Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

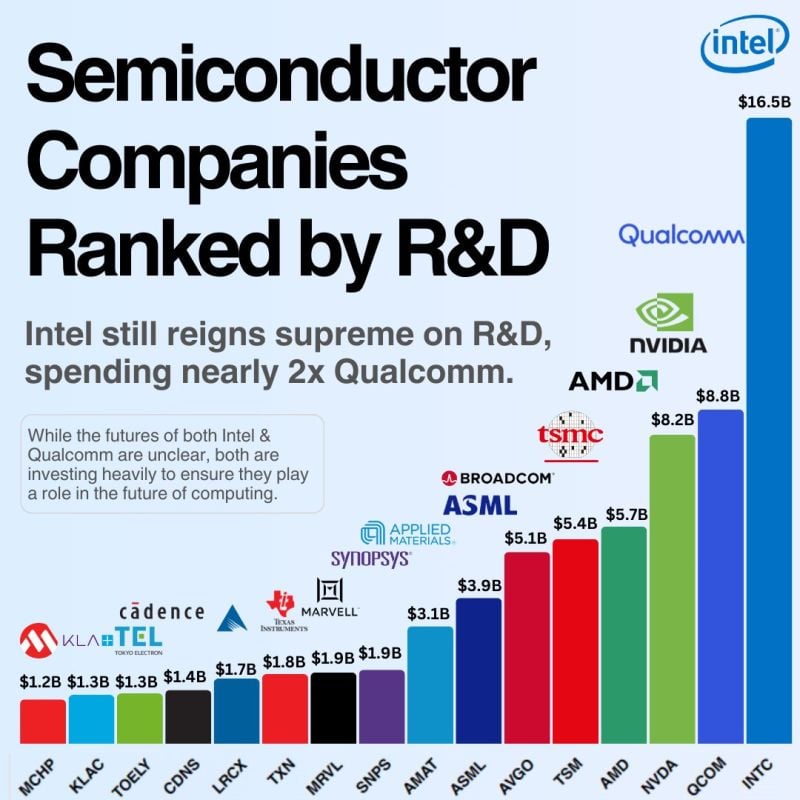

High R&D spending does NOT guarantee growth and/or high shareholder returns

The chart below courtesey of Eric | AI & Tech Investing shows semiconductor companies ranked by R&D over the last 12 months. $INTC $QCOM $NVDA $AMD $TSM lead the way. Intel has spent over $100B in R&D over the last decade. Despite that, they have the 2nd lowest shareholder return of all these companies (see addt'l chart below). Intel has generated $52.9B in revenue over the last twelve months. A decade ago, Intel generated $52.4B in revenue. An important cautionary tale for investors: R&D doesn't guarantee growth. Source: Eric | AI & Tech Investing

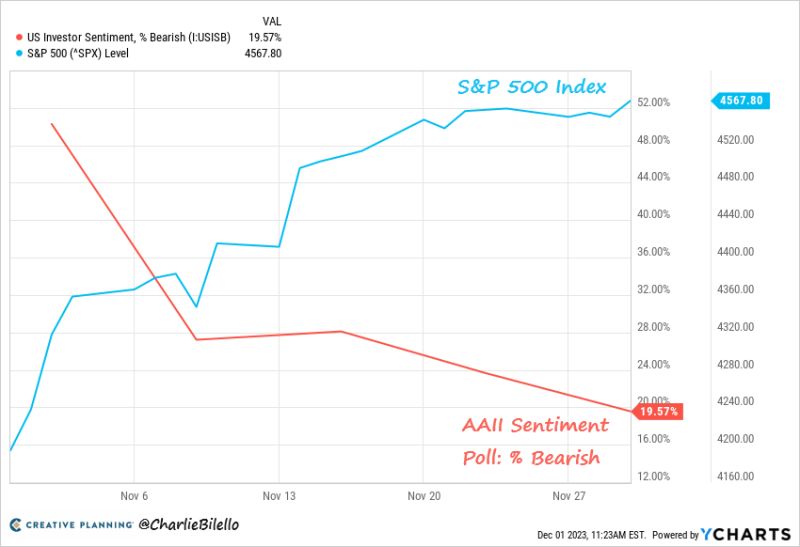

Sentiment is turning bullish. Bears in the AAII sentiment poll moved from over 50% to under 20% during November

This is the lowest bearish % since Jan 2018 (which followed 2017's record 12 straight up months). What changed? Prices. The S&P 500 gained 8.9% in November, one of its best months ever. $SPX Source: Charlie Bilello

Record holiday spending: good news, just one problem: consumers used buy-now-pay-later schemes to spend $7.3BN from Nov. 1 to Nov. 26, up 14% from a year ago, per Adobe

These are basically vendor/3rd party financing programs which don't show up on already maxed out credit cards... Source: Statista, www.zerohedge.com

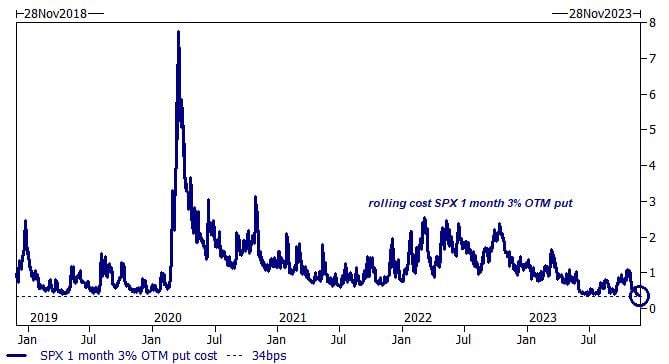

Goldman: Hedging against a market crash is the cheapest in more than five years...

The chart below shows the cost of a rolling SPX 1 month 3% OTM put: the current cost is 34 basis points, the lowest level in 5 years. Source: Goldman Sachs, TME

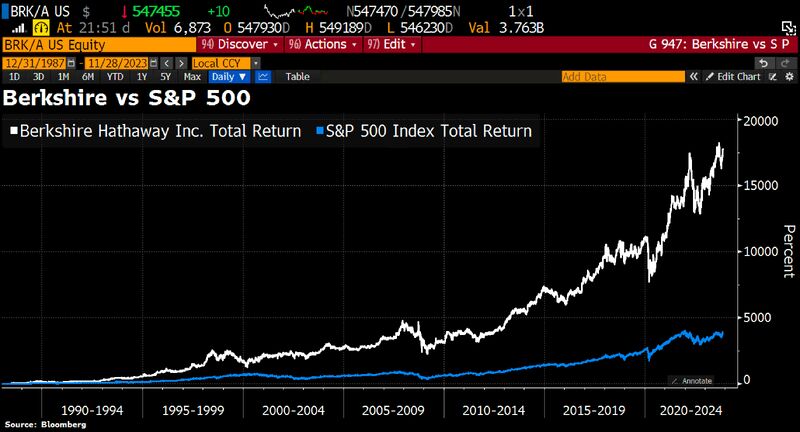

Charlie Munger, Warren Buffett's Partner and 'Abominable No-Man,' dies at 99

Munger helped Buffett, who was seven years his junior, craft a philosophy of investing in companies for the long term. Under their management, Berkshire avg an annual gain of 20.1% from 1965 through 2021 — almost twice the pace of the S&P 500 Index. Source: Bloomberg, HolgerZ

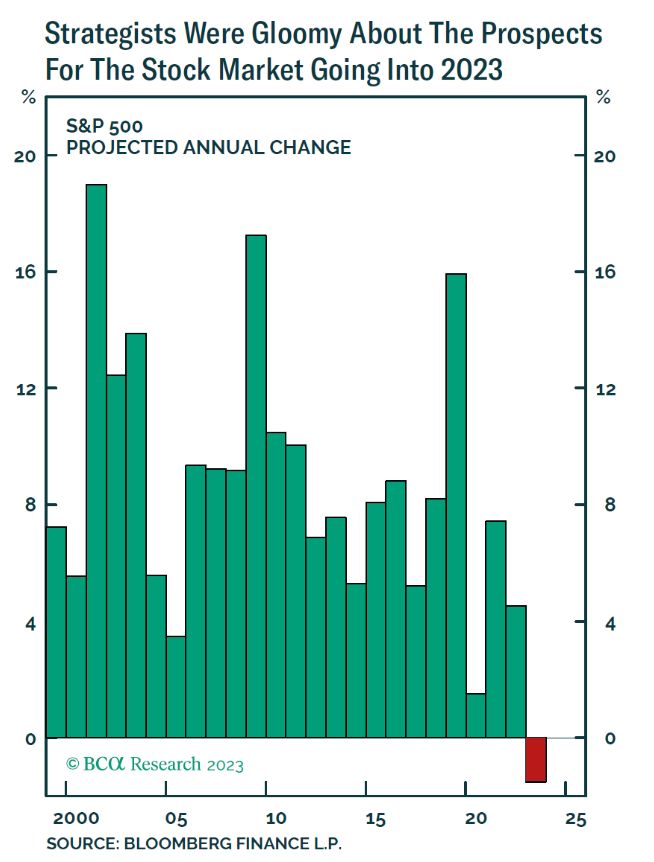

Here's a classical example of contrarian signal that can be used in your asset allocation decisions

Entering into 2023, Wall Street strategists were expecting the S&P 500 to decline. This was the first time ever (survey started in 2000) that aggregated 12-month S&P 500 targeted return was in negative territory. Fast forward to the end of November and the SP500 is up 18% year-to-date... As Warren Buffet said: "Be fearful when others are greedy and greedy when others are fearful" Source: BCA research, Barchart

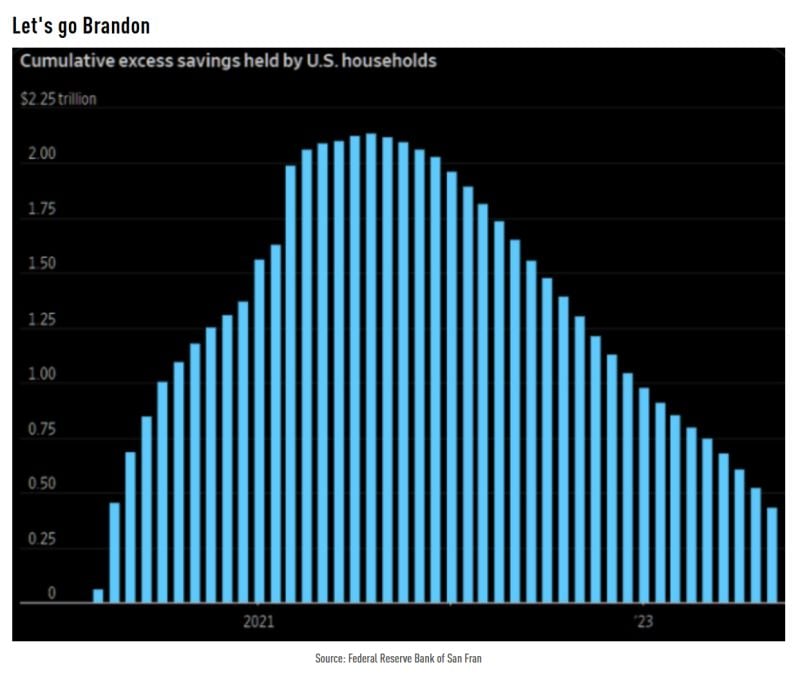

US households still have an estimated $433 billion in excess savings remaining from the 2020-21 stimulus programs

Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks