Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

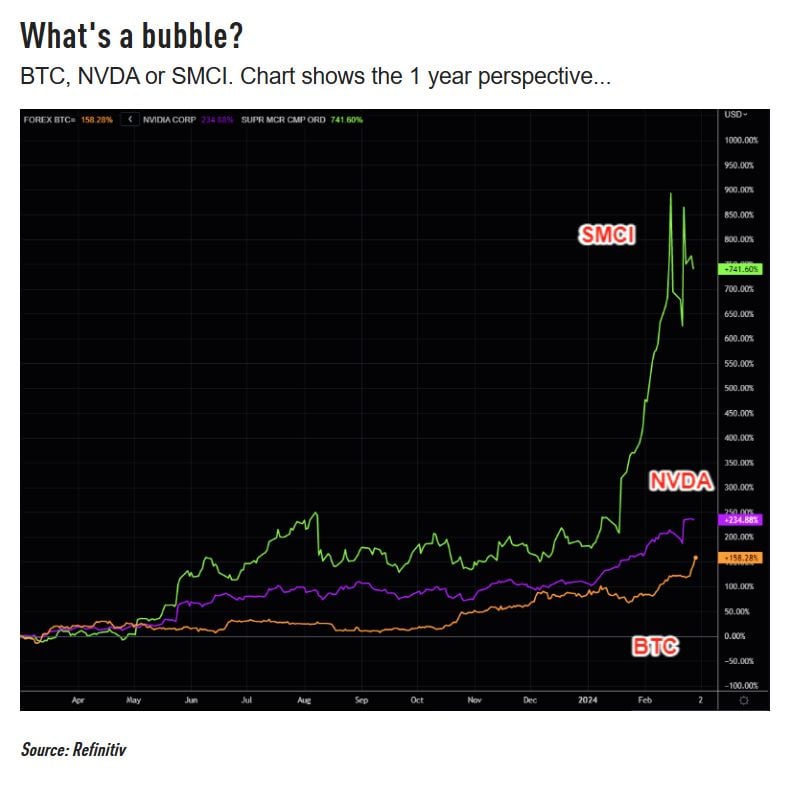

𝗕𝘂𝗳𝗳𝗲𝘁𝘁'𝘀 𝗖𝗮𝘀𝗵 𝗕𝗼𝗻𝗮𝗻𝘇𝗮 𝗡𝗼𝘁 𝗮𝘀 𝗕𝗶𝗴 𝗮𝘀 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸 💰

While Berkshire Hathaway is hoarding a record-breaking $167 billion cash pile, it accounts for just 22% of the market cap, trailing the 𝗵𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝟮𝟳% 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 the last 23 years. Source: John Haslett, CA(SA), FRM

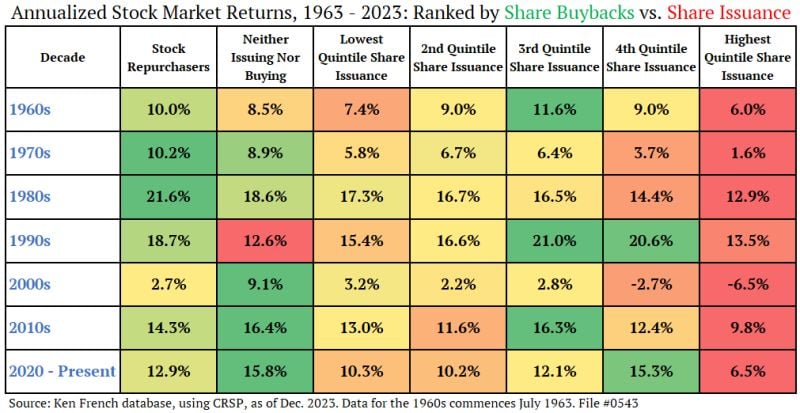

A SIMPLE INVESTMENT STRATEGY -> BUY THE STOCK REPURCHASERS, AVOID THE STOCK ISSUERS...

One of the better strategies from 1963-2023 was simply avoiding companies who issue stock. They are on the righthand side of this table, primarily in red. Stock repurchasers are on the left of the table, primarily in green. Source: Jeff Weniger

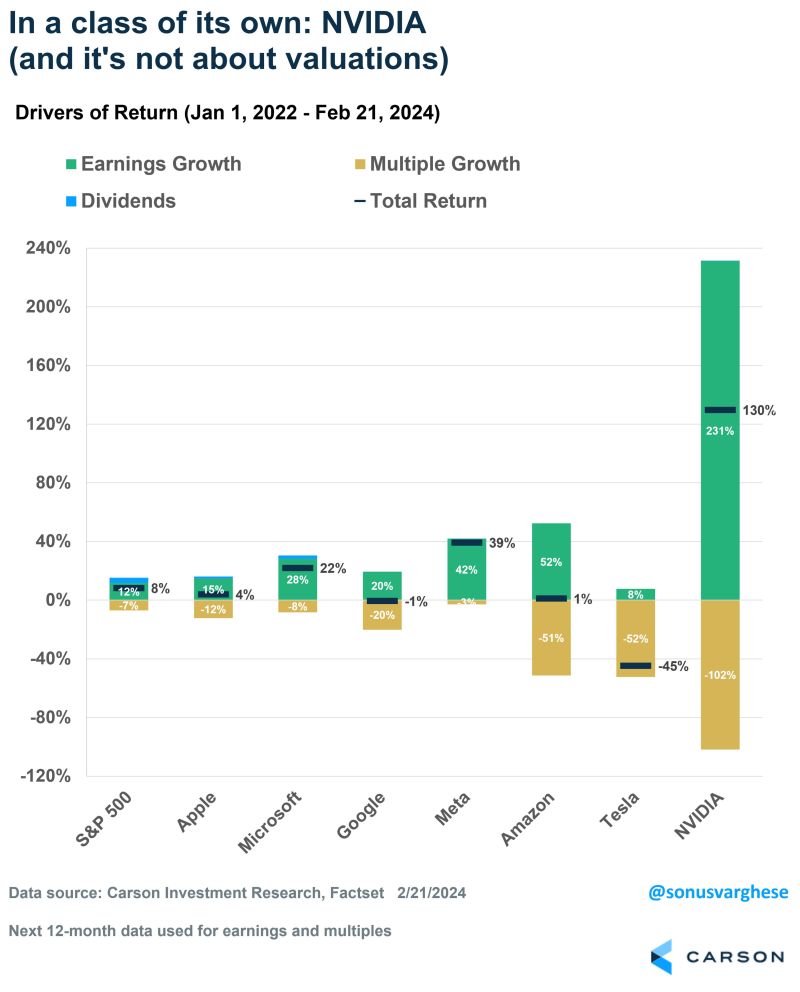

Are Mag7 stocks in a bubble?

No doubt, in some ways they are really pricey BUT as shown by this work from Sonus Varghese on this important question, fundamentals justify to some extent their dominance. Since 2021, NVDA stock is up 130%, yet earnings are up 231%. And other Mag 7 names are similar... Source: Carson, Ryan Detrick

The chart is a log graph of $1 invested in the S&P 500 in the year 1950 by Personal Finance Club.

They listed all of the market crashes that were 15% or more. They removed the Y-axis, but it shows $1 growing to over $1,000! Note that there were many -10% corrections over the period but that only -15% and worse are listed below

Investing with intelligence

Our latest research, commentary and market outlooks