Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

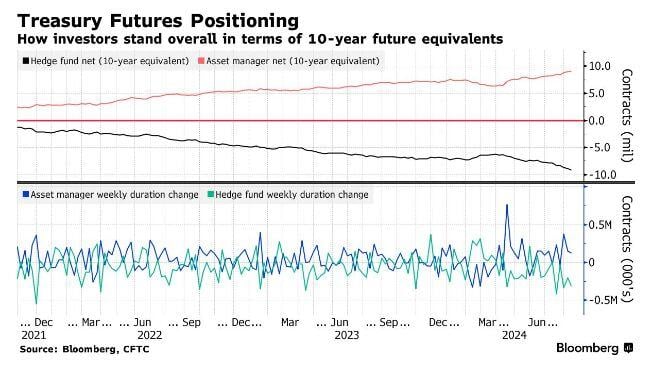

Record Short Position in 10-Year Treasuries

A short squeeze ahead? Hedge Funds have now built the largest 10-Year Treasury Future Equivalents short position in history. Note that Asset managers (long-only) have the opposite as they have built record long positions. Source: Barchart

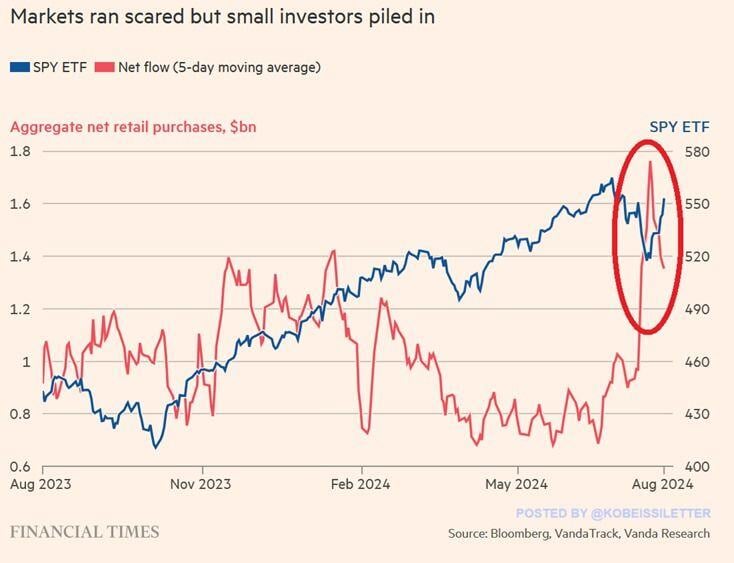

Retail investors are all in

Retail investors' inflows into U.S. stocks jumped over the last 2 weeks to their highest levels in at least 12 months. Aggregate net retail 5-day moving average purchases have more than DOUBLED in a month and hit~$1.7 billion last week. This comes after the S&P 500 fell ~7%, providing what proved to be a buying opportunity. Following the inflows, the S&P 500 surged over 8% from its low and is now 1.5% away from a new all time high. The risk appetite for stocks is still strong. Source: FT, The Kobeissi Letter

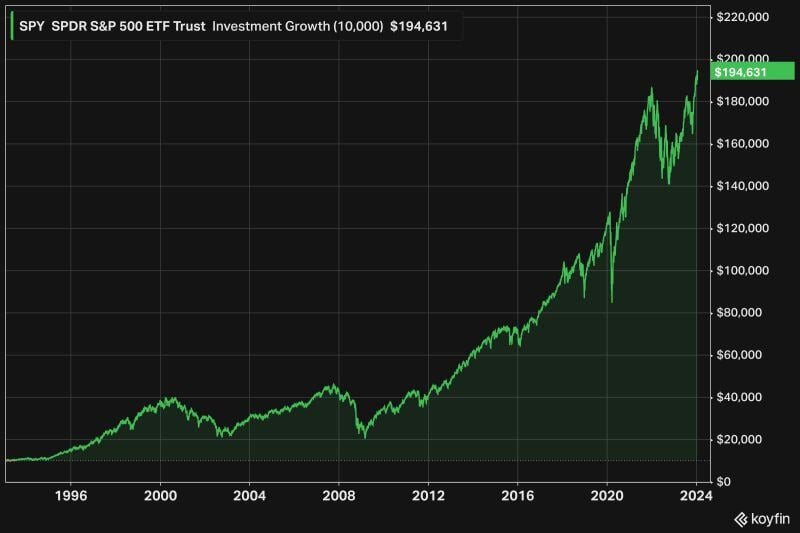

A person who invested $10k in the S&P 500 $SPY in 1993 would have faced:

• Asian Crisis, 1997 • Dotcom bubble, 2000 • GFC, 2007 • EU debt crisis, 2010 • Global pandemic, 2020 • Numerous recessions Yet, their initial investment would be worth $195k today (10% CAGR). Source: @KoyfinCharts

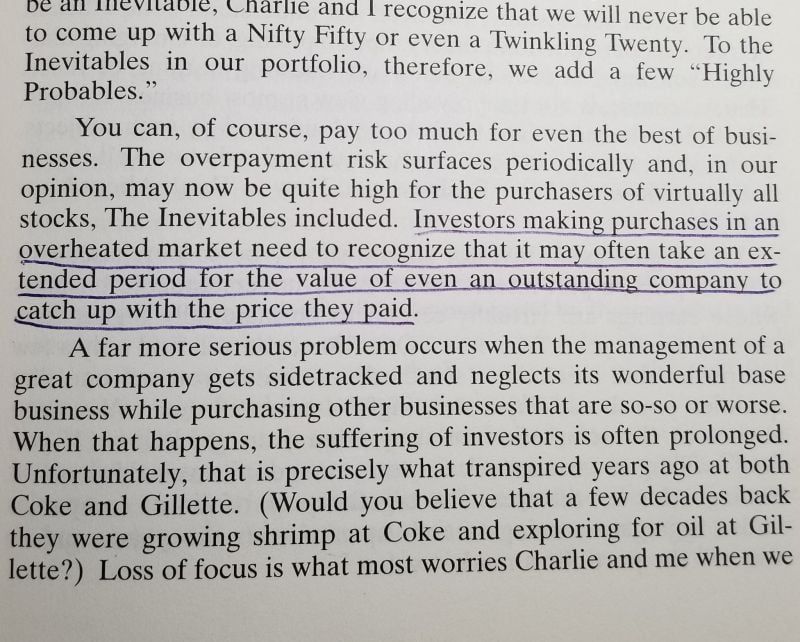

Buffett highlights the difference between a good business and a good investment:

Source: Investment wisdom

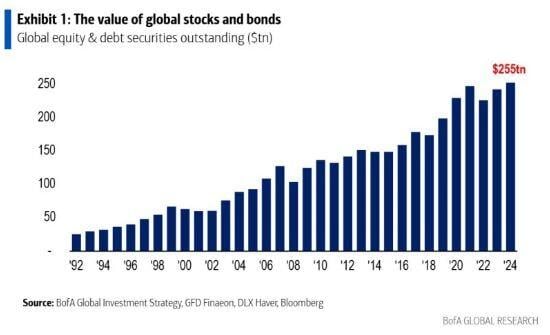

The natural trend of global markets is to go up

Source: BofA

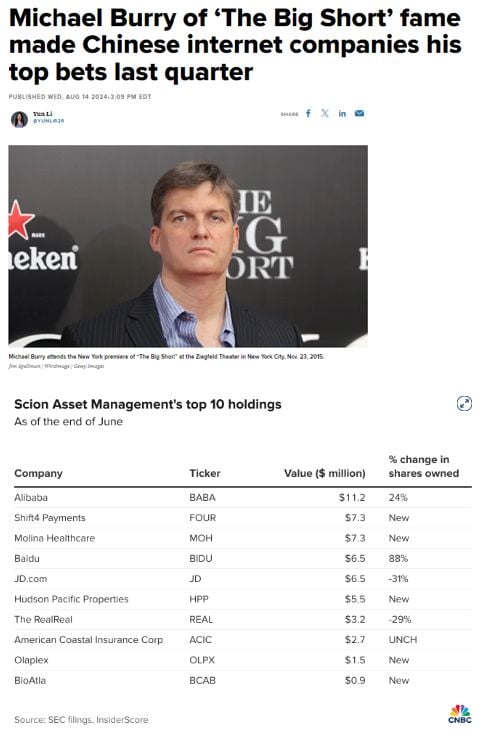

Michael Burry has made Chinese Internet Stocks his biggest holdings

His #1 holding is Alibaba which was worth $11.2 million at the end of the last quarter. Source: Barchart, CNBC

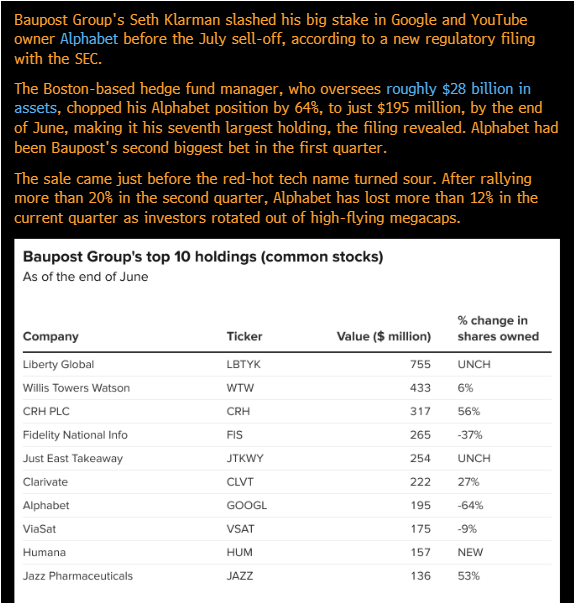

Value investor Seth Klarman cuts his stake in Alphabet and buys Humana

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks