Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

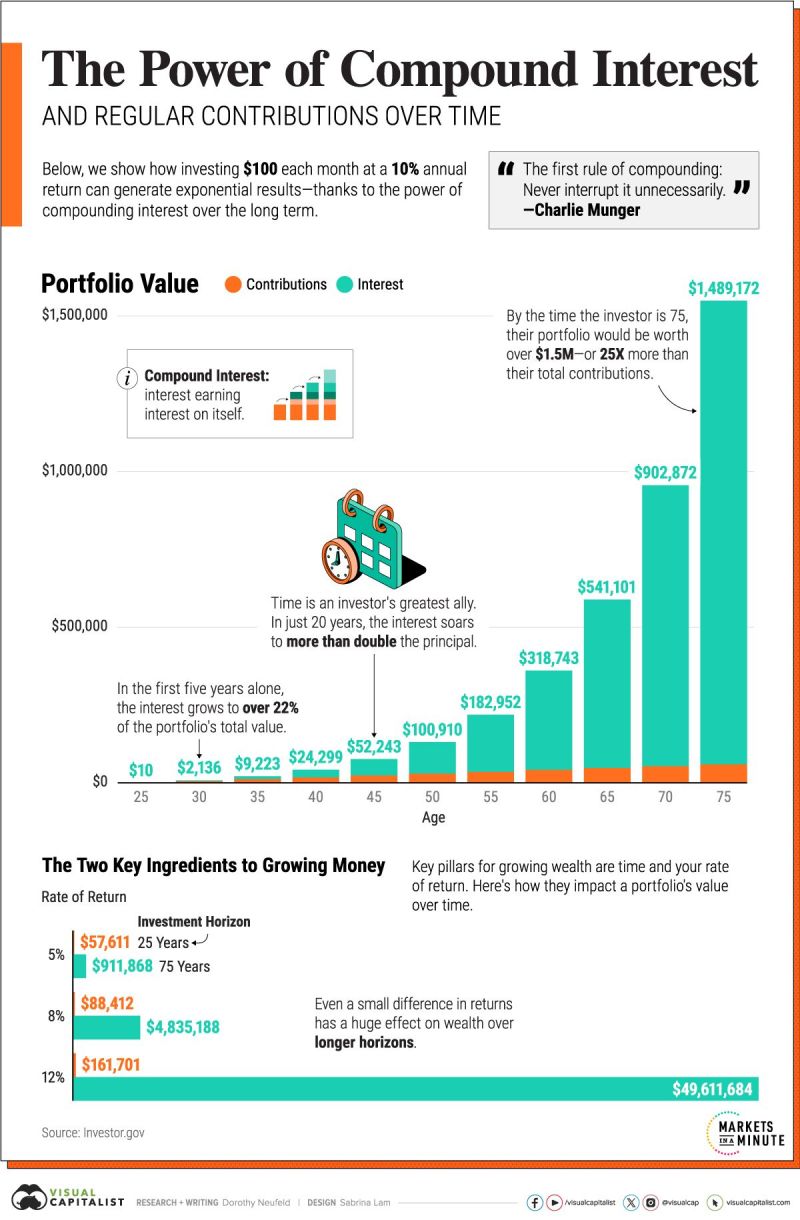

How Small Investments Make a Big Impact Over Time 💸

Source: The Visual Capitalist

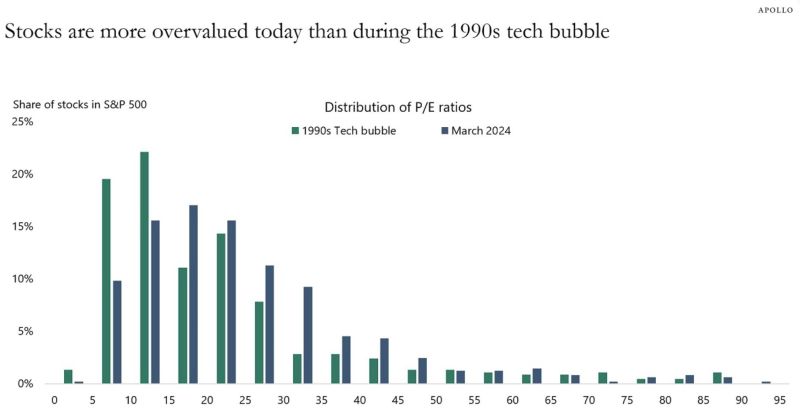

Apollo just doubled down on their view that we are in a bigger bubble than the 2000 Dot-com bubble.

3 weeks ago, they said the current bubble is "bigger than the 1990s tech bubble." They note that the Forward P/E ratio for the top 10 tech stocks right now is ~40x. Compared to 2000, at the peak of the Dot-com bubble, the Forward P/E on the top 10 tech stocks was ~26x. Now, Apollo says that ~30% of stocks have a P/E ratio of 30x or more. Overall, Apollo says that P/E ratios now are much higher than they were in 2000. What's next for AI hype? Source: The Kobeissi Letter

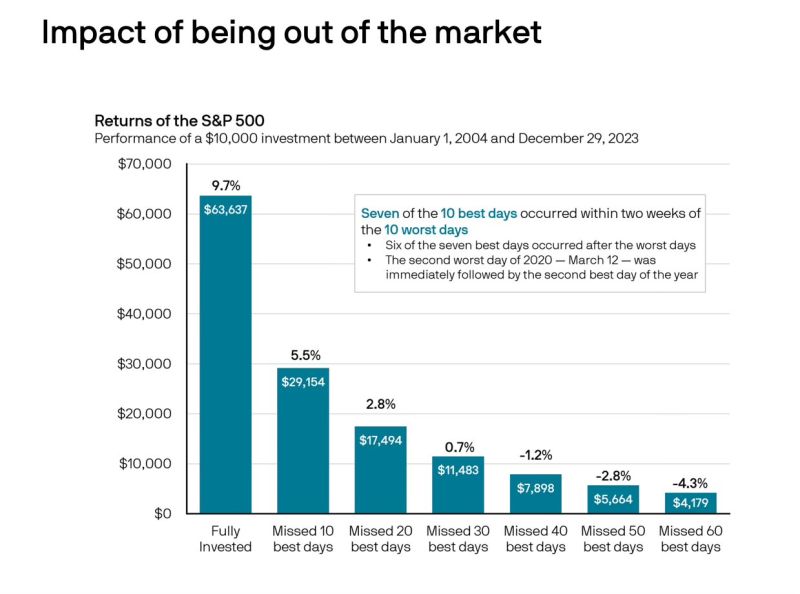

It is about missing the best days, not missing the worst days.

Source: Eugene NG

Investing with intelligence

Our latest research, commentary and market outlooks