Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

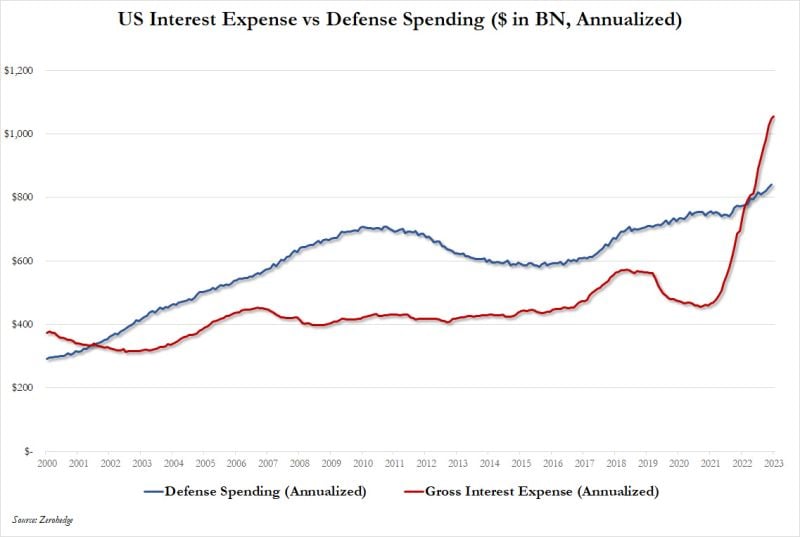

US defense spending vs interest on Federal debt

Source: www.zerohedge.com

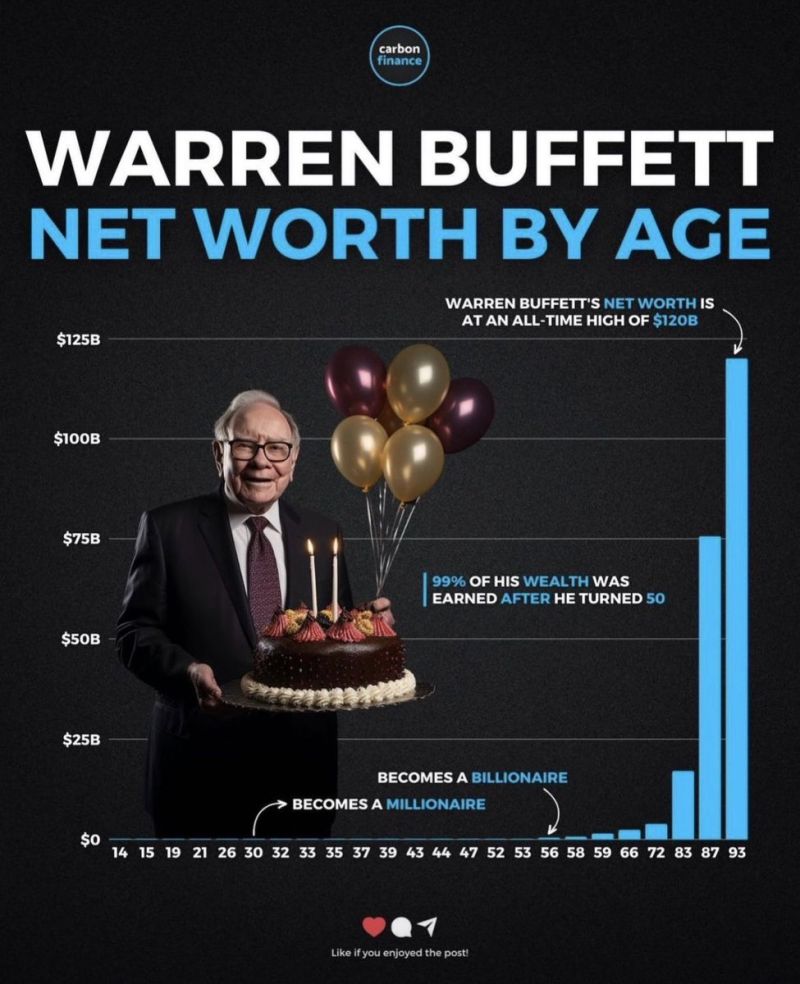

Warren Buffett became a Millionaire at the age of 30 and a Billionaire at 56

Here's Warren Buffett's net worth by age - source: Evan

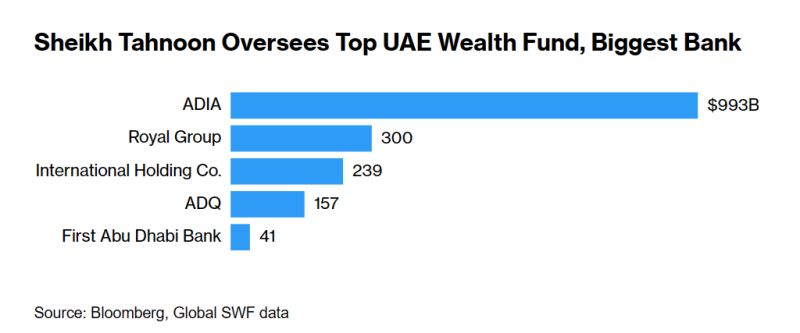

Abu Dhabi Royal Sets Up Firm to Hold $27 Billion in Assets

Abu Dhabi’s largest listed company, led by a key member of the emirate’s royal family, is setting up a new holding firm with assets worth 100 billion dirhams ($27 billion) across sectors ranging from financial services to mining. The new firm, called 2PointZero, will be transferred into Abu Dhabi’s $239 billion International Holding Co. Its holdings will include portions of Sheikh Tahnoon bin Zayed Al Nahyan’s sprawling empire, according to a statement late Tuesday. Lunate, Abu Dhabi’s newest fund, will be part of 2PointZero. International Resources Holding, which last month invested more than $1 billion in Zambia’s Mopani copper mine, will also be transferred into the vehicle. Other holdings will include private investment firm Chimera, Egypt’s Beltone Financial, crypto miner Citadel Technologies and Middle East-focused Sagasse Investments. Source: Bloomberg

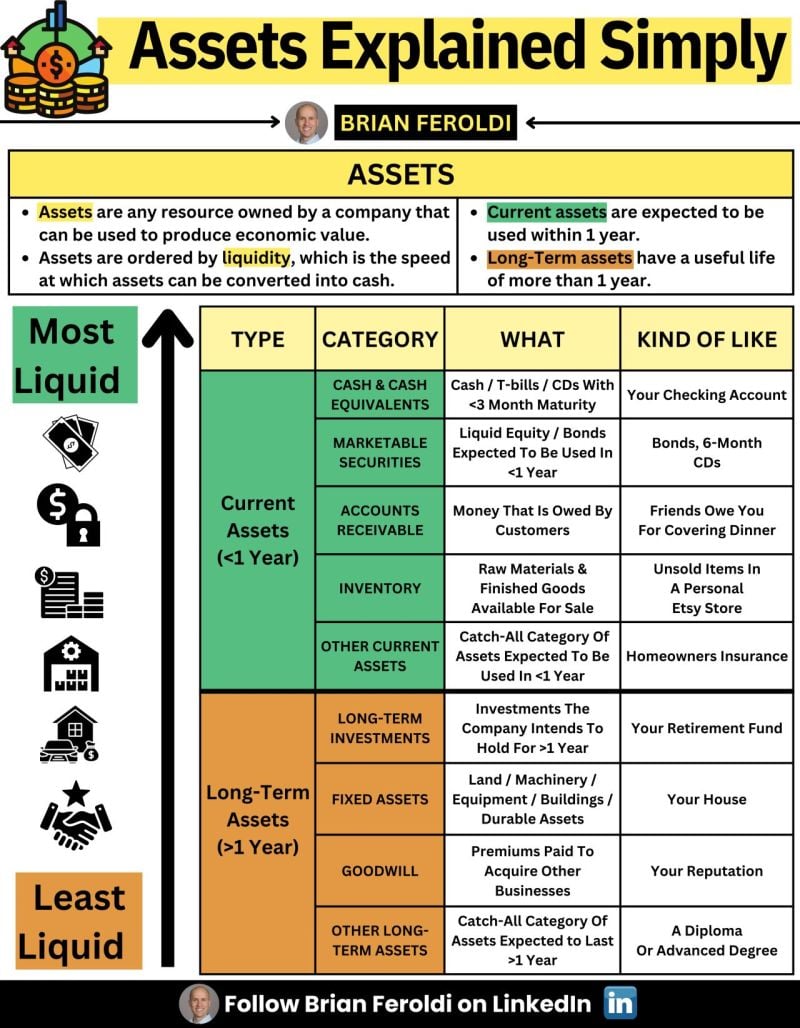

Buffett. Lynch. Munger. Fischer.

All of these investing legends use checklists. Source: Brian Feroldi

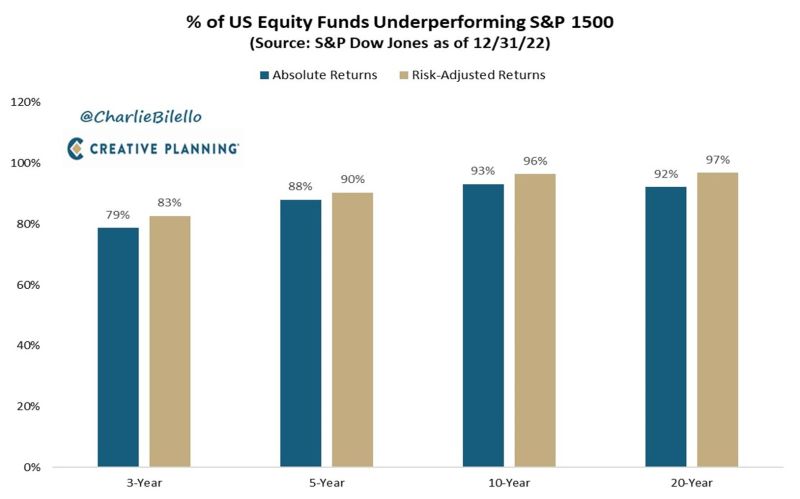

The longer you own an actively managed mutual fund, the more likely you are to underperform the market, especially on a risk-adjusted basis

Source: Peter Mallouk

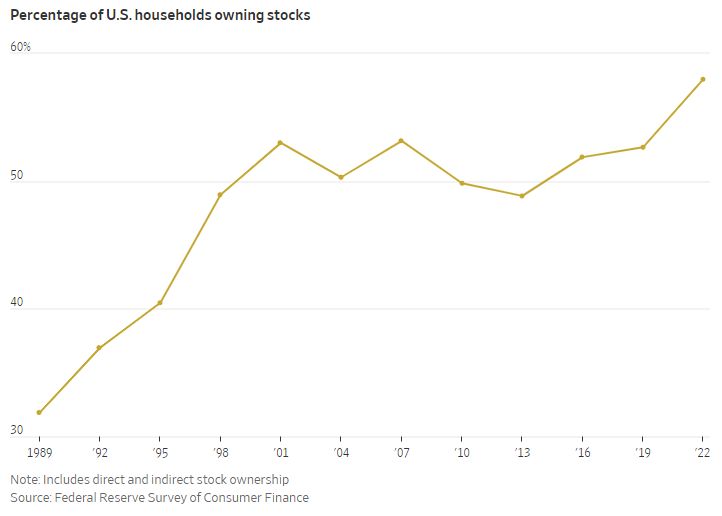

58% of US households own stocks, the highest percentage on record

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks