Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

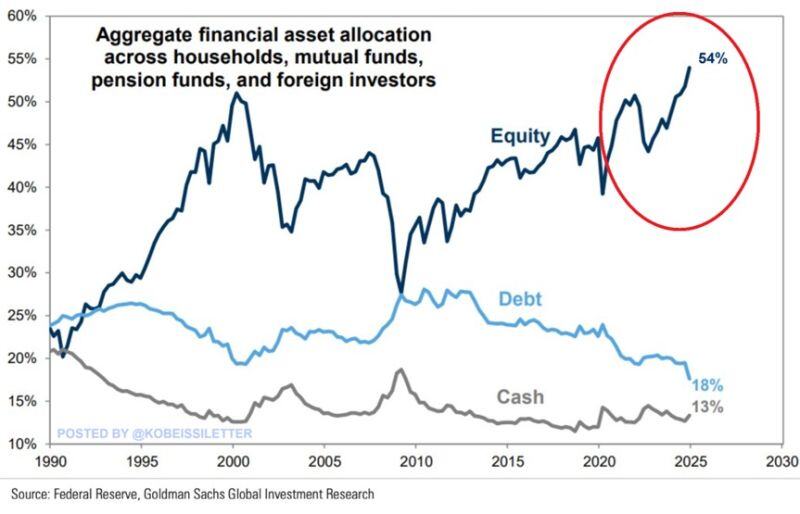

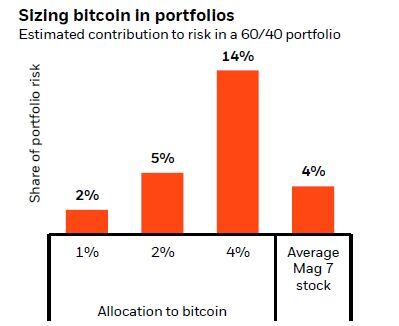

Bullish sentiment is through the roof: US households, mutual funds, pension funds, and foreign investors' financial asset allocations in US stocks hit a record 54%.

Since the 2009 low, this percentage has DOUBLED, exceeding the 2000 Dot-Com Bubble peak of 51%. On the other hand, allocation to debt instruments like bonds has dropped by 9 percentage points to an all-time low of 18%. At the same time, cash allocation has fallen to 13%, near the lowest on record. Investors are all-in on stocks.

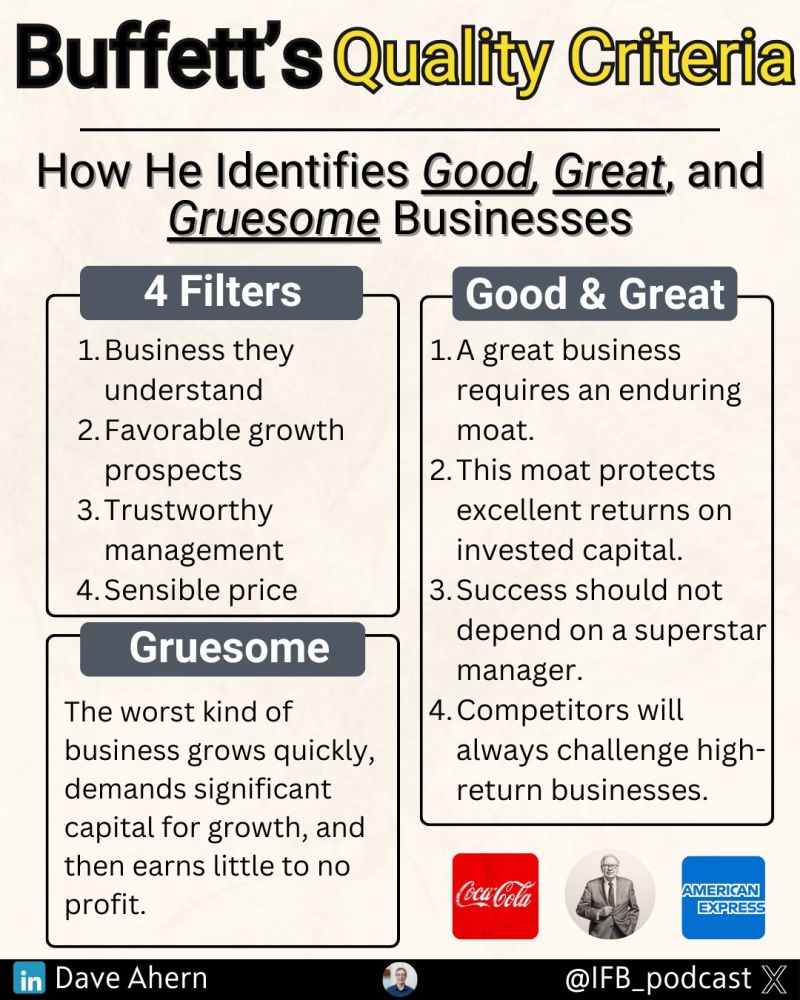

What Buffett Looks For and What to Avoid:

Source: The Investing for Beginners Podcast @IFB_podcast on X

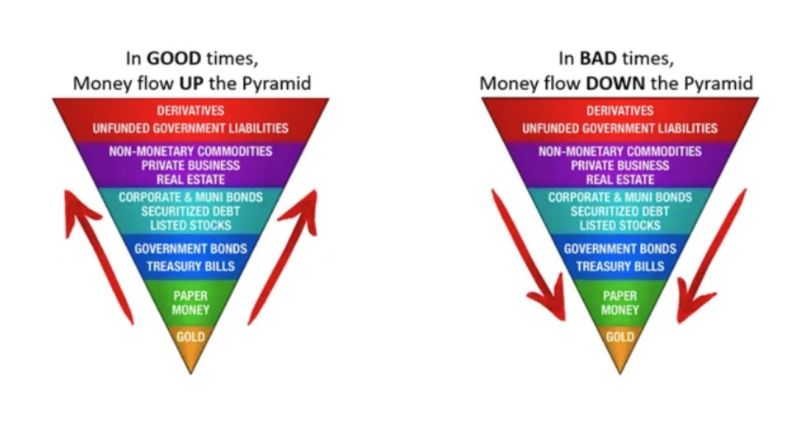

The insight from John Exter’s pyramid underscores the unseen layers of risk in financial flows, urging a broader consideration beyond balance sheets in investment decisions.

Amidst flaws in the financial system, gold offers liberation from credit and government risks and currency devaluation. As sovereign debt defaults loom and trust in public institutions to solve economic and societal issues shrinks, investors will more and more focus on asset with no counterparty risks like gold Source: Capitalizing on Gold’s Positive Tailwinds in 2024 : Hard Assets Alliance

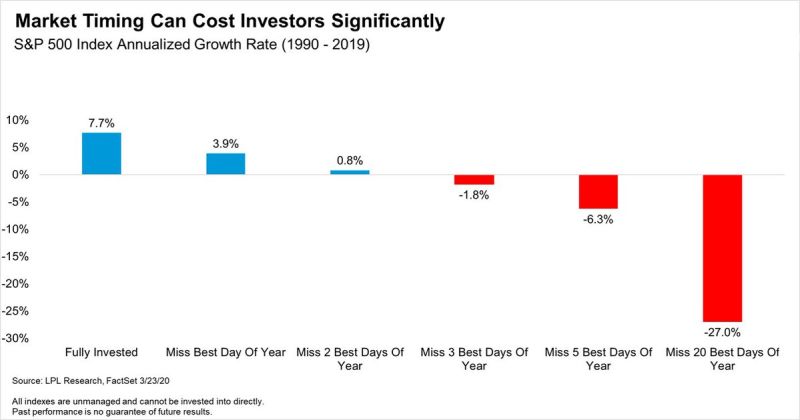

Don't try to time the market:

Source: LPL research through Brian Feroldi

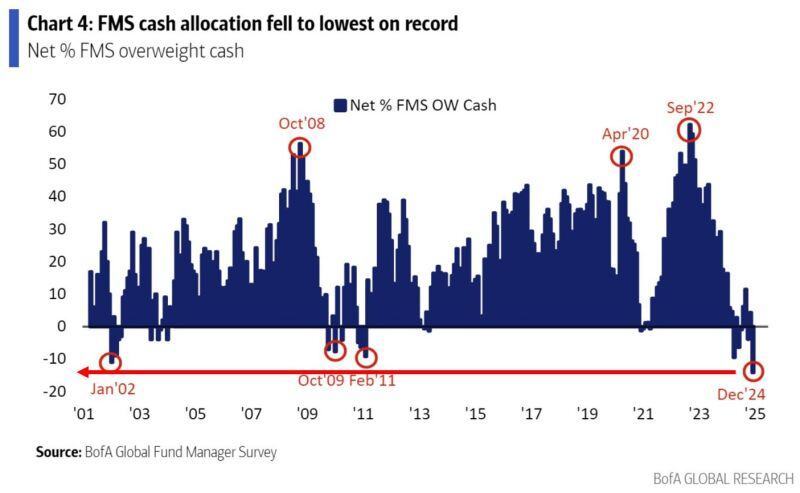

‼️AHEAD OF THE FED MEETING YESTERDAY, INSTITUTIONAL INVESTORS WERE ALL-IN ON US STOCKS AND CASH ALLOCATION AT RECORD LOW ‼️

Institutional investors* cash allocation hit the lowest level ON RECORD. This comes as allocation to US equities hit a RECORD HIGH. What will happen when stocks begin to drop? *171 Fund Managers with $450 billion in assets Source: BofA, Global Markets Investor

"Cash is trash"

Fund Manager cash allocations at a record low... Source: Callum Thomas, BofA

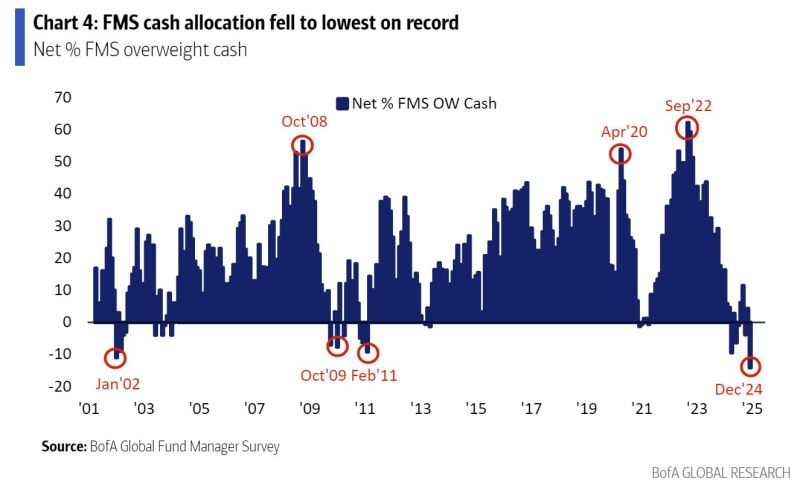

The case for a 2% Bitcoin allocation into multi-assets portfolios by Blackrock:

"So how can investors think about a bitcoin allocation? We take a risk budgeting approach: sizing the allocation based on how much it would contribute to total portfolio risk – measured by its long-run volatility and correlation to other assets (...). But from a portfolio construction perspective, it has some similarities with the “magnificent 7” group of mostly mega-cap tech stocks. Their market value – averaging $2.5 trillion in December 2024 – is similar to bitcoin’s (...) In a traditional portfolio with a mix of 60% stocks and 40% bonds, those seven stocks – if held at their current weights in the MSCI World – each account for 4% of the overall portfolio risk on average. That’s about the same share a 1-2% exposure to bitcoin would represent: Even though bitcoin’s correlation to other assets is relatively low, it’s more volatile, making its effect on total risk contribution similar overall. A bitcoin allocation would have the advantage of providing a diverse source of risk, while an overweight to the magnificent 7 would add to existing risk and to portfolio concentration. Why not more than 2%? A larger bitcoin allocation means its share of overall portfolio risk rises sharply. This effect is small when the allocation is small, but above 2% bitcoin’s share of total portfolio risk becomes outsized compared with the average magnificent 7 stock (...) . In an extreme case, should there no longer be any prospect of broad bitcoin adoption, the loss could be the entire 1-2% allocation. We think this is much less likely to happen to a magnificent 7 stock given these companies generate major cash flow and have tangible underlying assets. The upshot? By allocating no more than 2% to bitcoin, investors would: 1) introduce a very different source of return and risk; and 2) manage risk exposure to bitcoin".

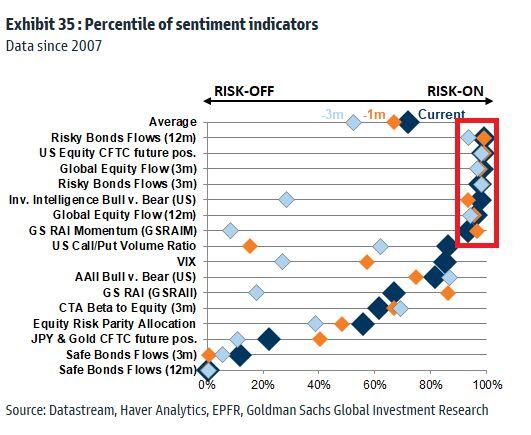

We are maxed out across a host of sentiment indicators.

Source: Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks