Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Long-term investing cheat code

Buying SP500 $SPY near the 200-week has basically been free money for 15 years. Wild. Source: Trend Spider

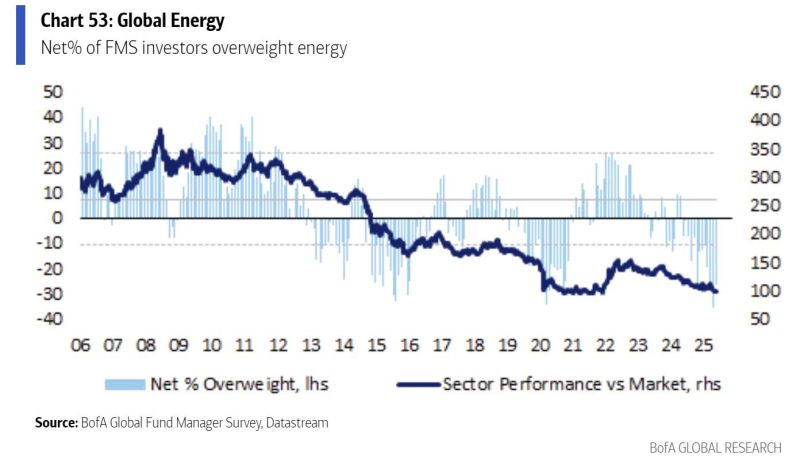

Investors hold very little exposure to energy stocks today, from a relative perspective.

This is often the kind of setup that leads to a meaningful shift in positioning. Source: Otavio (Tavi) Costa @TaviCosta, BofA

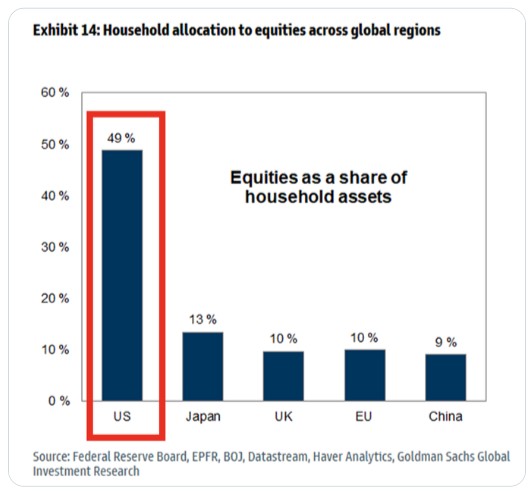

US households own WAY more stocks than in other major markets: US household allocation to equities sits at ~49%.

Source: @GlobalMktObserv

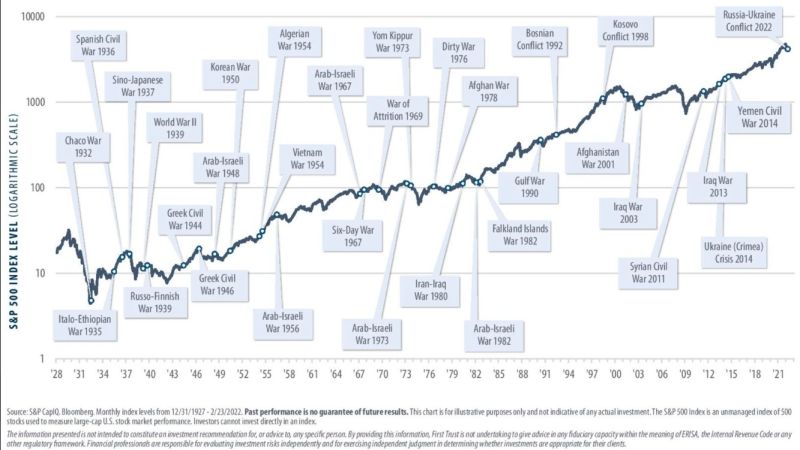

The long-term story of the S&P 500 — through the war, the fear, the crisis

source : s&p, bloomberg

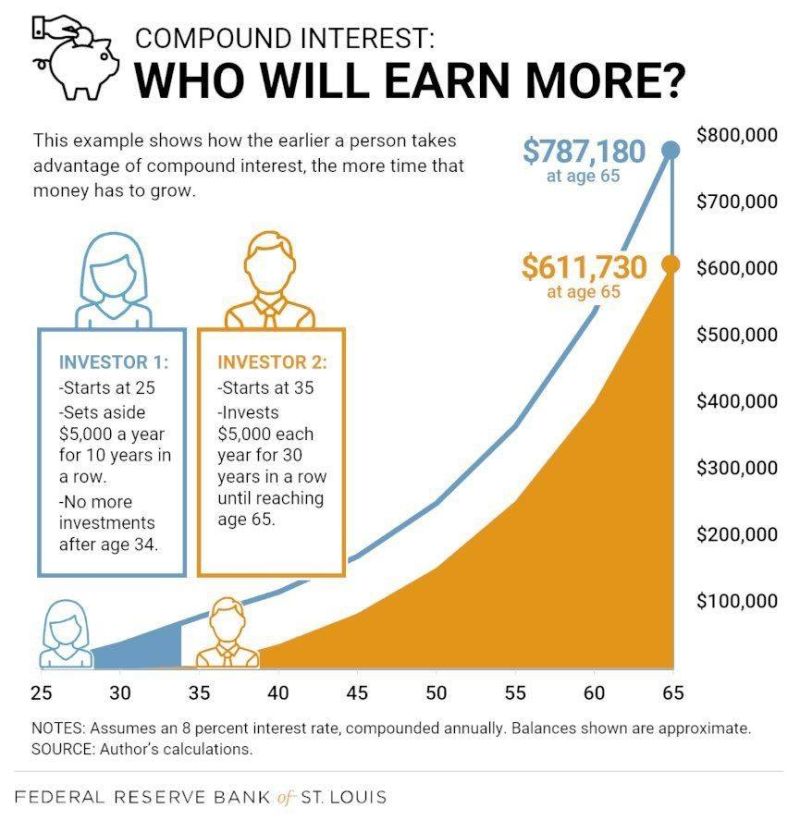

The Importance of Starting Your Investing Journey As Early As Possible

Source: Dividend Growth Investor

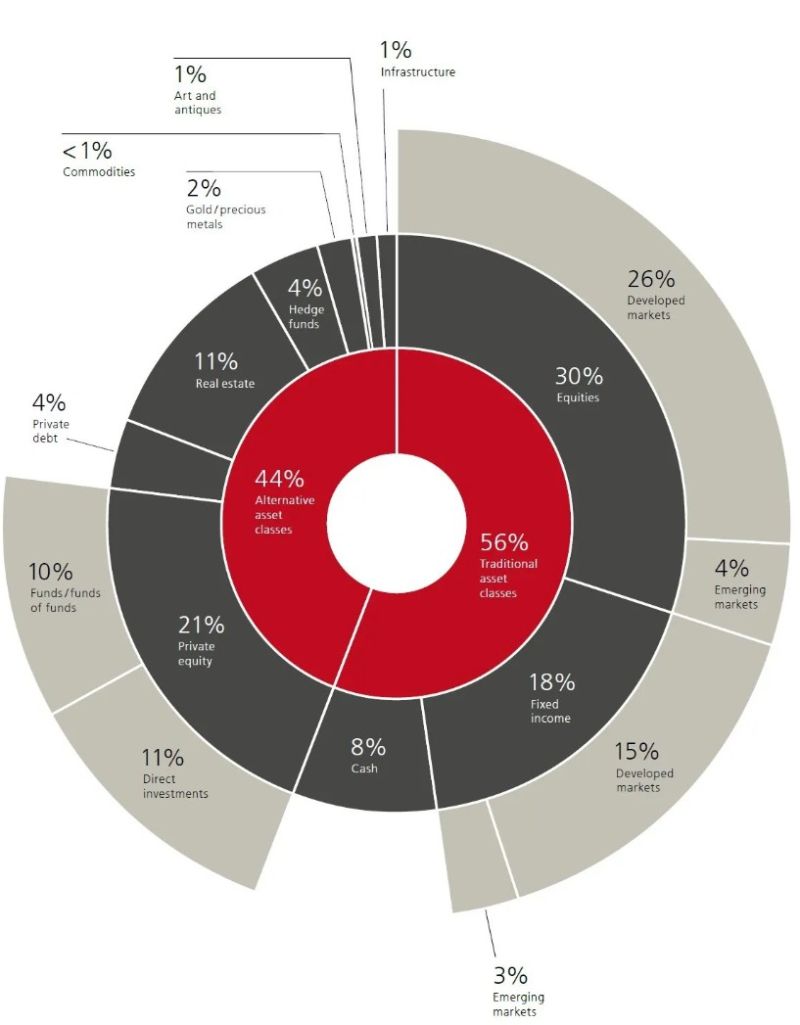

According to the aggregate strategic asset allocation of family offices published in the latest UBS Global Family Office Report, gold is NOT a crowded trade, far from it...

I don't see an allocation to bitcoin either by the way. file:///C:/Users/cmonchau/Downloads/global-family-office-report-desktop2025.pdf

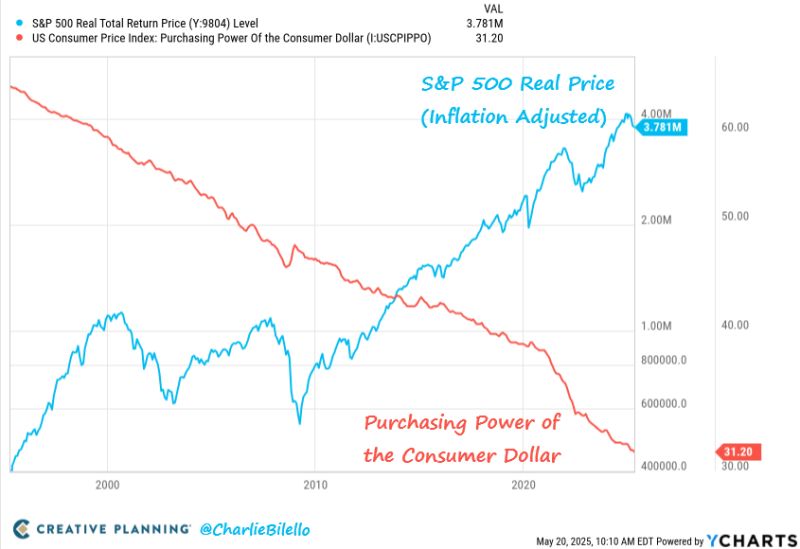

Why you need to invest, in one chart...

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks