Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

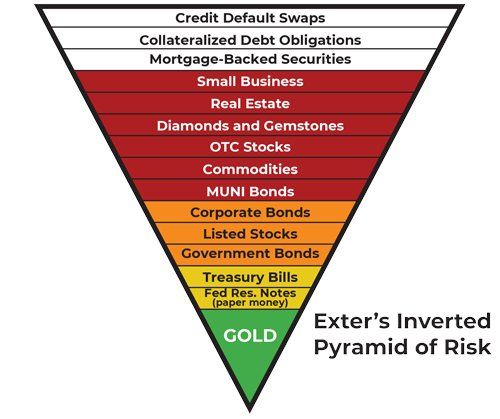

Exter's Inverted Pyramid of Risk

Organized from the most illiquid and highest counterparty risk assets to the least risky and most liquid, the layers of the inverted pyramid provide a unique perspective that builds from the mindset of a counterparty-risk sensitive investor. A swift glance at the pyramid reveals that the removal of any assets on the lower end (the more narrow base), will lead to the downfall of everything associated with it on the higher end, akin to a collapsing Jenga tower. Link to the article: https://lnkd.in/ekK3Nkby Source: www.schiffgold.com

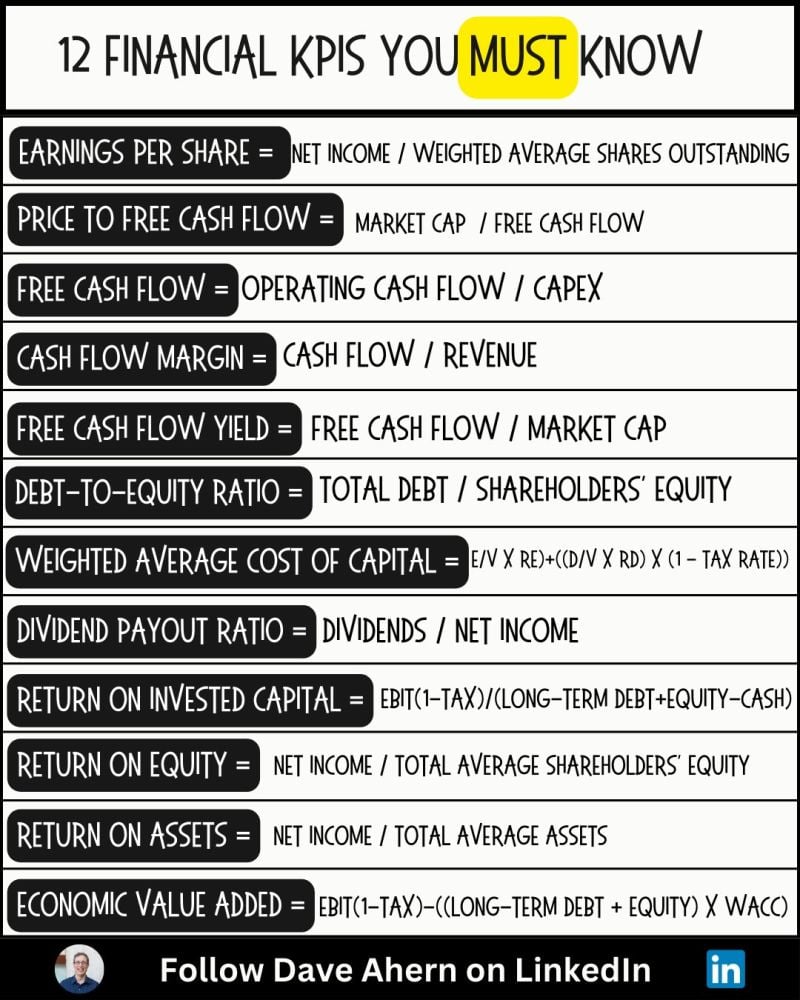

12 Financial KPIs every investor should know.

Source: The Investing for Beginners Podcast

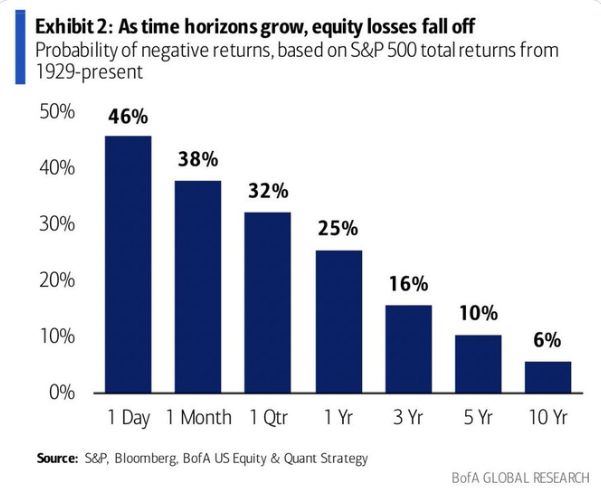

Invest For The Long Term

Probability of Negativ Returns, Based on S&P500 Total Returns From 1929-Present

Playing Monopoly

It's getting harder and harder to own anything... source : wallstreetsilver, david henning

From Facebook to Meta...

Swith the benefit of insight the renaming wasn't that bad after all... More seriously, it seems that the shift from metaverse to ai and the focus on shareholder value have been working very well. What a turnaround by Zuck... By the way, he will receive a $175 million quarterly dividend, on track for making $700 million annually in dividend... Is Mark Zuckerberg the mist underrated tech CEO. Source chart: Mac10

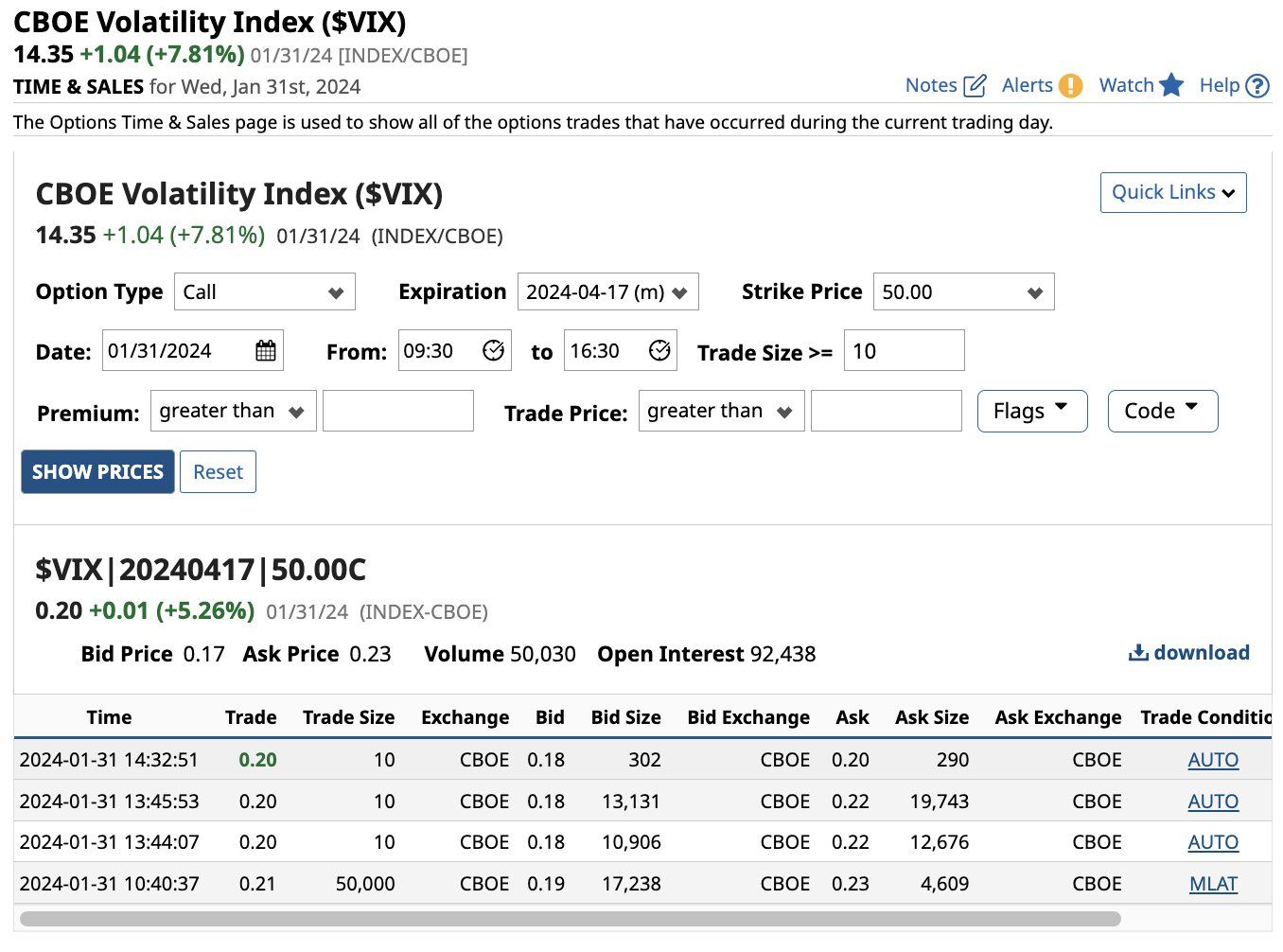

A Trader bought 50,000 CBOE Volatility Index $VIX April expiry 50 strike calls for $0.21 which is a total premium of just over $1 million.

Source: Barchart

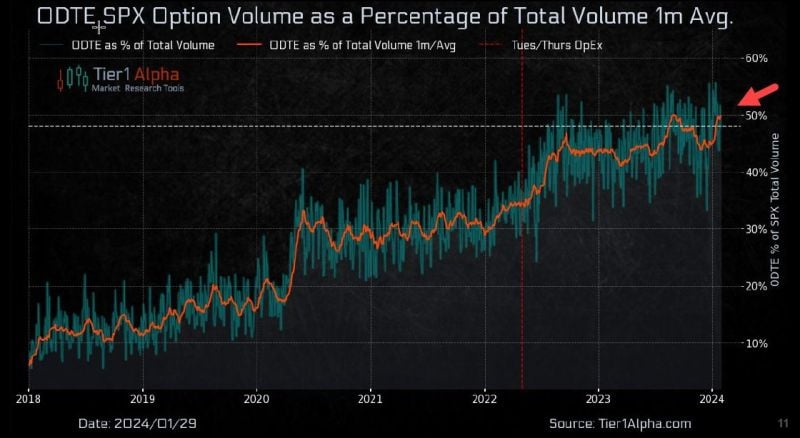

BUBBLES = Super-short-term gambling (zero days to expiration options)... is now running at 50% of the daily flow

Source: Keith McCullough, Bloomberg

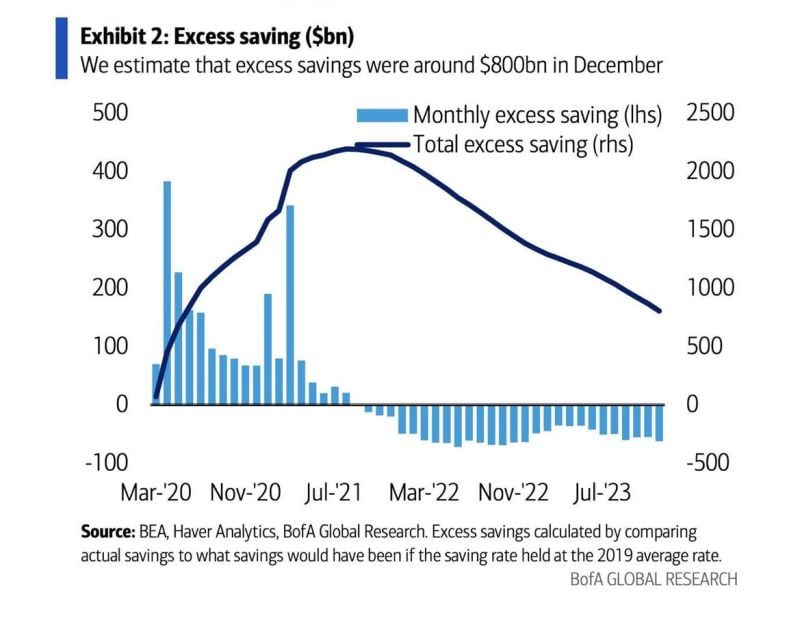

B of A: “.. At the current monthly rundown pace, excess savings should continue to support consumer spending at least through the rest of 2024."

.

Investing with intelligence

Our latest research, commentary and market outlooks