Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

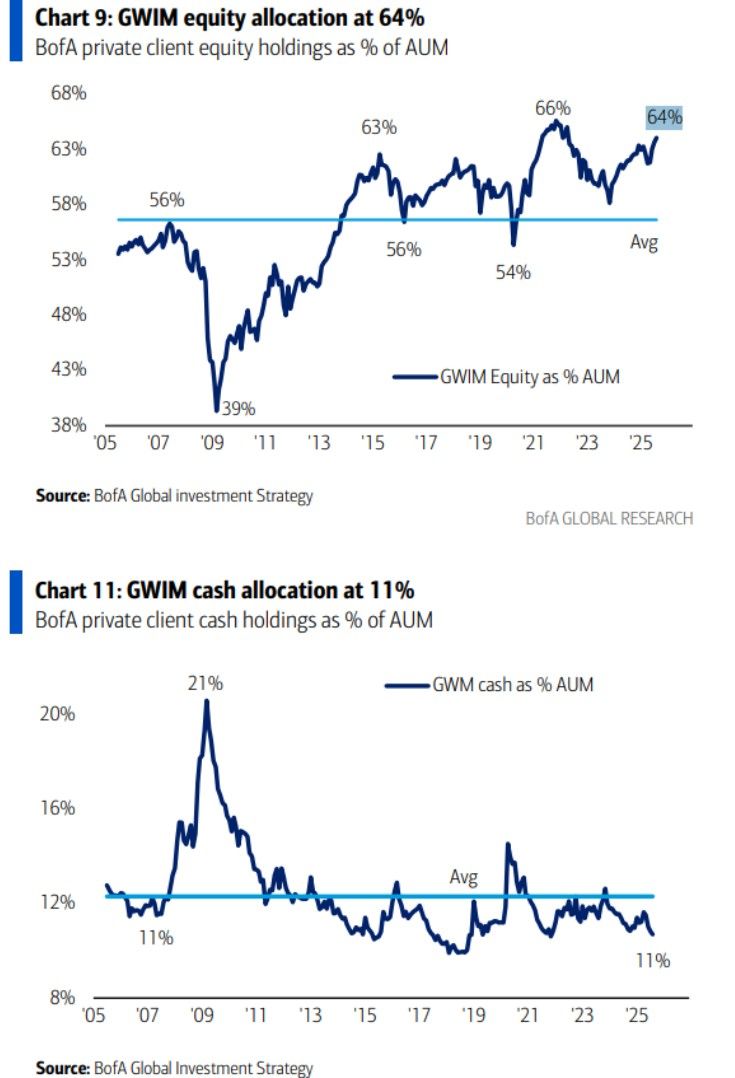

BofA private clients: 64% stocks, highest since March 2022

10.7% cash, lowest since October 2021 (Hartnett) Source: Mike Zaccardi, CFA, CMT, MBA

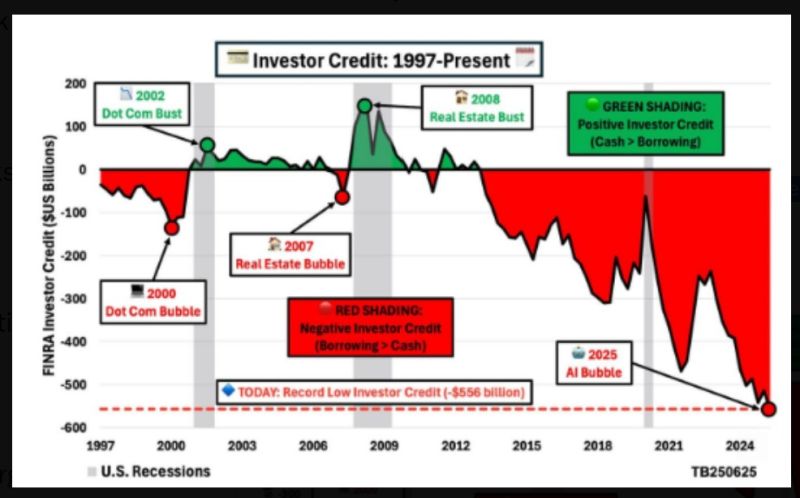

Investors are now buying stocks on margin at levels never seen before in history

Source: Barchart

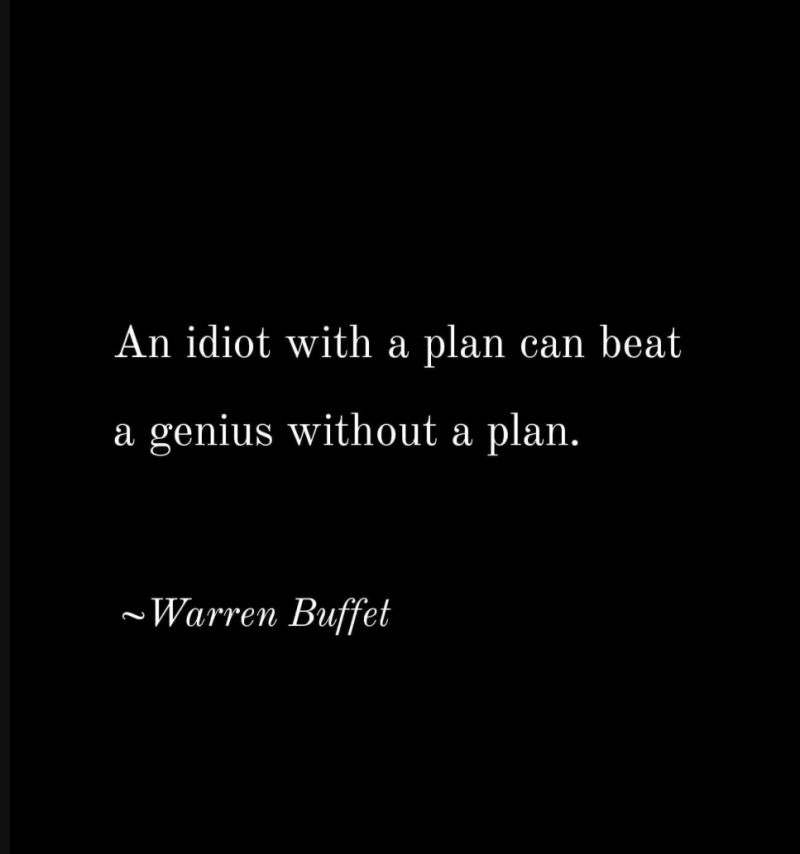

The importance of having a plan

Source: Mindful Maven on X

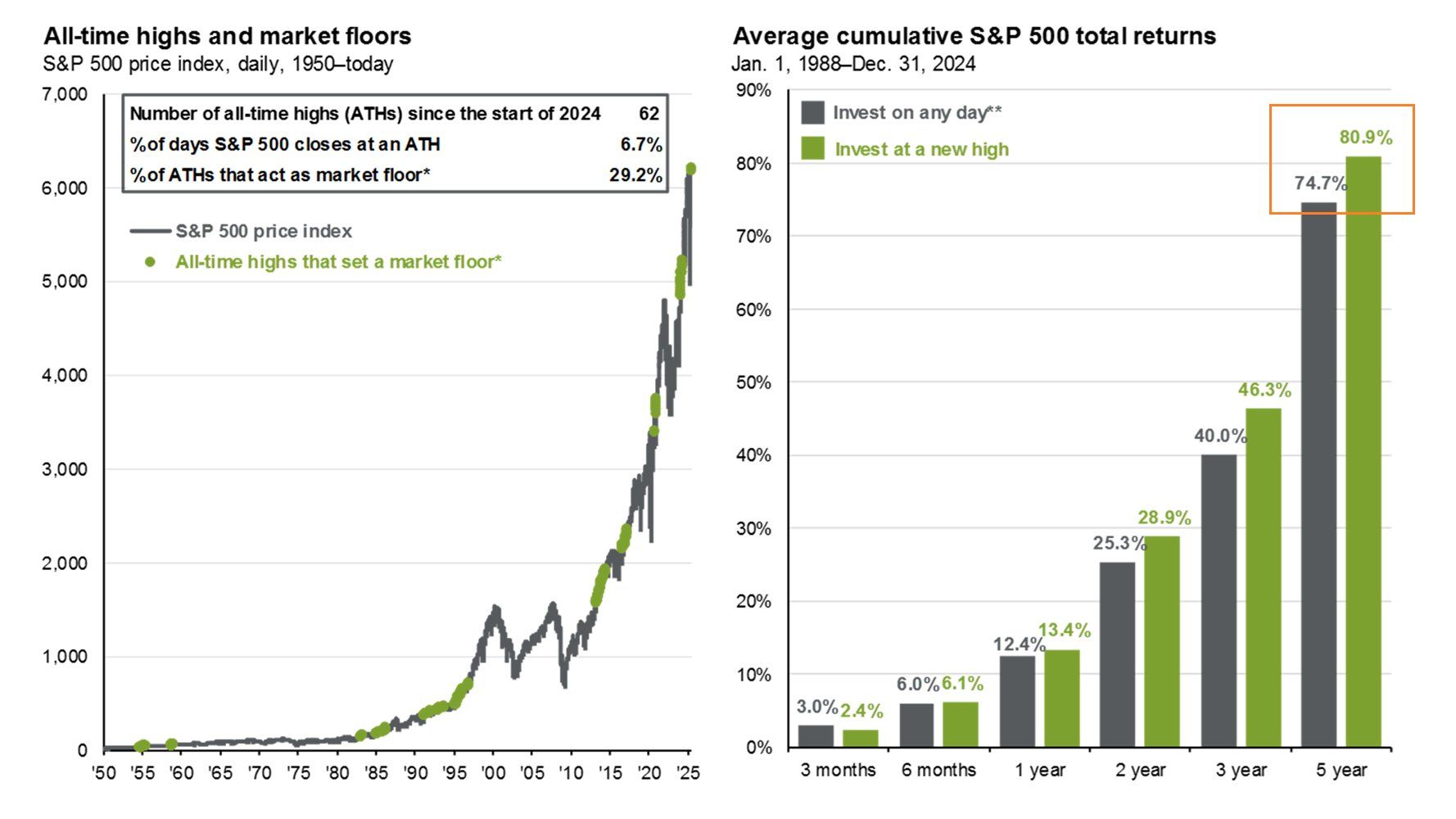

This is counterintuitive: It's safer to invest when the sp500 is at an all-time high...

Source: @MikeZaccardi on X

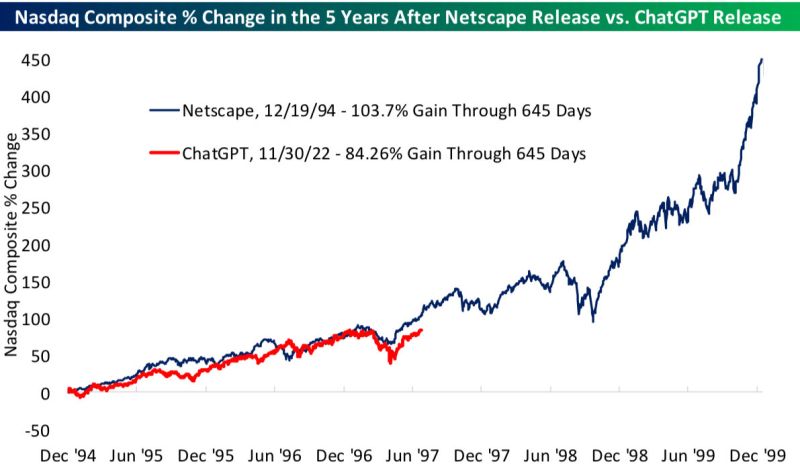

Here’s how the Nasdaq is tracking at 645 days since the release of ChatGPT versus the release of Netscape in December 1994.

Source: Bespoke @bespokeinvest

10 year returns of more than 2,000%

Bitcoin: +44,369% Nvidia: +31,323% AMD: +5,722% Shopify: +3,680% Broadcom: +2,478% Comfort Systems: +2,365% Axon Enterprise: 2,339% Texas Pacific Land: +2,310% MicroStrategy: +2,108%

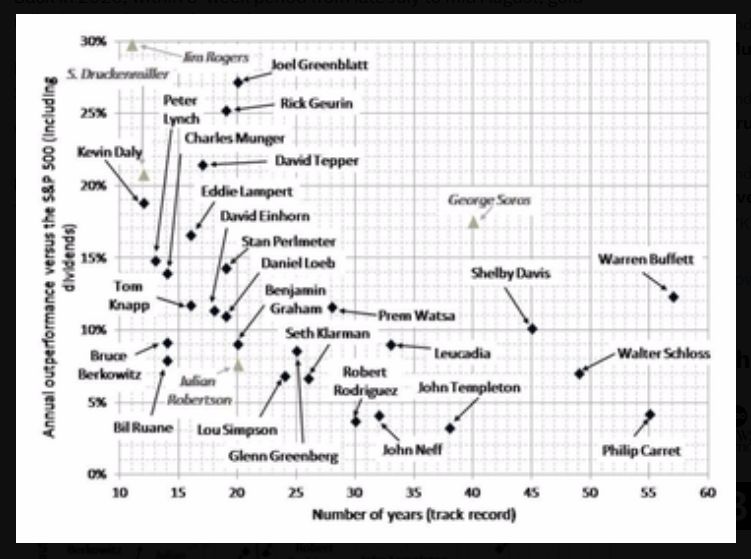

The GOATs of investing

Annual outperformance vs. sp500 / number of years (track record)

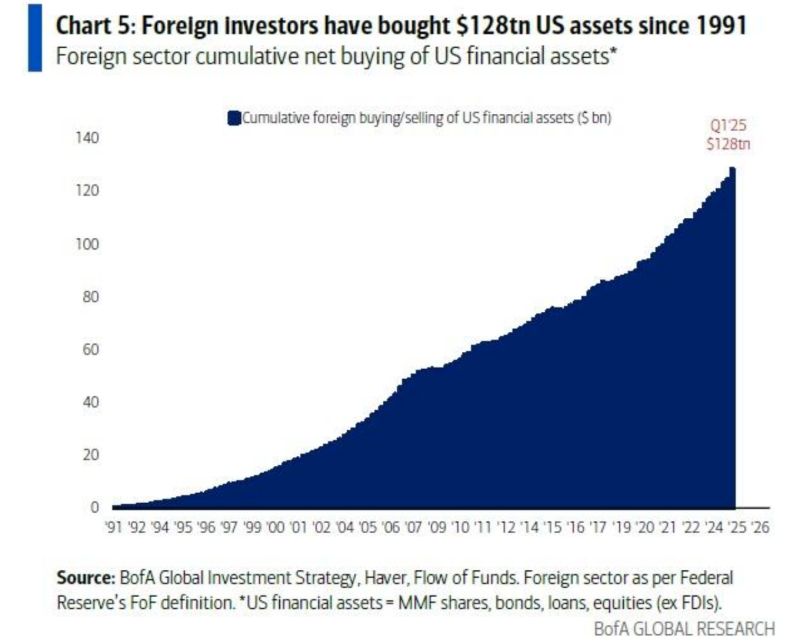

Foreign investors have bought a whopping $128 trillion of US assets over the last 34 years.

Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks