Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Ray Dalio says benefits of investing in China outweigh risks

Source: South China Morning Post

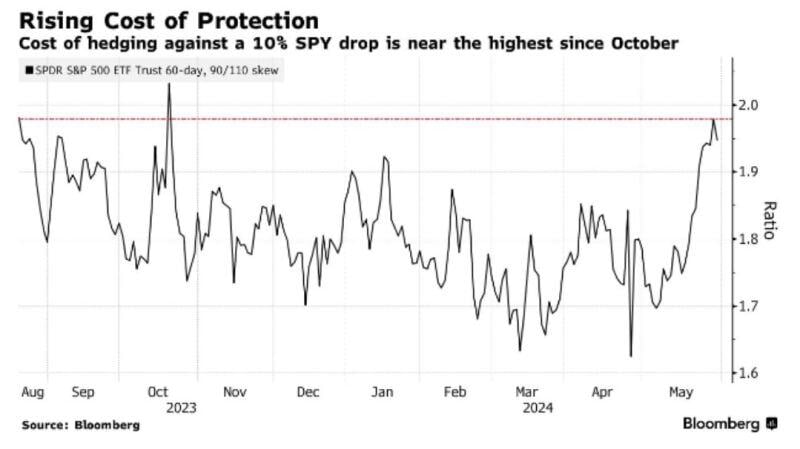

The cost to hedge a 10% drop in the S&P 500 reached its highest level since October

Source: Win Smart, Bloomberg

Penny stock trading is booming.

Seven of the top 10 most traded US equities in May are penny stocks worth less than $1. None are profitable Source: FT, Gunjan Banerji

Warren Buffett's Berkshire Hathaway owns 3% of the entire Treasury Bill market according to JP Morgan

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks