Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

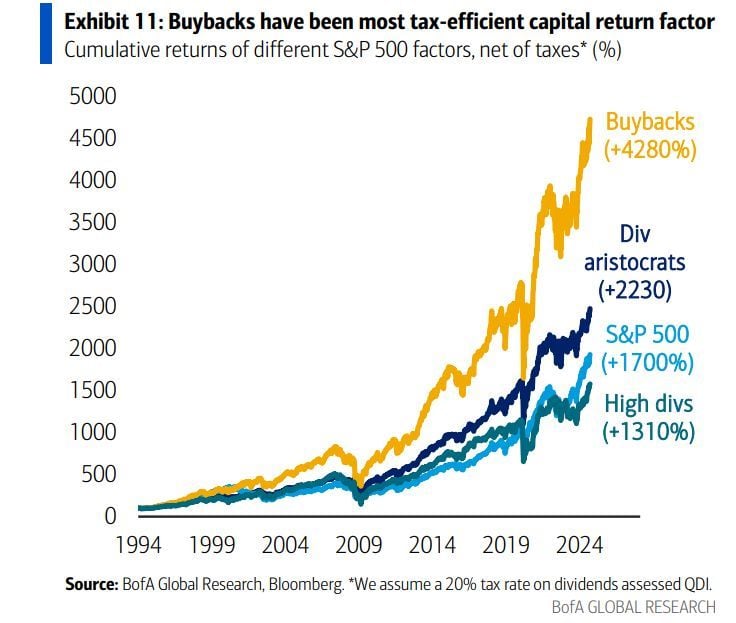

Buybacks vs dividends... which one you intend to favour going forward?

Source chart: BofA

Billionaire investor Paul Tudor Jones today on CNBC:

“All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own ZERO fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.” Source: CNBC

BREAKING 🚨: Illegal SHORT SELLERS in South Korea now face the possibility of LIFE IN PRISON

#freemarkets Source: Barchart

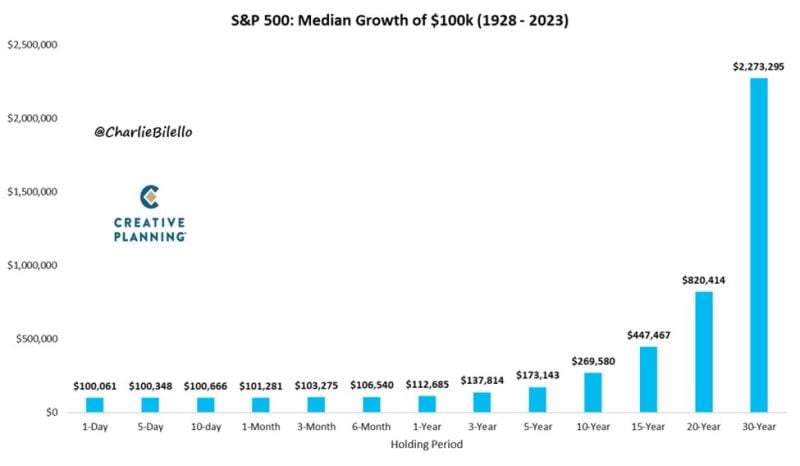

"The first rule of compounding is to never interrupt it unnecessarily." - Charlie Munger

Source: Charlie Bilello

Time in the market vs. timing the market...

Time in the market can work magic! This is an example showing the median growth of 100k given length of time in the market. Source: Peter Mallouk, Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks