Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The "Bitcoin is dead" narrative just jumped the shark

Each cycle, Bitcoin is declared “dead,” but this ignores a deeper structural shift in monetary sovereignty. Behind the negative headlines, fundamentals are advancing: major U.S. regulation (CLARITY Act), rapid institutional adoption through asset tokenization, and crowded bearish positioning near the 200-week SMA. The transition from speculative asset to institutional financial infrastructure is painful but ongoing when the bear case relies on fear narratives, it often signals that the structural shift is already underway.

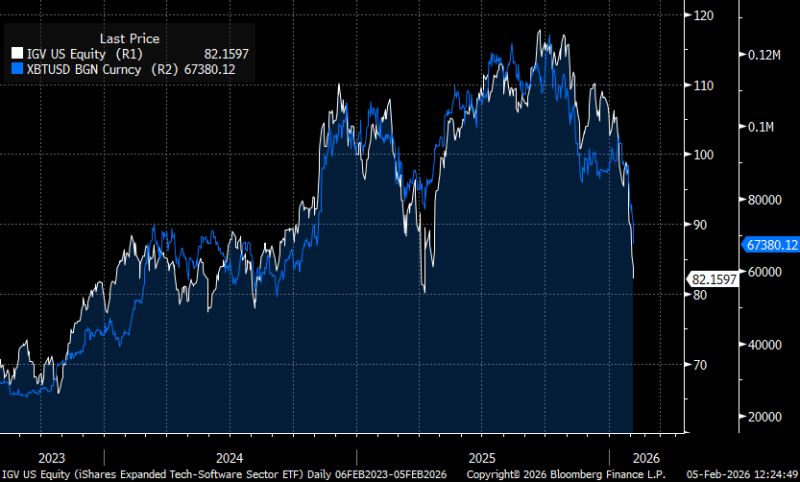

As shown on the chart below, the iShares Expanded Tech-Software Sector ETF (IGV) and bitcoin look like twins...

Source: Bloomberg

Bitcoin is experiencing severe sell-off pressure, with one of the worst days of the decade similar to past crisis moments (COVID crash, Terra Luna, FTX).

BTC is extremely oversold: daily RSI hit 16 and weekly RSI fell below 30 for only the 4th time ever. Historically, buying at these levels and holding for one year has delivered strong returns (+112% in 2015, +136% in 2019, +26% in 2022). Source: Trendspider

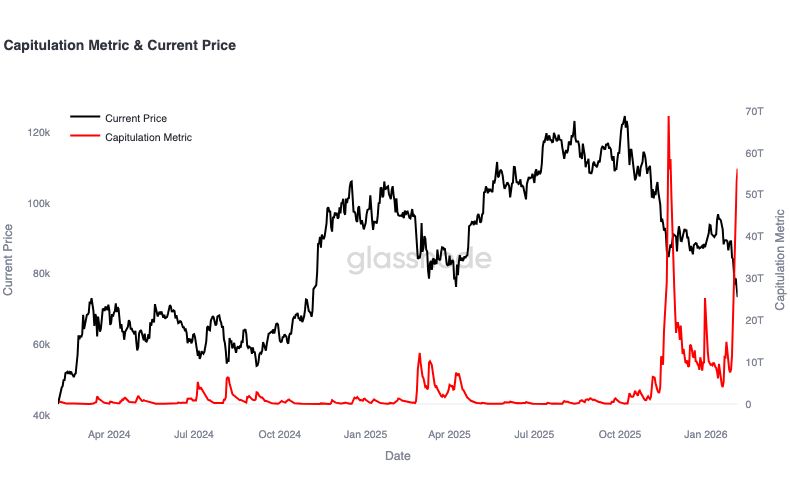

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning". Source: Glassnode

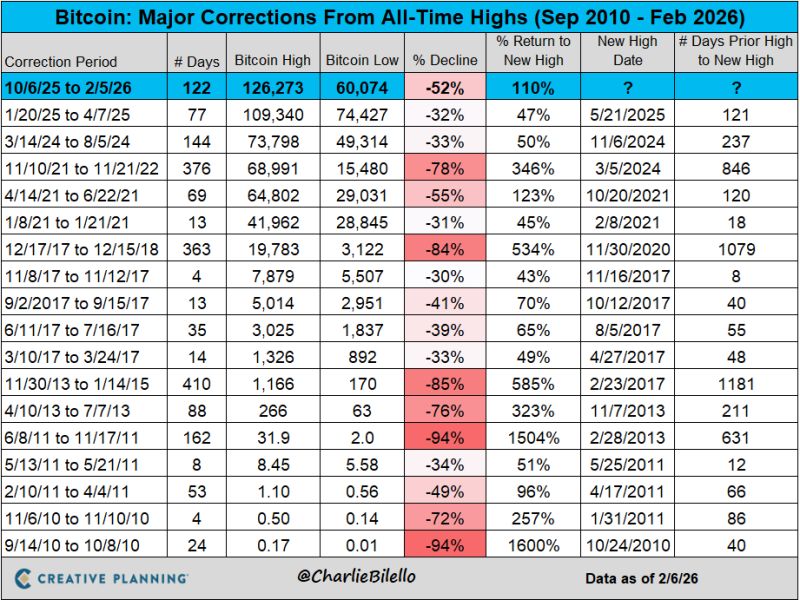

At yesterday's low of $60k, bitcoin was down over 52% from its October 2025 peak.

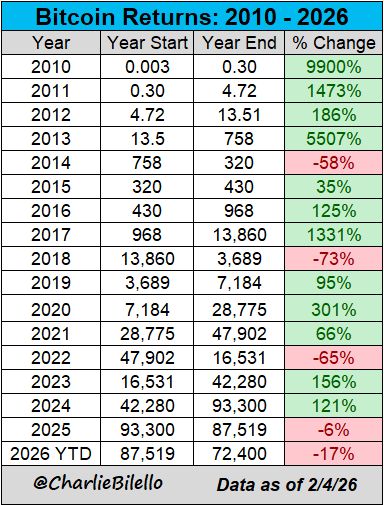

This was its 9th 50+% decline off an all-time high since it began trading on exchanges back in 2010. $BTC Source: Charlie Bilello

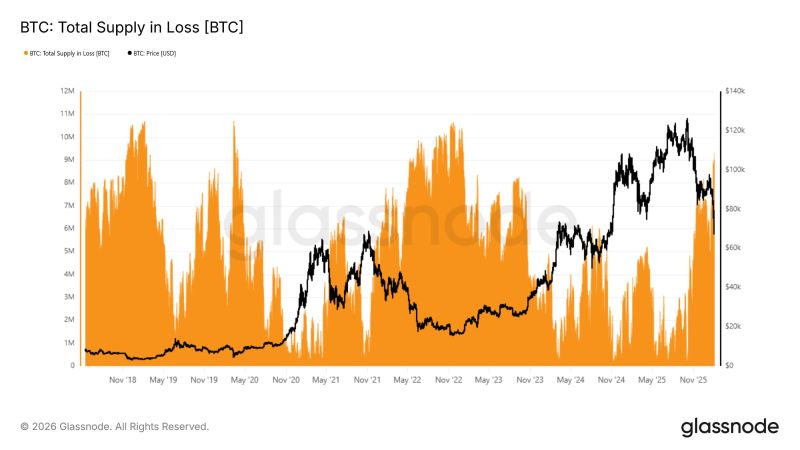

Over 9.3M Bitcoins are underwater, the highest supply in loss since January 2023, per Glassnode.

Source: www.cointelegraph.com

They used to be the same...

Imagine if $BTC still carries some of that aggregate investor psychology... The gap vs NASDAQ remains absolutely huge. Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks