Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

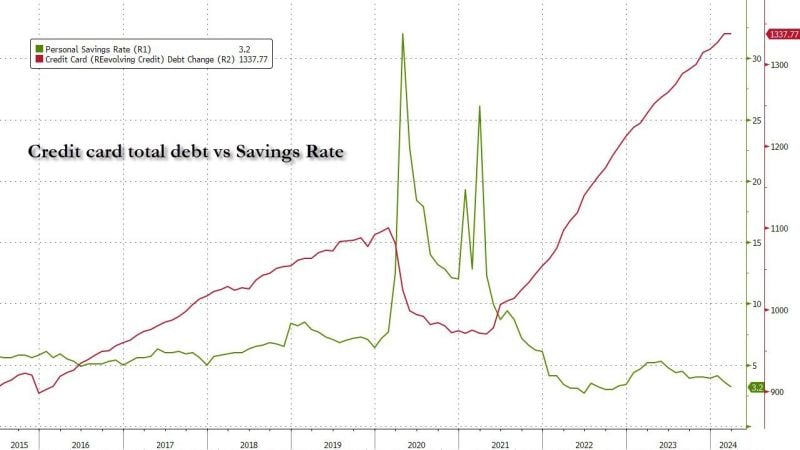

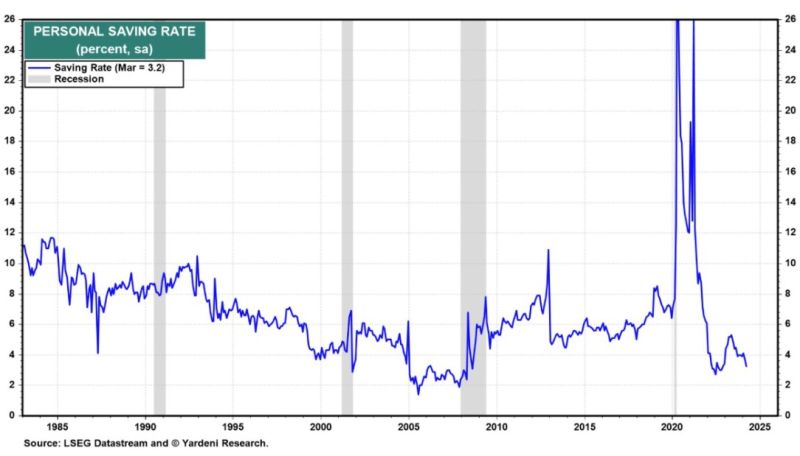

The US consumer (risk) in one chart: credit card debt at record high, personal savings rate record low

Source: www.zerohedge.com

Sell in May and Go Away?

It hasn't worked in the last decade, and it isn't working this year either, with the S&P 500 already up more than 3% this month! Source: Barchart, Bloomberg

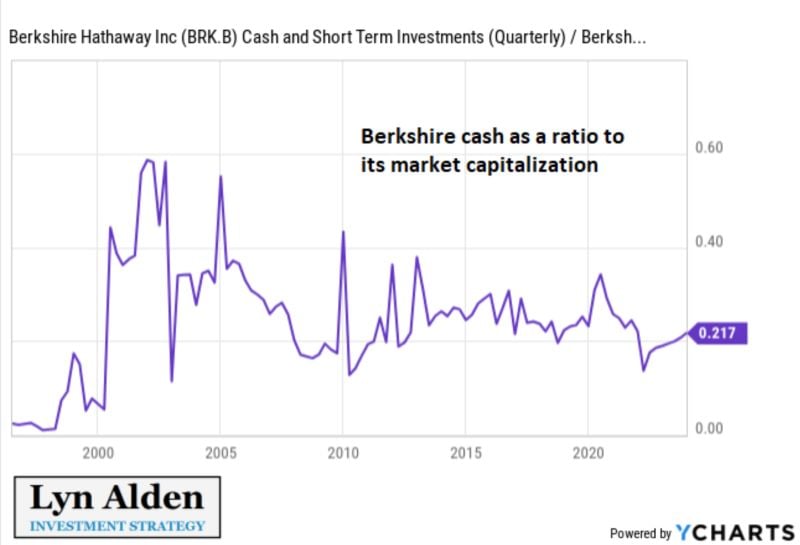

As highlighted by Lyn Alden ->

"People often report the nominal amount of cash that Berkshire $BRK.B has, as though Buffett is hoarding cash. You can't just look at the nominal cash level. All of Berkshire's numbers go up. An insurer needs a lot of liquidity. His cash as a % of his assets is in a normal range".

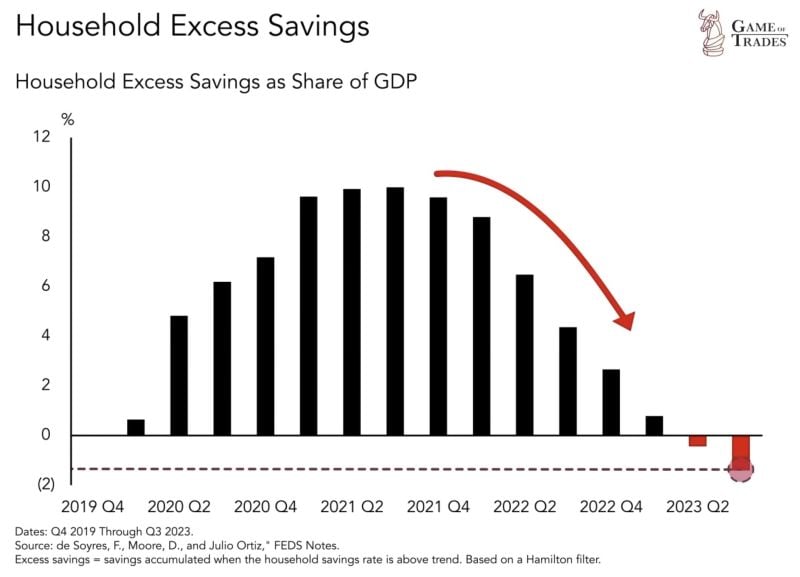

US Households have now run out of excess savings.

Current levels are worse than even 2019. The hard part is that this is happening just as the labor market has started to weaken. Source: Game of Trades

“I don’t mind at all under current conditions building the cash position."

"When I look at what’s available in equity markets and the composition of what’s going on in the world, we find it quite attractive." - Warren Buffett

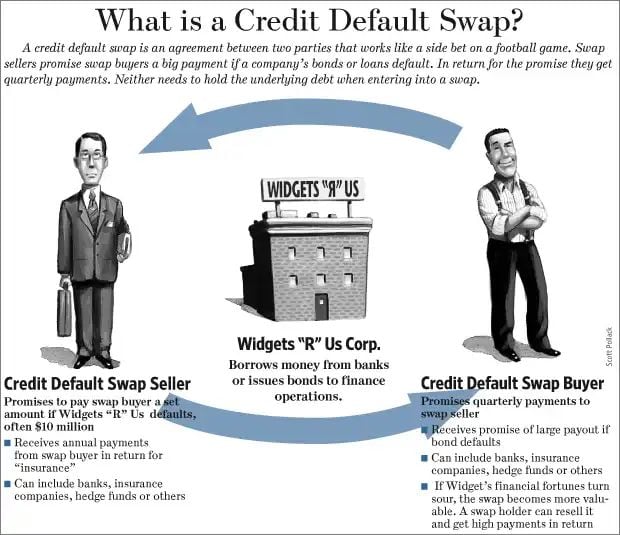

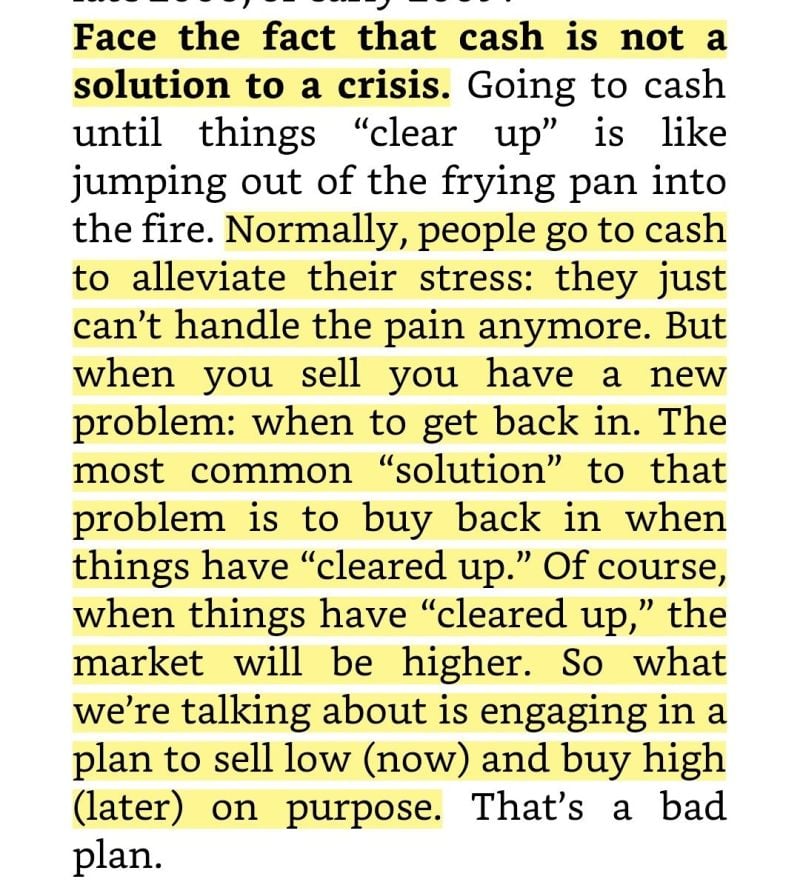

Face the fact that cash is NOT a solution to a crisis

Source: Investment Books (Dhaval)

YARDENI on savings rate and labor supply shortage :

“.. retiring Baby Boomers are likely the reason that the personal saving rate is falling; they’re depressing the rate as they spend their retirement funds and no longer have earnings to save. In addition, they are spending at a record pace on labor-intensive services (restaurants, travel and entertainment, and health care), thus boosting labor demand ..” Source: LESG, Yardeni research

Investing with intelligence

Our latest research, commentary and market outlooks