Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

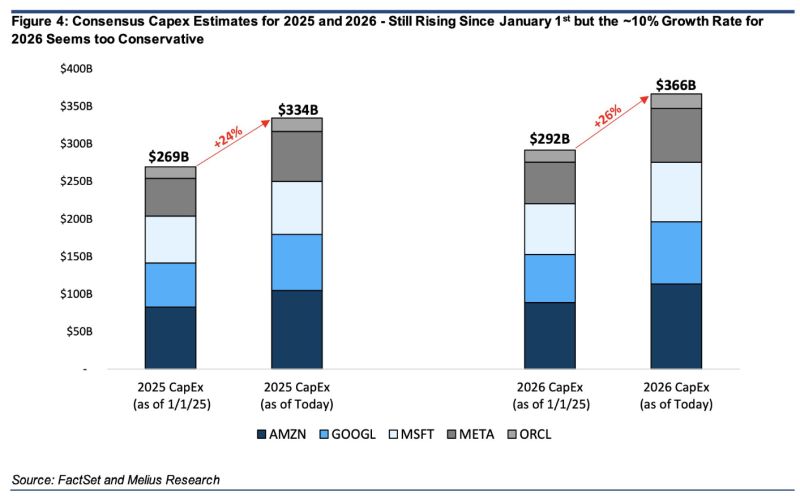

The latest earnings reports offer some reassurance that capital spending (capex) remains strong, says Melius’s Reitzes.

Hyperscalers haven’t cut back on their investments, which is good news for AI-related stocks like Nvidia, Broadcom, and Arista Networks. Source: HolgerZ, Melius Research

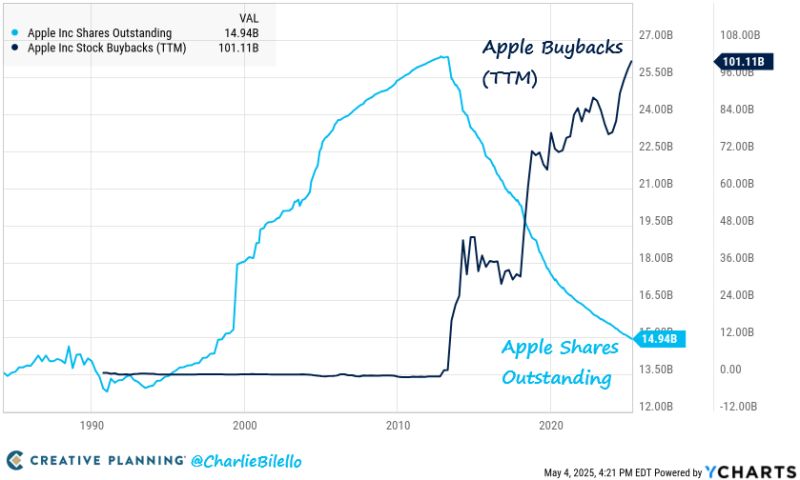

Apple has bought back $693 billion in stock over the past 10 years, which is greater than the market cap of 488 companies in the S&P 500

Source: Charlie Bilello

The Warren Buffet Way..

Since 1964, Berkshire Hathaway has delivered a staggering return of over 5,500,000% That’s 5.5 million percent… To put it in perspective: a $10,000 investment back then would be worth $550 million today Source: Stocktwits @Stocktwits

Warren Buffet's portfolio as of 31st of March 2025

Source: Investywise

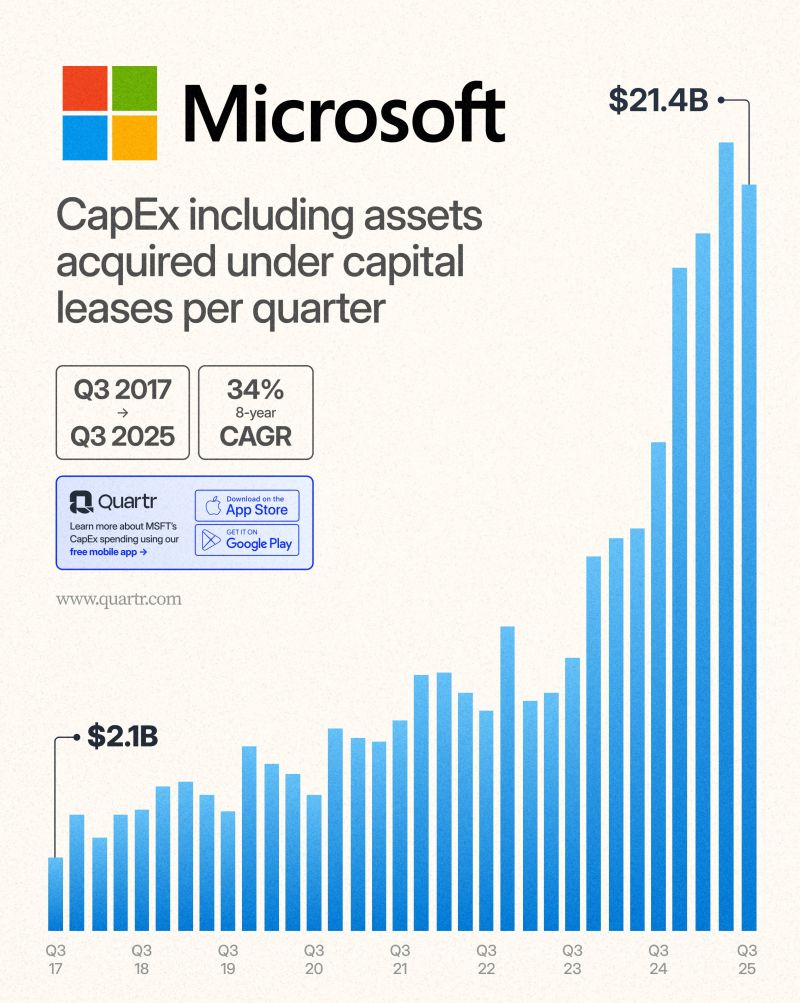

Microsoft $MSFT CapEx increased with 53% y/y in Q3'25

Source: Quartr

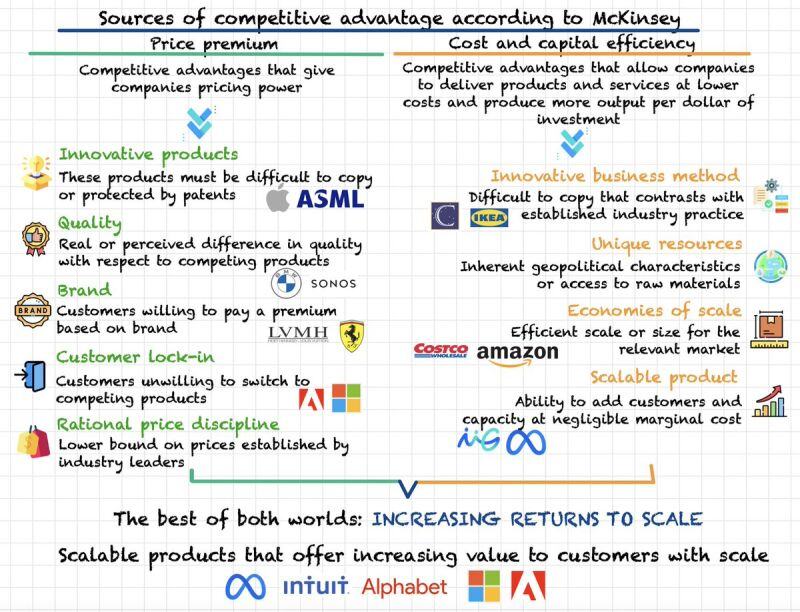

Types of competitive advantage.

Nice pic by @Invesquotes thru Brian Feroldi

World's Biggest Pension Funds have halted their investments in the U.S. until the country stabilizes

Some of the world’s biggest pension funds are halting or reassessing their private market investments into the US, saying they will not resume until the country stabilises after Donald Trump’s erratic policy blitz. The moves underscore how big institutional investors are rethinking their exposure to the world’s largest economy as the US president’s trade policy upends markets, adding pressure to America’s private capital industry, which is under increasing liquidity strain. Some top Canadian funds are backing away from taking on more US private assets because of geopolitical concerns and fears they will lose tax breaks on their American investments. Canada Pension Plan Investment Board, which has C$699bn ($504bn) in assets, is among those considering its approach. Meanwhile, one of Denmark’s biggest retirement funds has paused new investments in US private equity because of concerns over stability and Trump’s threats to take over Greenland, an executive at the fund told the Financial Times. Source: FT, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks