Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

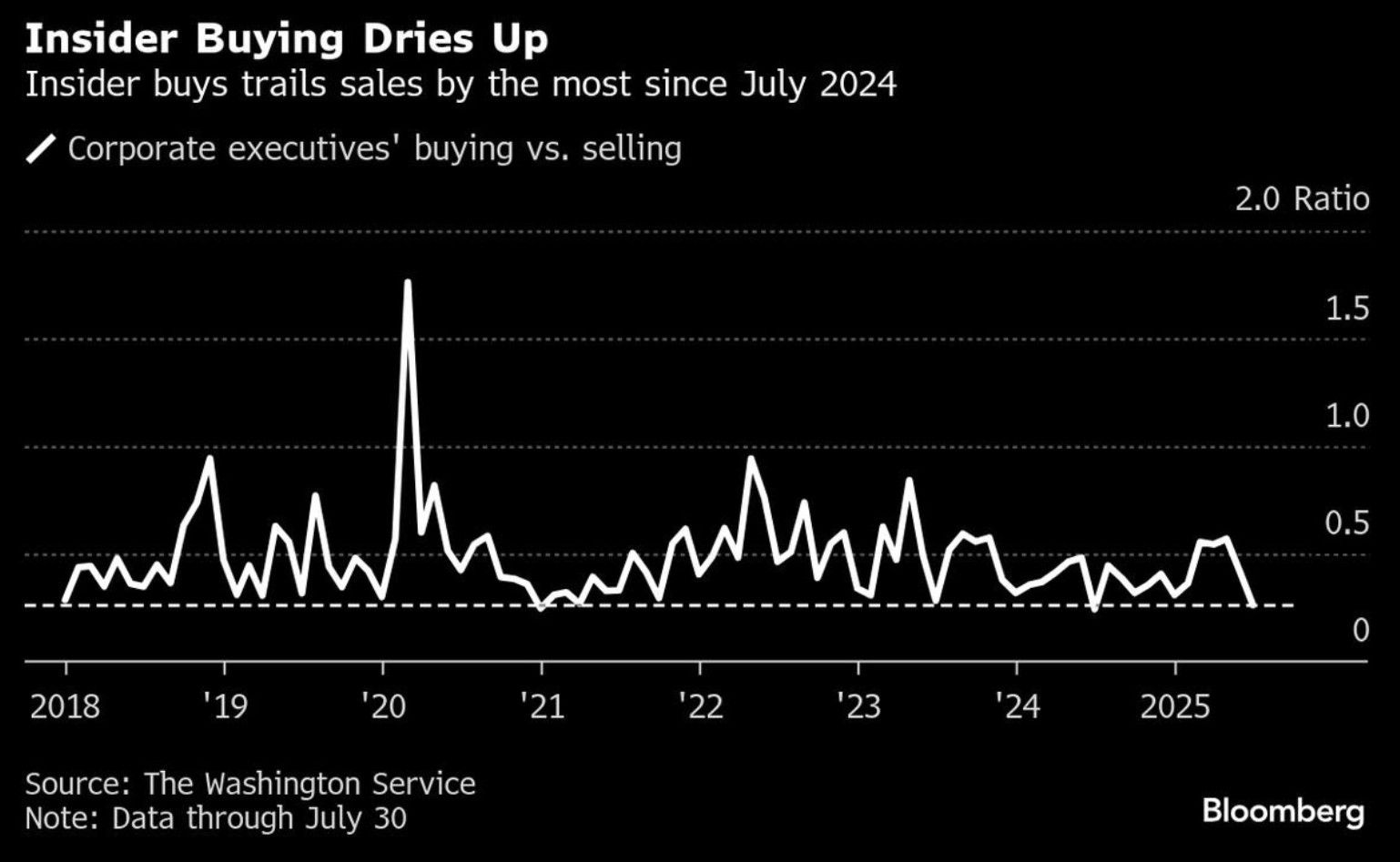

“Insiders at just 151 S&P 500 companies bought their own stocks last month, the fewest since at least 2018, according to data compiled by the Washington Service.”

Source: Kevin Gordon on X, Bloomberg

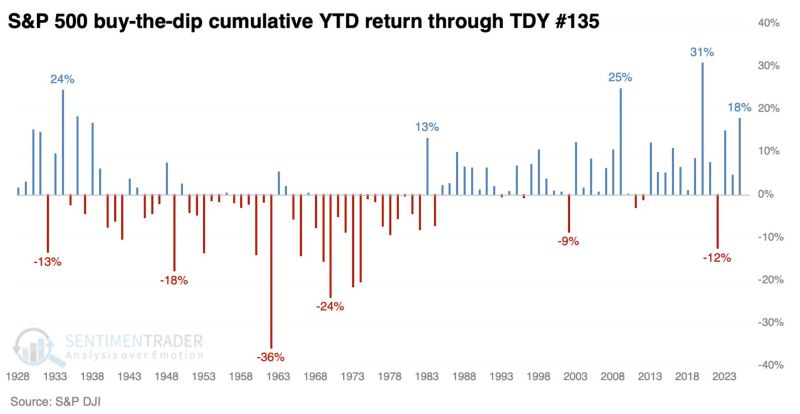

The "buy the dip" mentality is intact.

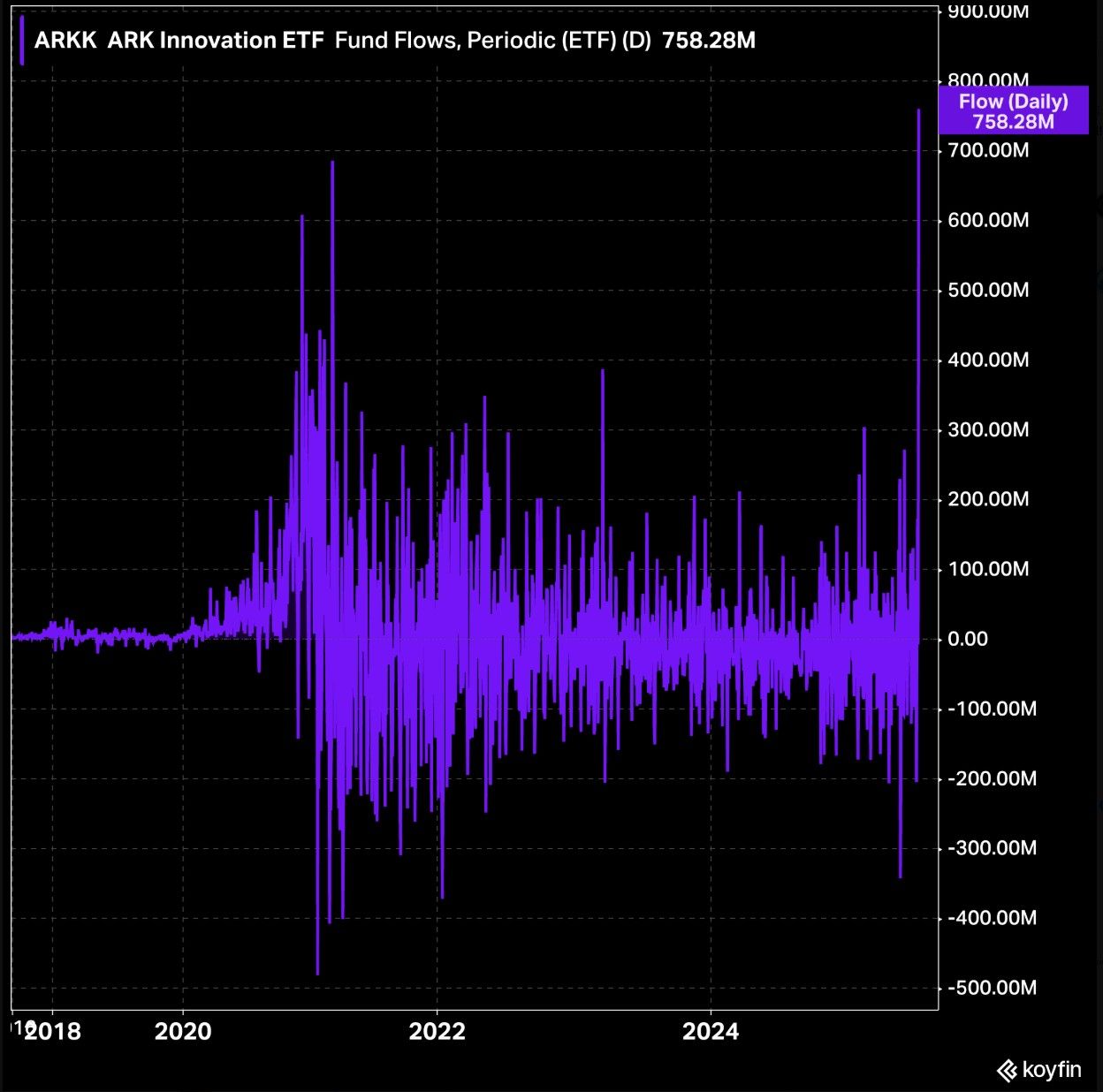

$ARKK Cathie Wood's ARK Innovation fund $ARKK saw its largest ever single day of inflows on Friday. Source: Koyfin

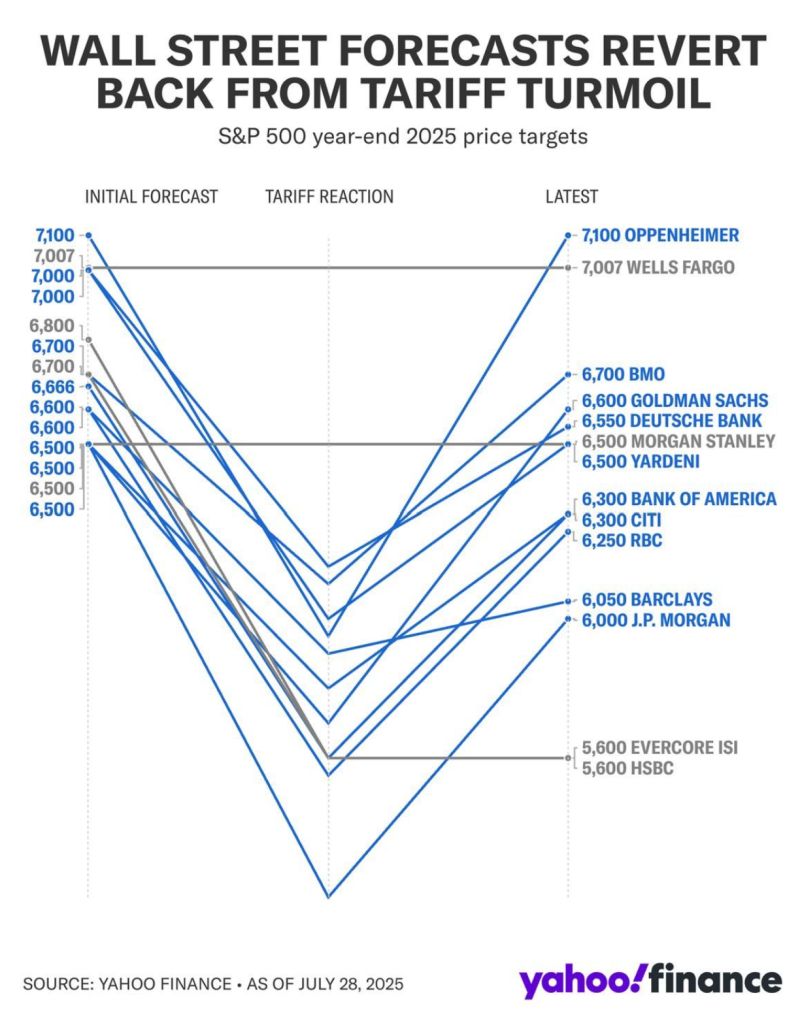

THIS IS WHY YOU NEVER FOLLOW WALL STREET PRICE TARGETS BLINDLY

Source: Gurgavin, Yahoo Finance

Bitcoin $BTC price will go up if there are more buyers, says Citi - couldn't agree more...

"A bitcoin is worth what the next person will pay for it," the FT journalist, Bryce Elder, writes. "The same can be said of a lot of assets." Spot on! This is correct and accurate reporting indeed. And that's how investors need to think about markets, whether it's Bitcoin (BTC), shares of Apple (AAPL), or the direction of Gold.

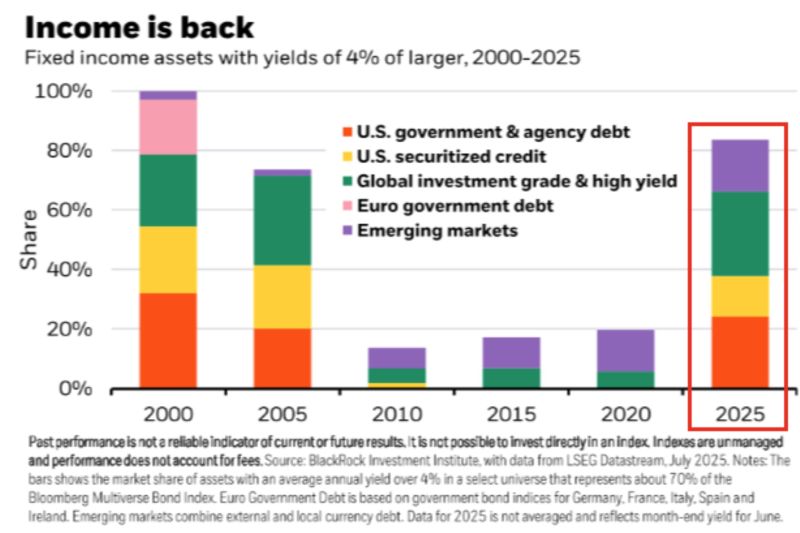

More than 80% of fixedincome assets yield above 4%.. income is back.

Source: BlackRock thru Mike Zaccardi, CFA, CMT, MBA

'Buy the Dip' mentality remains strong.

So far this year, the cumulative gain by buying a down day in the S&P 500 and holding it only for the next session is +18% ... tied for the fourth-highest since 1948 Source: Kevin Gordon @KevRGordon

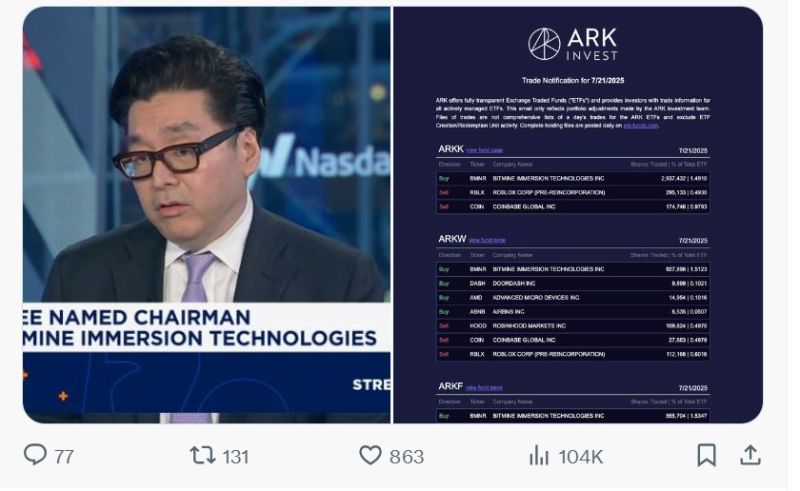

Cathie Wood and Ark Invest bought 4,421,034 shares of Tom Lee's new Ethereum Treasury Company $BMNR

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks