Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

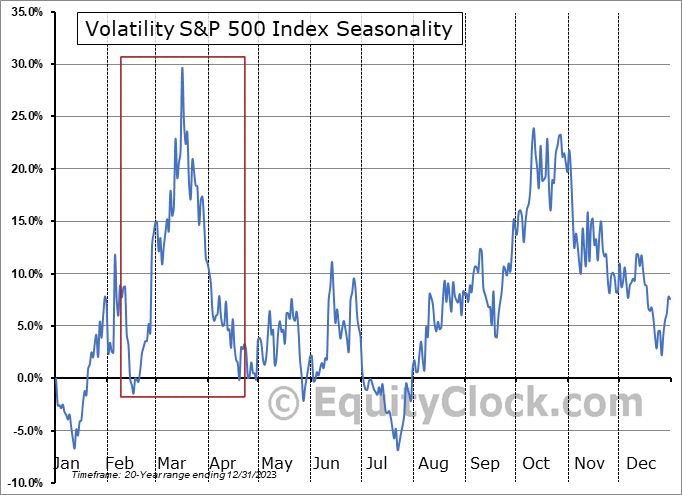

Will the seasonality of volatility matter this year? 🤔

If so, we may be at the trough before a fairly significant rise into mid-March. Source: Markets & Mayhem

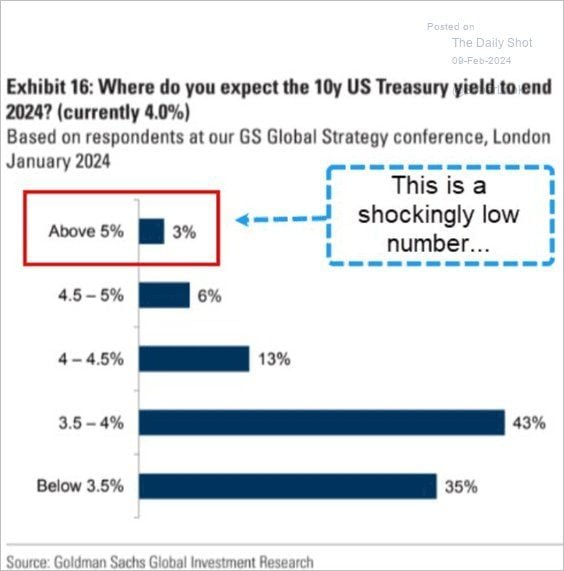

Are investors too complacent on the 10-year us treasury?

Investors expect 3% treasuries at year-end Source: Win Smart, CFA, BofA, The Daily Shot

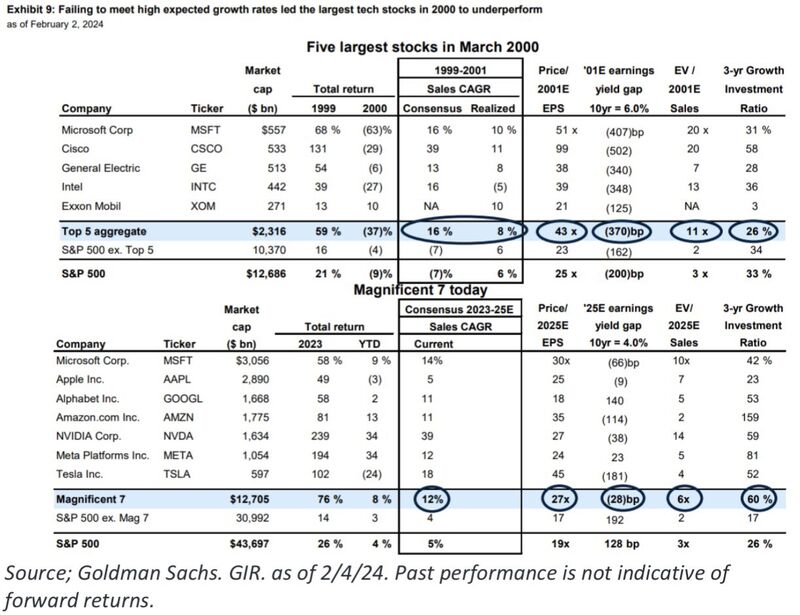

Lots of talk about a bubble in AI/Mag 7...

At this point, valuations at the top are no where near as frothy as they were at the height of the Dot Com Bubble. The 5 largest stocks traded at 43x Fwd PE in March ‘00, a 59% premium to the Mag 7’s current multiple of 27x. Source: David Marlin, Goldman Sachs

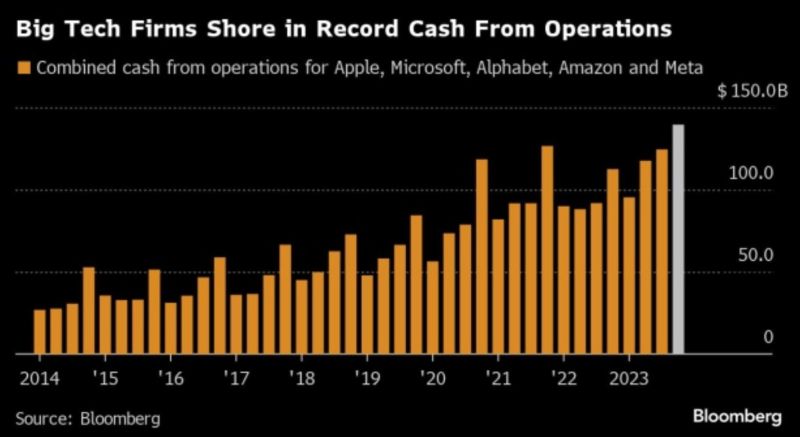

Over the past twelve months, Microsoft, Alphabet, Amazon, Apple, and Meta have produced a combined operating cash flow of $476.9 billion.

For three consecutive quarters, from Q2 to Q4, these five companies collectively generated over $100 billion each quarter. source : bloomberg

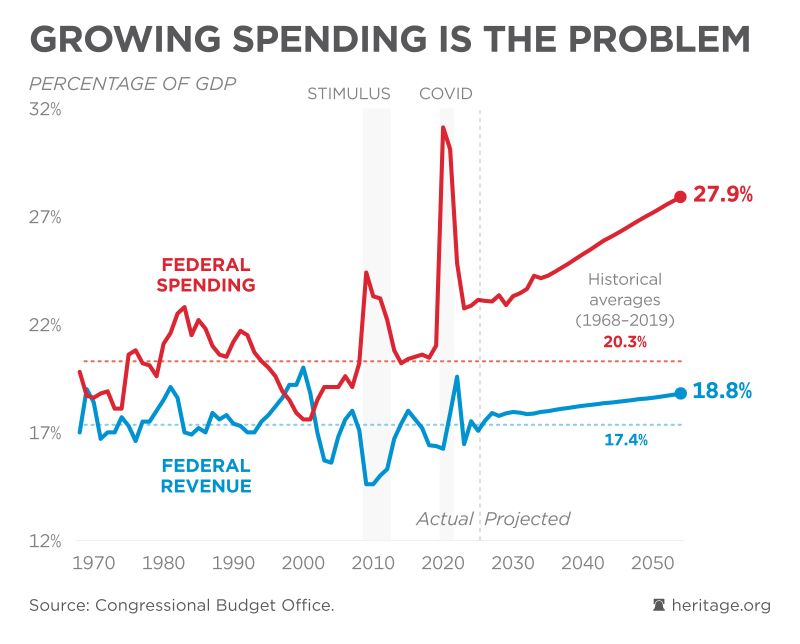

A very important chart to understand for America's future, both economically and politically.

Source: David Ditch, CBO

Investing with intelligence

Our latest research, commentary and market outlooks