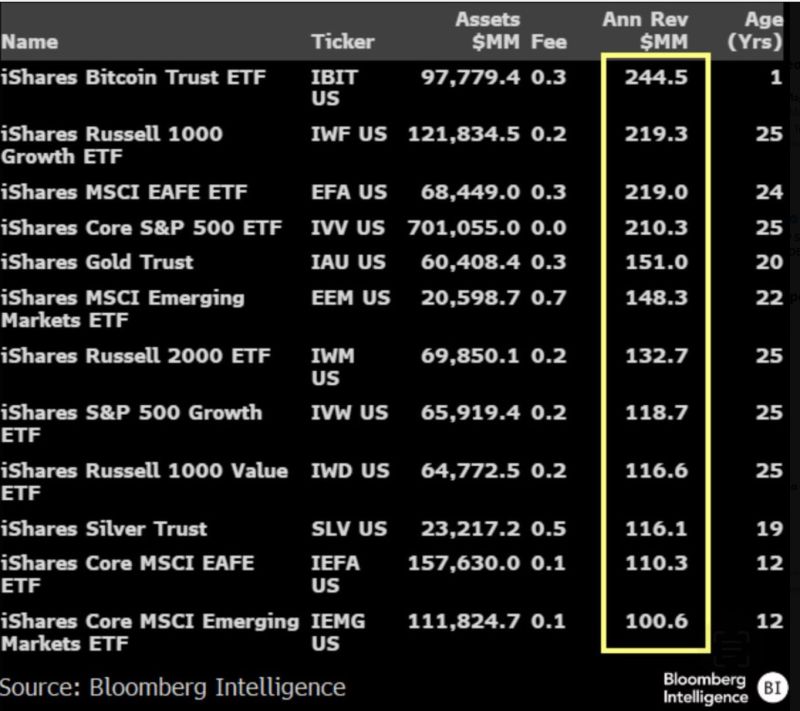

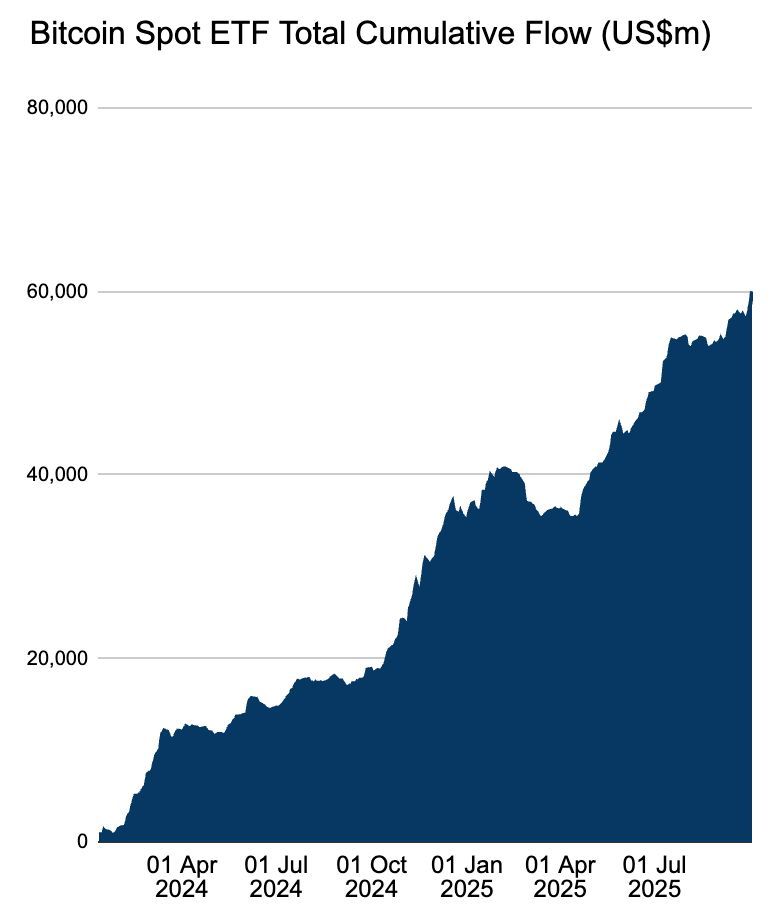

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

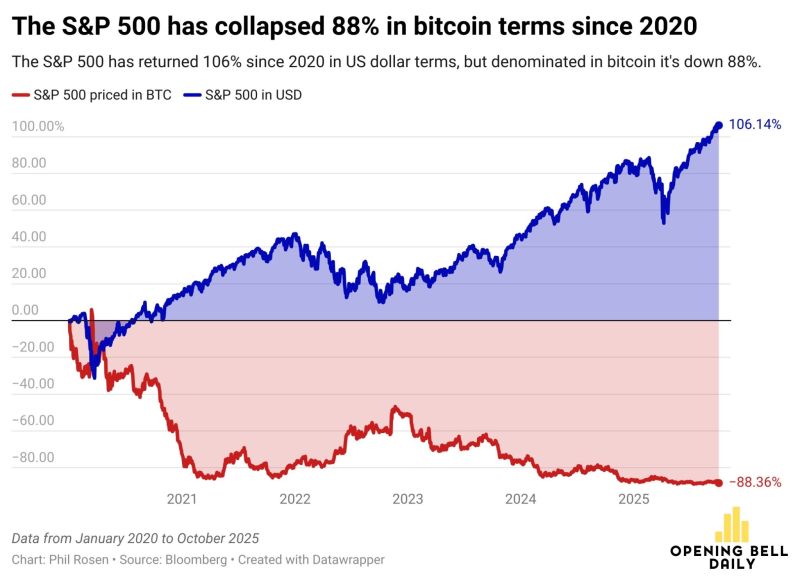

The S&P 500 is up more than 100% since 2020

But the index is actually down 88% when priced in a hard asset like bitcoin. Source: Anthony Pompliano 🌪@APompliano (H/t @philrosenn)

It's liquidity stupid!

Strong M2 growth in China, and to a smaller extent Brazil and India, add to the ongoing expansion of M2 in the United States and in Europe. Our Global M2 proxy continues to point to a broadly supportive liquidity environment for risk assets. The S&P 500 continues to follow the evolution of our Global M2 proxy with an 11-week lag. Bitcoin has desynchronized from our Global M2 proxy since mid-August but bounced up strongly last week. Will it catch up our Global M2 proxy (and rise toward 140k)? NB: liquidity is one risk assets driver among others. Past results do not guarantee future results

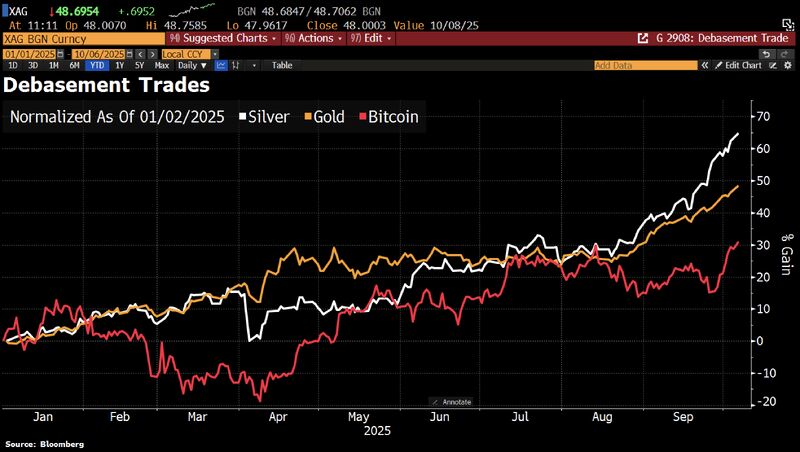

Debasement Trade propels Gold, Silver and Bitcoin as investors flock to the perceived safety of real assets while pulling away from major currencies.

The Yen tumbled on Monday as pro-stimulus lawmaker Sanae Takaichi was set to become Japan’s next PM. The dollar, which has weakened about 30% against Bitcoin this year, remains under pressure as the US government shutdown drags on. The euro has its own problems w/fresh political uncertainty brewing in France. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks