Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

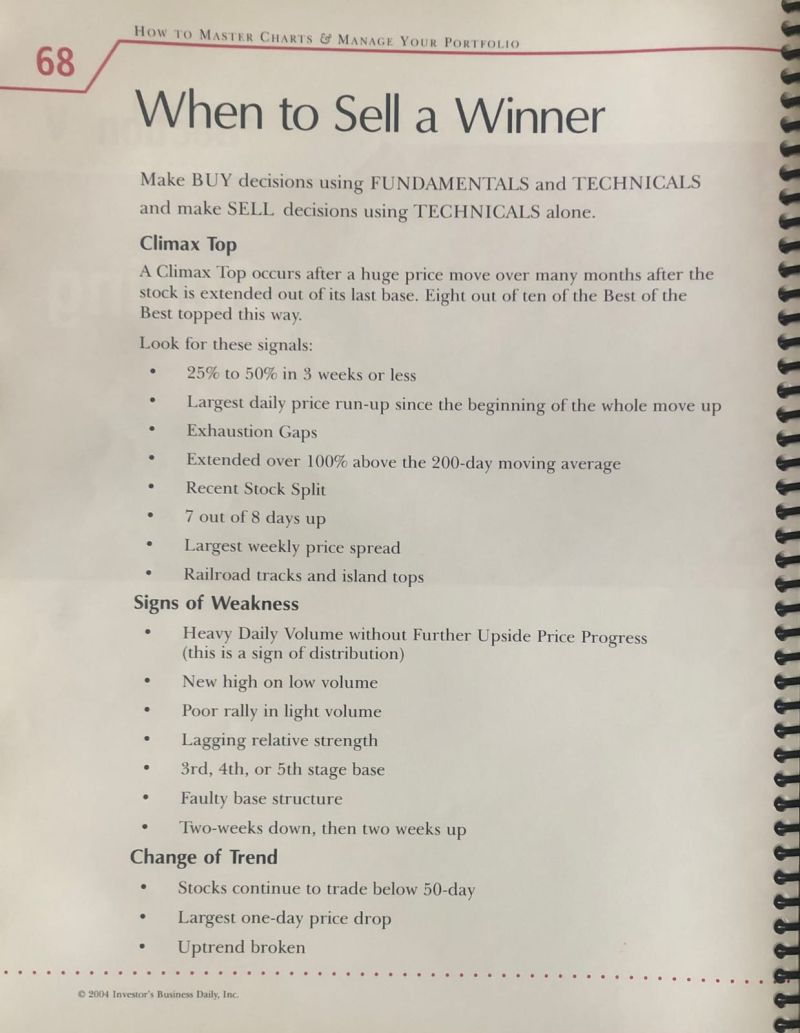

Probably one of most difficult question to answer for portfolio managers... WHEN TO SELL A WINNER?

Source: Marketr rebellion

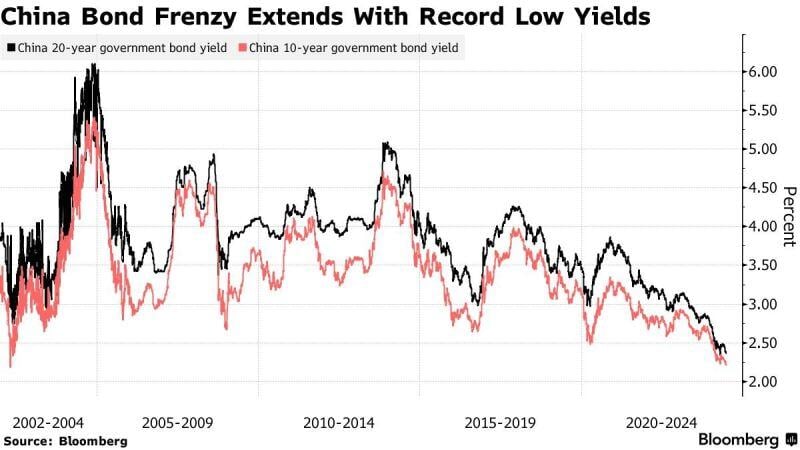

China 10-year yield declines to historic low as rally extends

The yield on China’s benchmark bonds fell to a record low as investors continued to snap up the notes amid pessimism about the domestic economy. The onshore 10-year government yield declined two basis points to 2.18%, set to close at the lowest since Bloomberg began tracking the data in 2002. Yields on the 20- and 50- year bonds have been trading at their historic lows for months. Source: Bloomberg

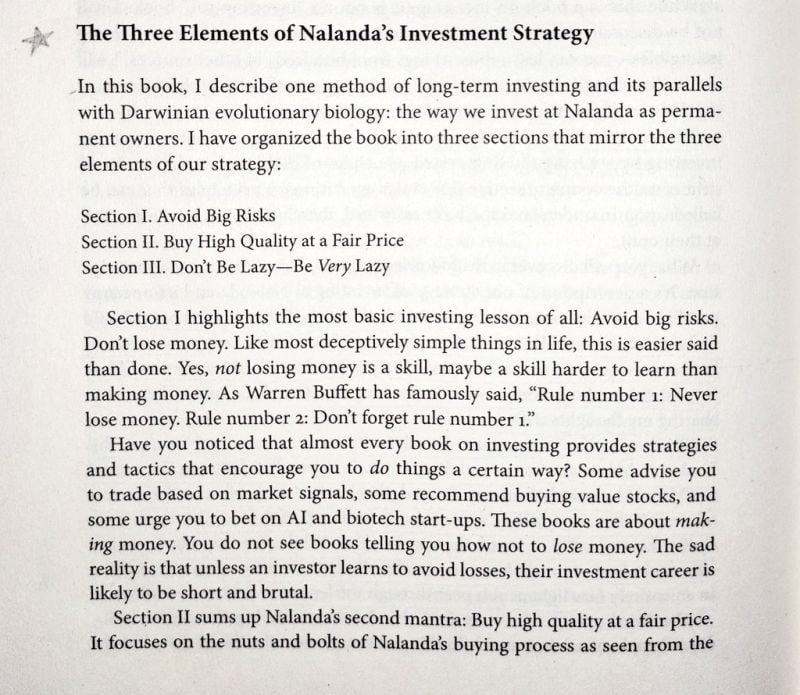

The 3 Elements of Nalanda's investment strategy

1. Avoid Big Risks 2. Buy High Quality at a Fair Price 3. Don't Be Lazy; Be Very Lazy Source: Investment Books (Dhaval)

Investing with intelligence

Our latest research, commentary and market outlooks