Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

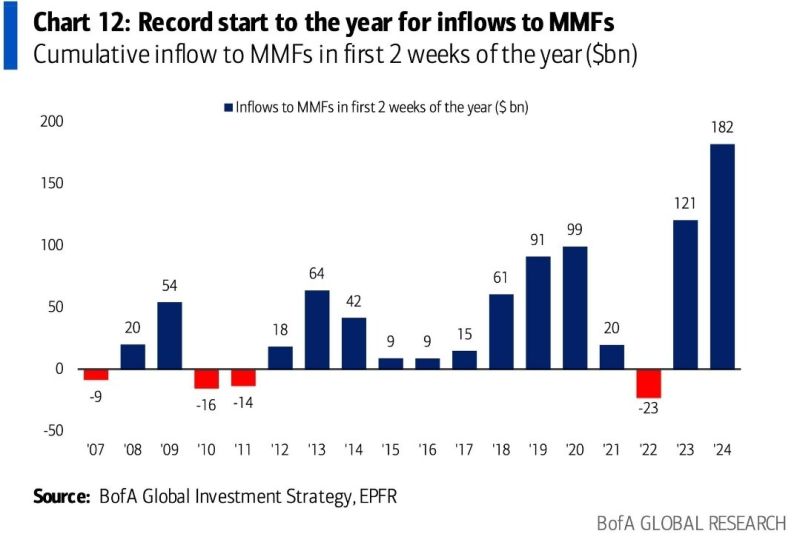

Fund flows do not sound "risk-on" at all...

Money Market Funds have seen inflows of $163 billion over the first 2 weeks this year, the highest amount EVER 👇 Source: BofA, Win Smart

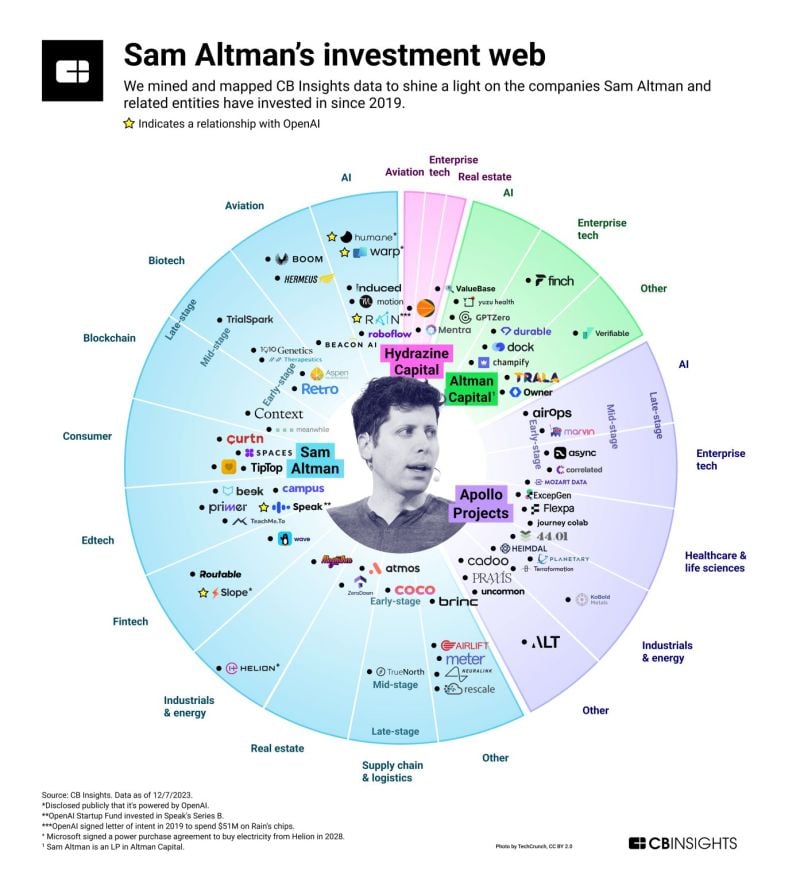

OpenAI CEO Sam Altman is not only one of the most powerful people in the world right now.

He's also one of the best angel investors and entrepreneurs. Source: CB Insights thru Linas Beliūnas

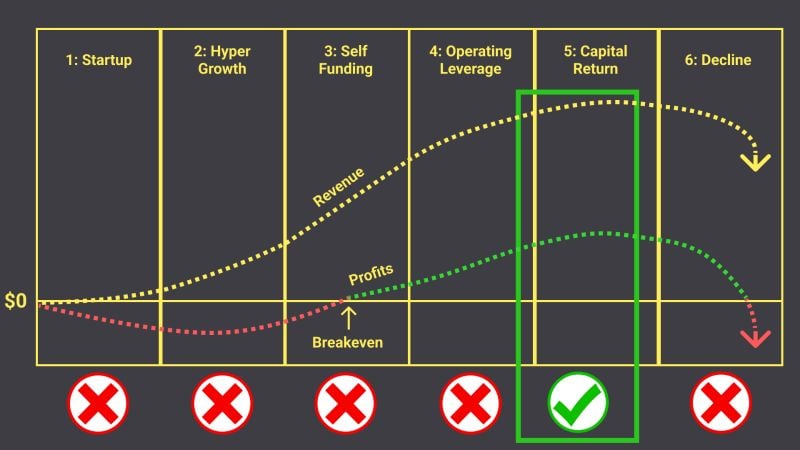

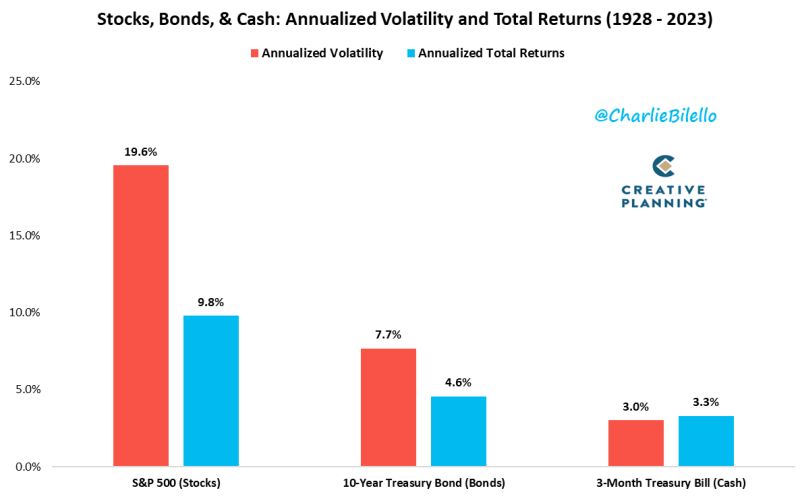

Why investors should embrace risk in one chart by Charlie Bilello:

Annualized Volatility since 1928... Stocks: 19.6% Bonds: 7.7% Cash: 3.0% Annualized Returns since 1928... Stocks: +9.8% Bonds: +4.6% Cash: +3.3%

Investing with intelligence

Our latest research, commentary and market outlooks