Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The only person that can lose you money in the stock market?

Yourself. Source: Compounding Quality

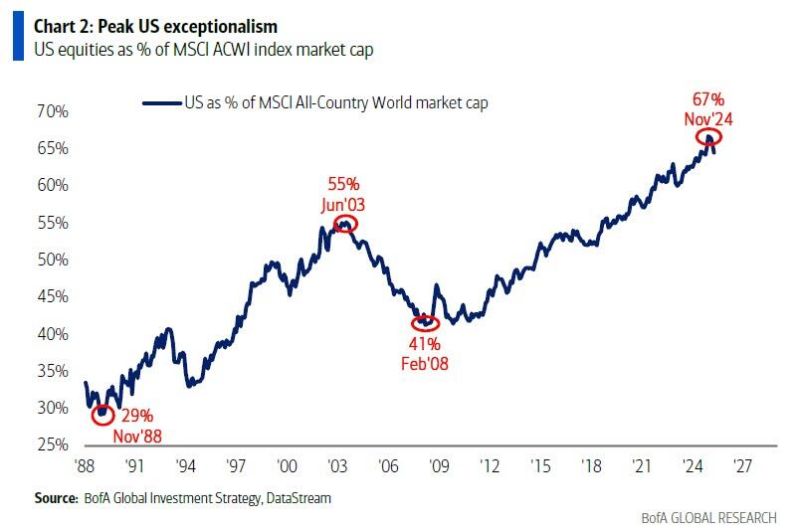

Has a new secular BEAR MARKET begun in the US?

The US share in the global stock market has fallen 3-4 percentage points since its November 2024 peak of 67%. This comes as the US has significantly underperformed other markets this year. Many investors are not ready for this.. Source: BofA, Global Markets Investor

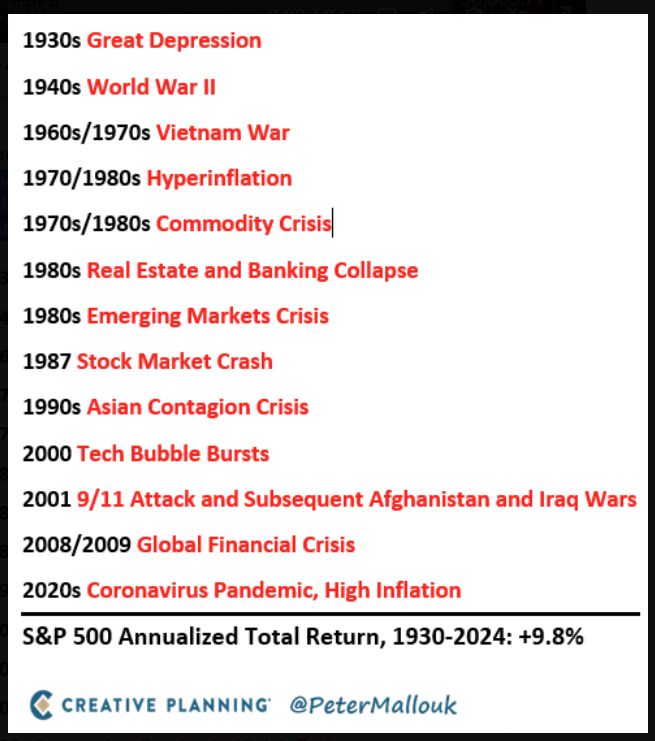

Well said by Peter Mallouk >>>

"It’s been a rough year so far for US equity markets, but we’ve been through much worse in the past and gotten through it. We’ll get through this as well. As Abraham Lincoln once said: This, too, shall pass.”

Never interrupt the compounding effect:

Source: Invest in Assets

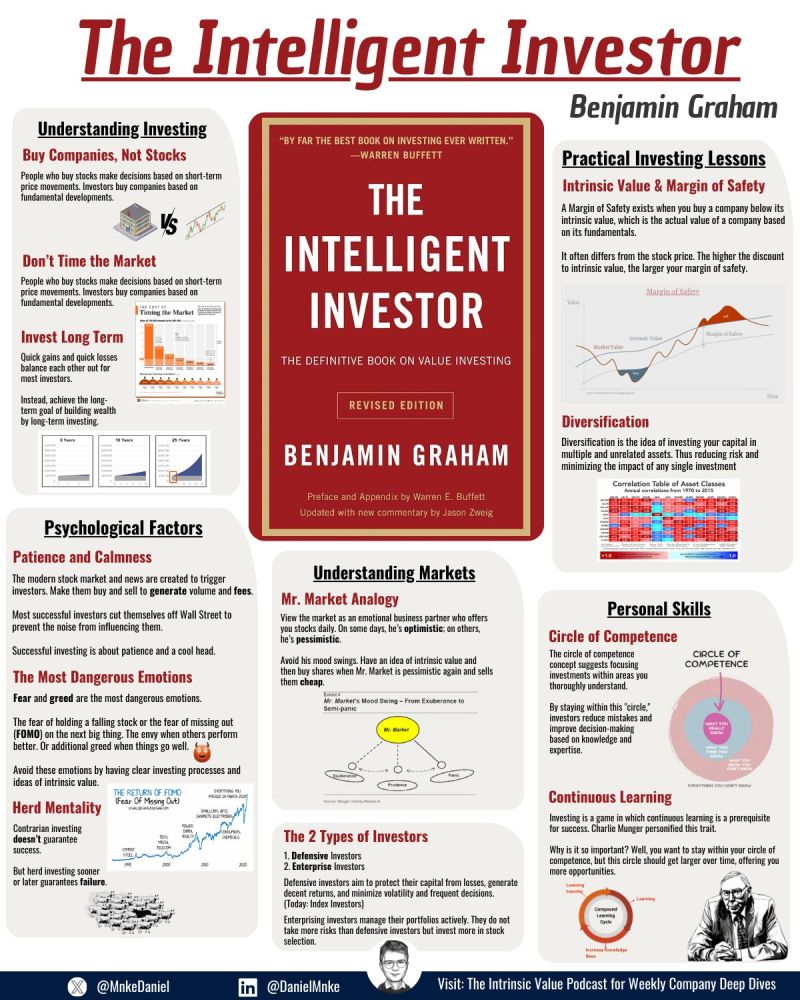

One-Pager on The Intelligent Investor:

Source: Daniel @MnkeDaniel

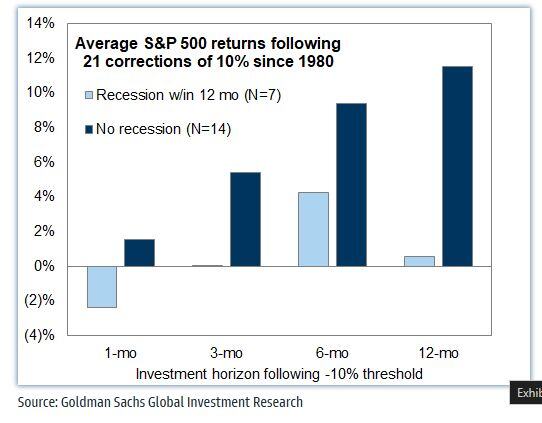

SP500 corrections are usually good buying opportunities

Source: Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi

Investing with intelligence

Our latest research, commentary and market outlooks