Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Don't be obsessed by trying to avoid corrections

Peter Lynch: "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves".

Why investing is so difficult

Investment Books (Dhaval) @InvestmentBook1

Make defense industry great again..

France Armies Minister Sébastien Lecornu encourages the French “to invest money patriotically to finance Defense”.

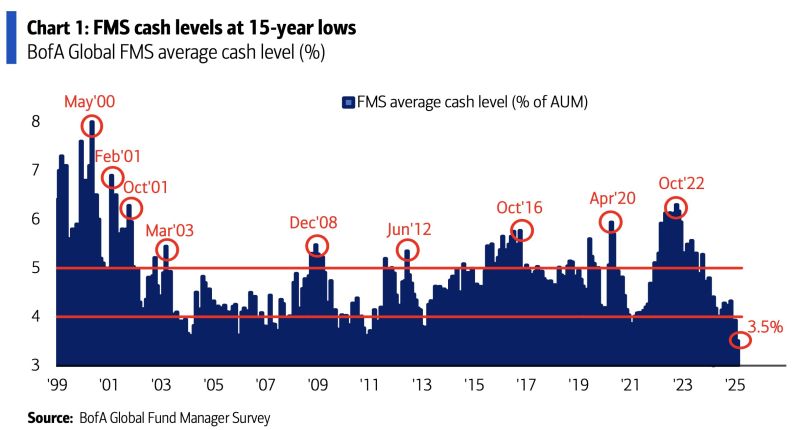

Investors are extremely bullish—heavily invested in stocks while betting against everything else.

Cash levels have dropped to just 3.5%, the lowest since 2010, according to the BofA Fund Manager Survey. Source: BofA

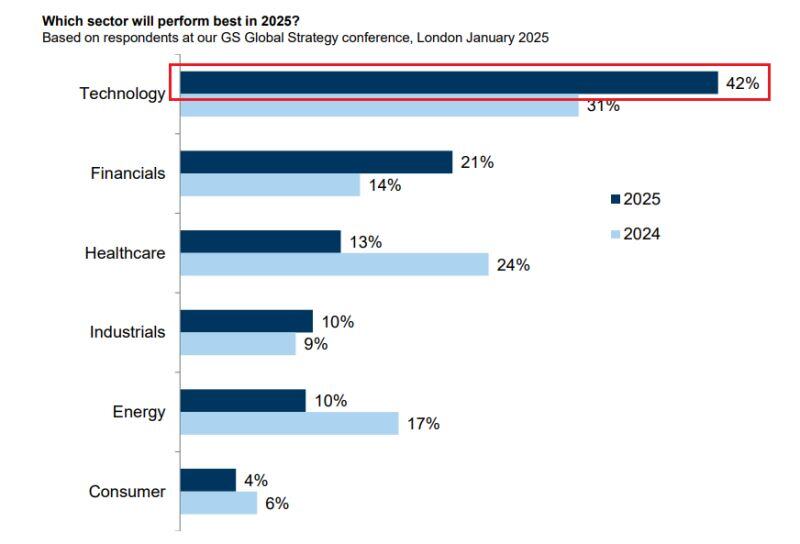

Overweight technology is a crowded trade.

"Goldman Sachs: Most of our clients expect Technology to outperform in 2025" Source: Mike Zaccardi, CFA, CMT, MBA

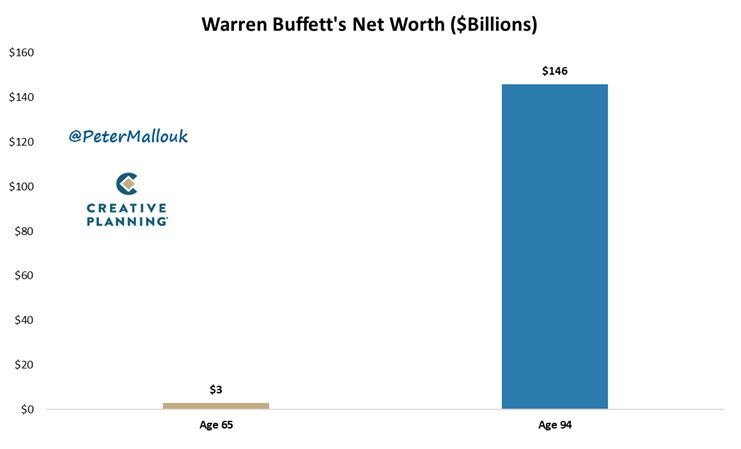

Incredible stat: 98% of Warren Buffett's current net worth of $146 billion came after he turned 65

"My life has been a product of compound interest." - Warren Buffett Source: Peter Mallouk

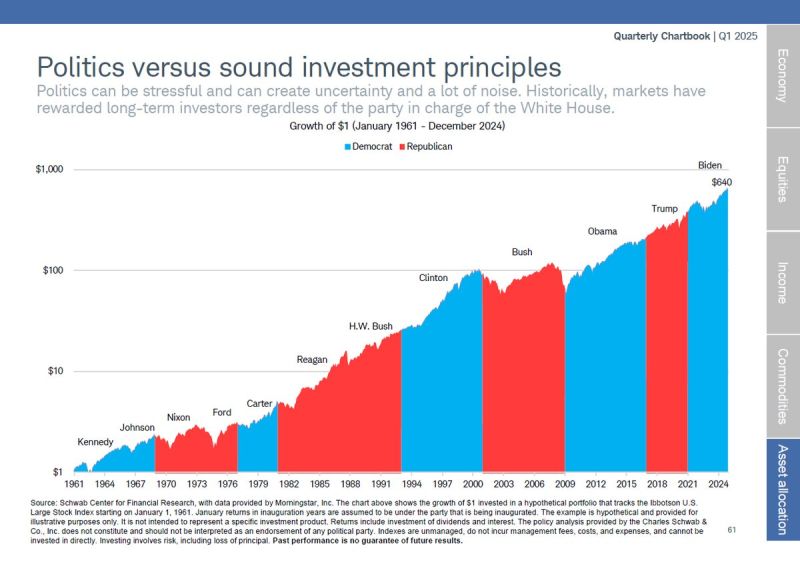

An important remainder ahead of Trump inauguration:

"Don't let your politics get in the way of your investing. The market finds a way forward, regardless of who is in power. The market soared under both Trump and Biden, as it has under most presidents" - Peter Mallouk

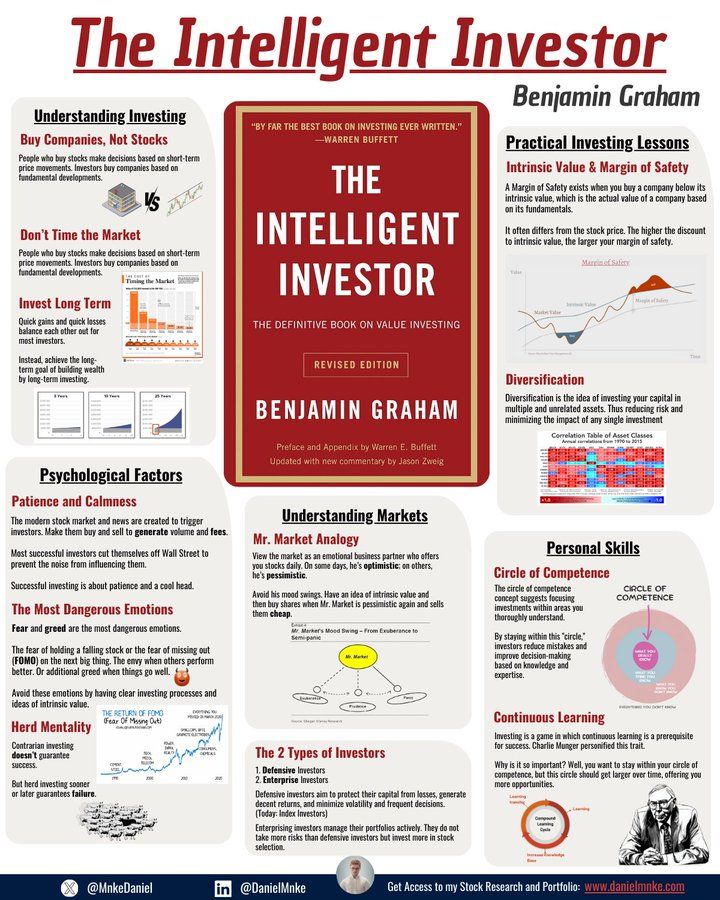

Investing with intelligence

Our latest research, commentary and market outlooks