Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tesla just posted a double miss for Q2:

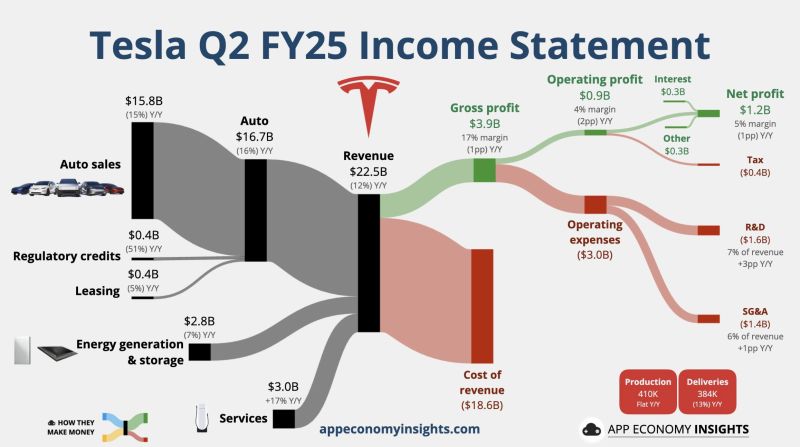

~EPS: $0.40 vs $0.42 est ~REV: $22.50B vs $22.79B est Still, the stock $TSLA was up +1% in after-hours trading Here are the details: • Revenue -12% Y/Y to $22.5B ($0.4B beat). • Gross margin 17% (-1pp Y/Y). • Operating margin 4% (-2pp Y/Y). • Capex +5% Y/Y to $2.4B. • Free cash flow -89% Y/Y to $0.1B. • Non-GAAP EPS $0.40 (in-line). Source: App Economy Insights

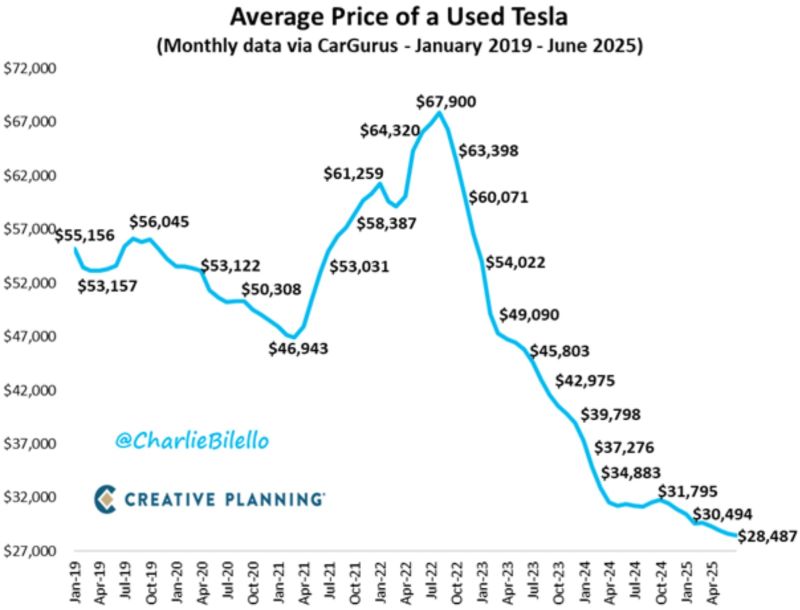

Buying a Tesla is becoming more and more affordable with each passing month.

The average price of a used Tesla has moved down to a record low of $28,487. That's 58% below the peak price from July 2022. $TSLA Source: Charlie Bilello

On June 29th 2010: Tesla went public.

$4,000 invested in the IPO would be worth more than $1 million today. Source: Jon Erlichman @JonErlichman

Tesla stock $TSLA, surges over +5% as President Trump says he is not getting rid of his Tesla.

Trump also called Starlink a “good service” and say he wishes Elon well. Global Pulse on X: “Despite rising tensions, the Trump Vs Musk conflict will cool down in the coming days till next election. Both are high-stakes players, and neither wants to risk their empires”. Source image: Not Jerome Powell on X

Current state of affairs 🍿Markets situation yesterday summarized in one image courtesy of Trend Spider.

Tesla was a big laggard in the session, down more than 14%, after President Donald Trump said he was “very disappointed” in CEO Elon Musk. Musk shot back at President Donald Trump, saying in a post on X that “without me, Trump would have lost the election.” The feud further intensified after Trump called Musk ”‘CRAZY” and signaled that he might cut his companies’ government contracts.

The Trump-Elon meltdown: the breakup between the world’s most powerful politician and the world’s richest man is playing out in a manner befitting an era of hyperreality:

With stunning speed, wild recriminations, and in public via television and their own social media platforms. Tesla shares plunged 14%, comp lost $153bn in mkt cap, now worth less than $1tn. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks