Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

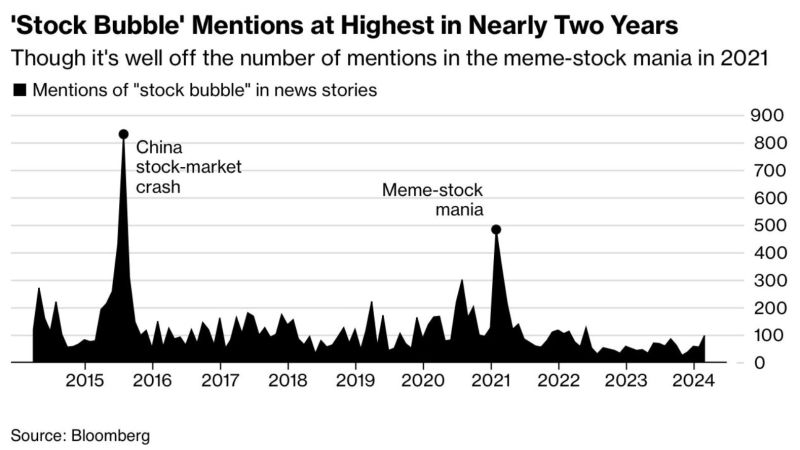

Stock Bubble mentions in the media are at 2-year highs but still well short of the meme-stock mania period in early 2021

source : bloomberg, barchart

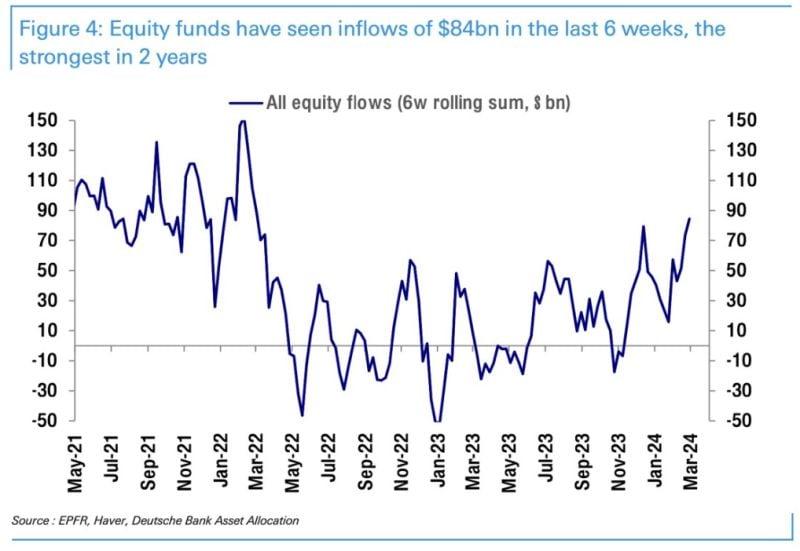

Global Equity Funds have seen inflows $84 billion over the last 6 weeks, the highest amount in 2 years

source : deutsche bank, barchart

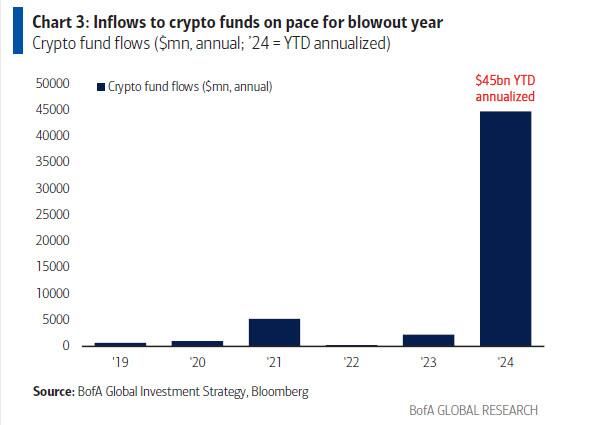

Inflows to crypto funds

The recent approval of bitcoin ETFs, which has enabled record crypto fund inflows, to the tune of $7.7 billion already which blows all of 2021's $5.2 billion inflows (the year when bitcoin hit its previous all time high) away, which also means that the current explosion in crypto is taking place with far less leverage. Annualize that, and you get a shocking number. Source: BofA

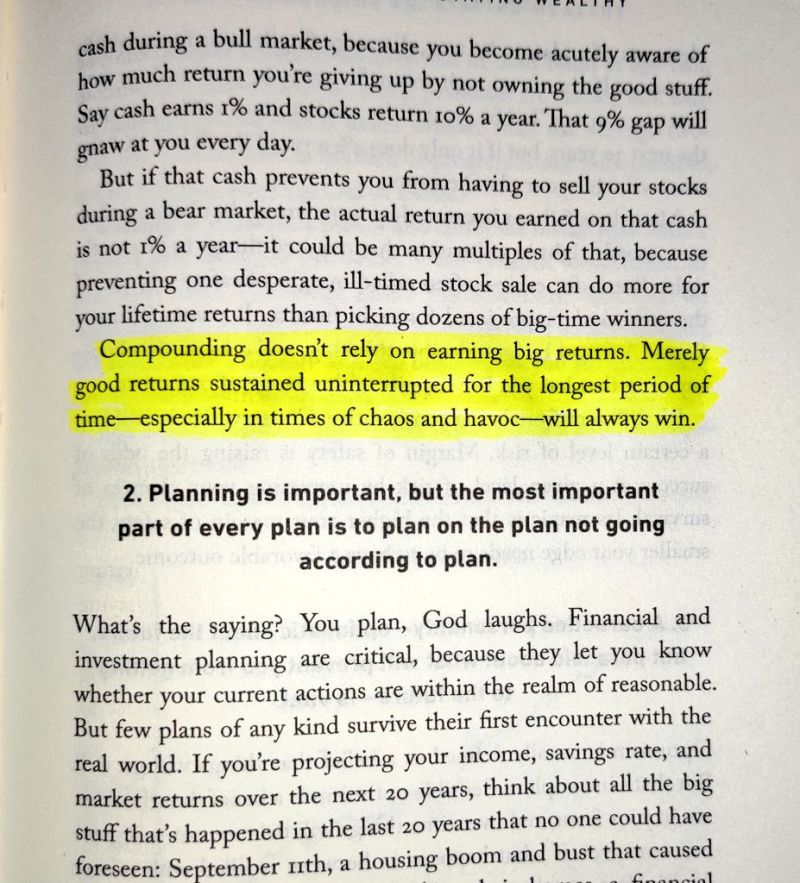

Compounding doesn't rely on earning big returns

Merely good returns sustained uninterrupted for the longest period especially in times of chaos and havoc-will always win Source: Investment books (Dhaval)

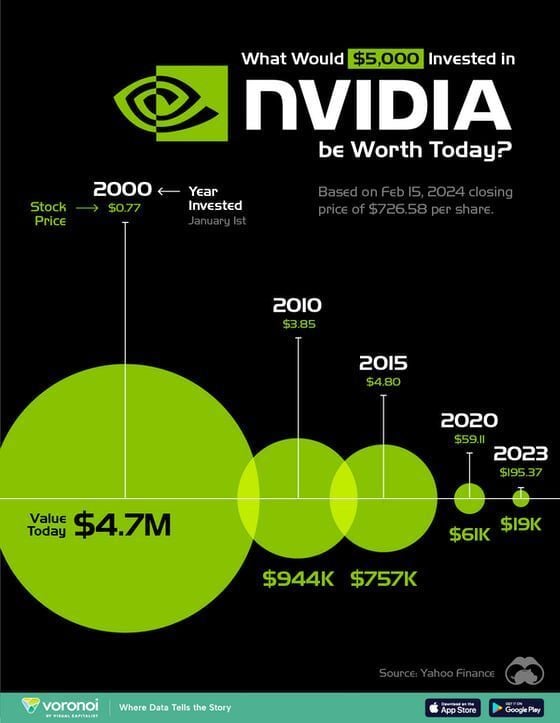

Wow. If you had invested $5,000 in $NVDA back in 2000 you'd have $4.7M today. 😮

Source: Markets & Mayhem

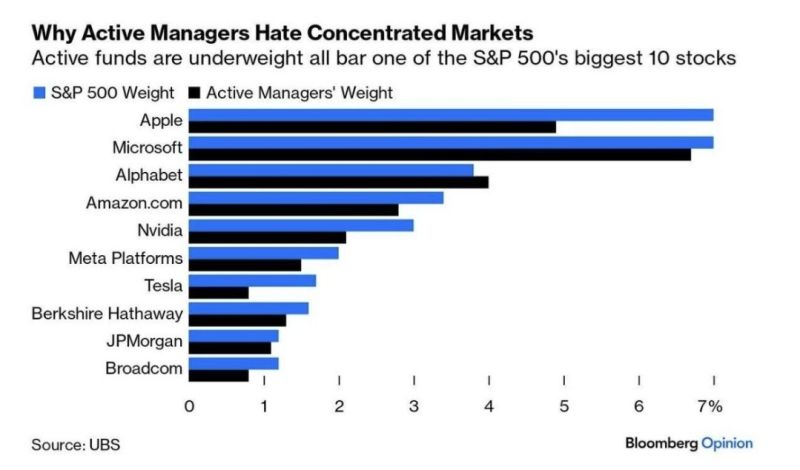

Active Funds are underweight all of the S&P 500's largest 10 stocks except for Alphabet $GOOGL. The underweights are most likely driven by diversification / regulatory rules

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks