Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

So brutal but so true from @psarofagis

Source: @Eric Balchunas

One of the most investing rule: letting your winners run

Source: Compounding Quality

The YOLO crowd is back.

Retail investors were clearly in the driver's seat today, with Bitcoin-sensitive names finishing +19.7% and Goldman Sachs Meme Basket (GSXUMEME Index) closing +7%! Source: Bloomberg, HolgerZ

The share of US consumers expecting higher stock prices over the next 12 months hit 51.4%, the highest on record.

This is even higher than the previous records seen in 2018 and 2000 before the Dot-Com bubble peaked. The percentage has more than DOUBLED over the last 2 years as the stock market has seen one of the largest gains this century. The S&P 500 is now up 40% over the last 12 months marking its 4th best performance since 2000. Stock market sentiment has never been so euphoric. Source: The Kobeissi letter

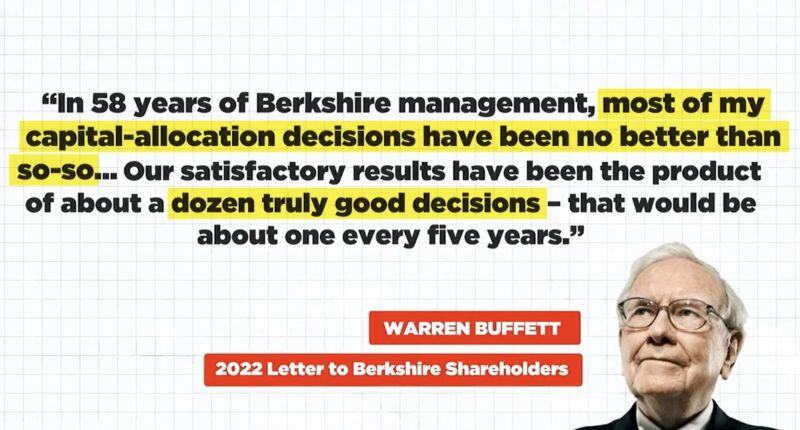

Warren Buffett once said: 'My success over 58 years was mainly the result of “about a dozen truly good decisions."

Source: Compounding Quality

Investing with intelligence

Our latest research, commentary and market outlooks