Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

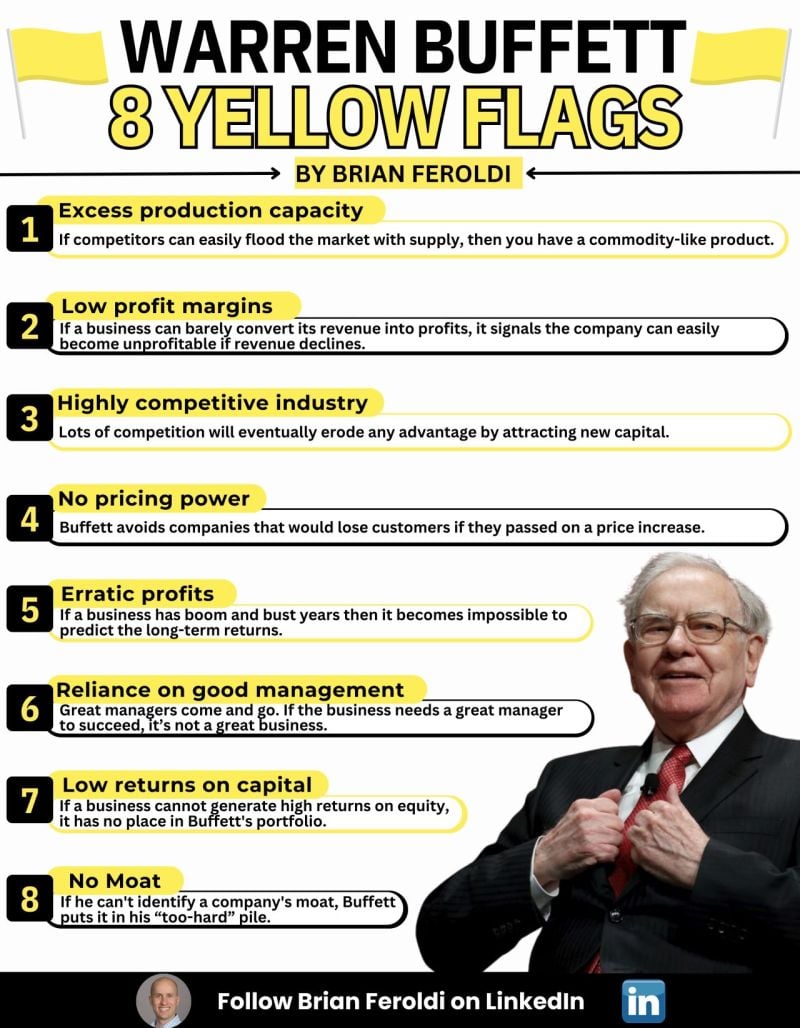

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

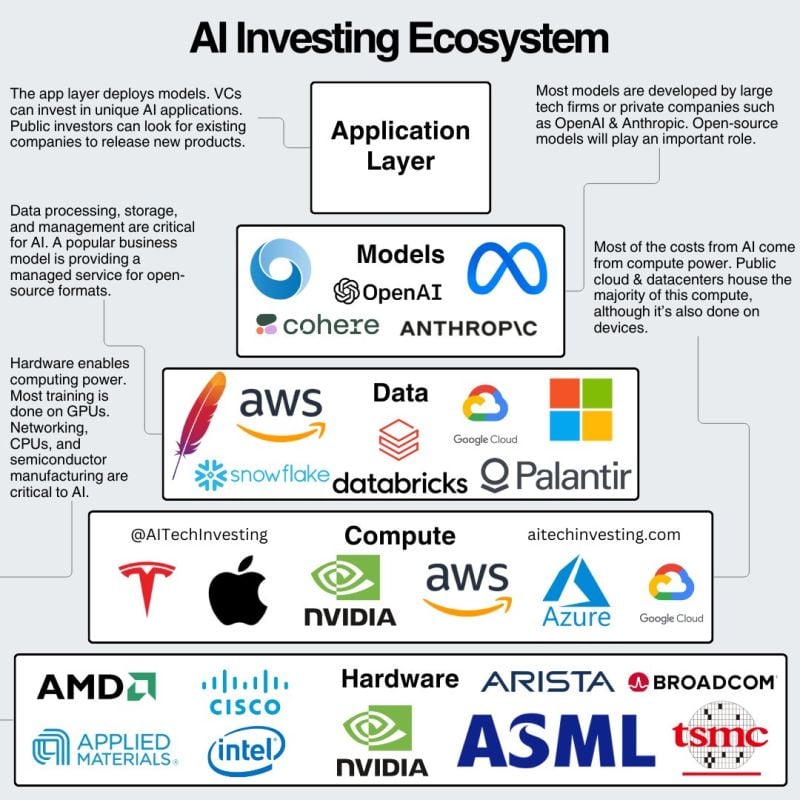

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

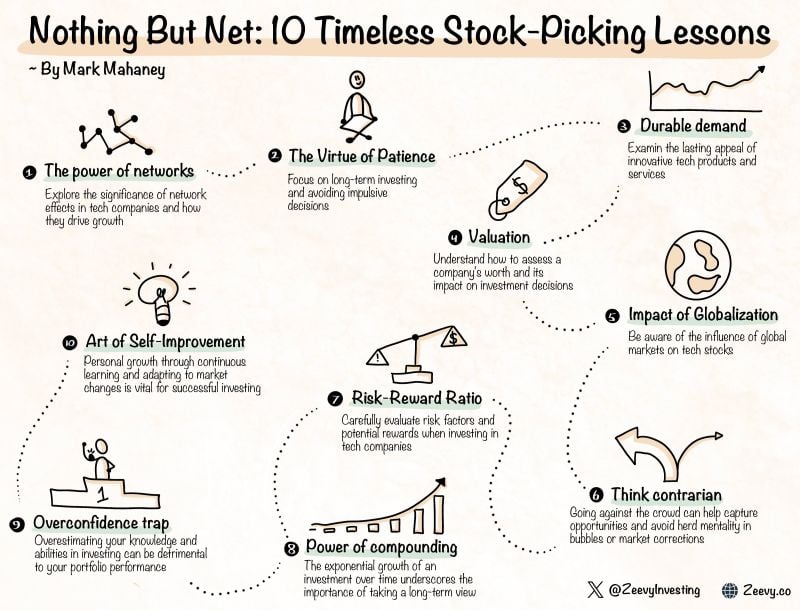

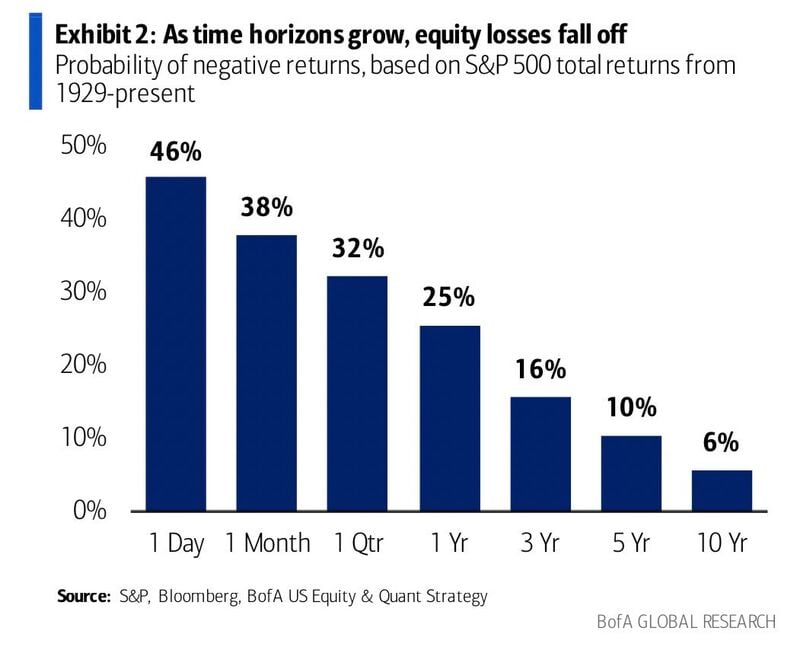

How to not lose money in the stock market? Answer: keep a long-term time horizon

Source: BofA

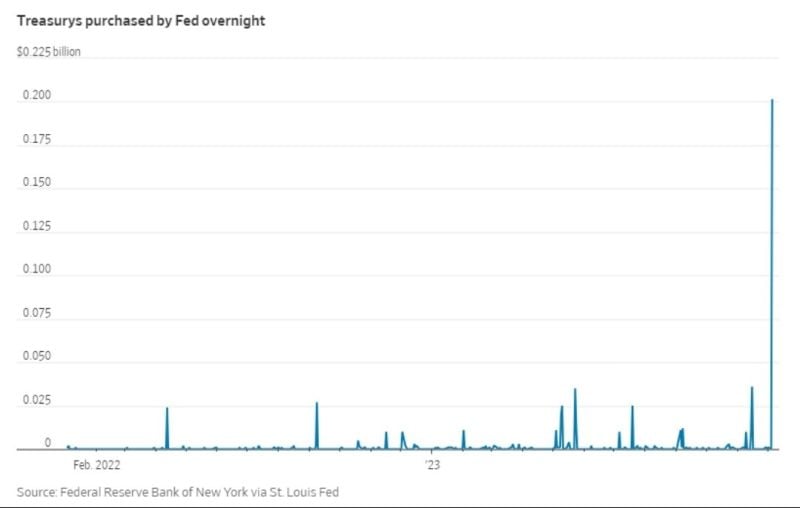

The Federal Reserve lent out roughly $200B in overnight cash on Wednesday through its standing repo facility

This is the highest amount since the onset of covid. What's going on? Is another repo crisis looming? Source: Win Smart, CFA

Investing with intelligence

Our latest research, commentary and market outlooks