Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

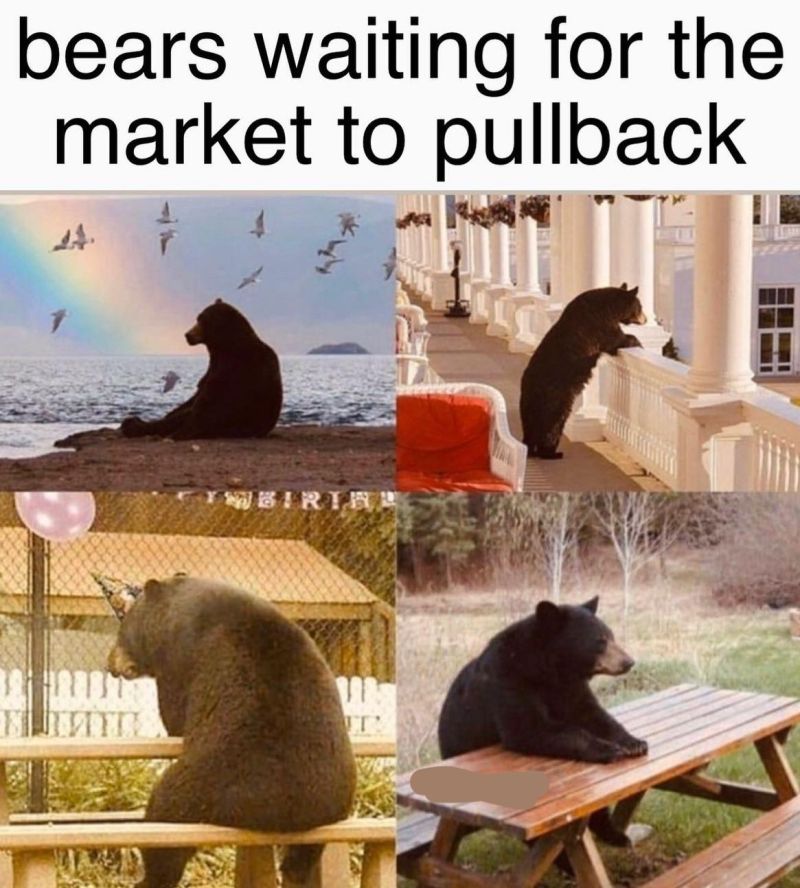

November has been a very long month of frustration for the bears

Source: Trend Spider

For some shoppers, the upcoming holiday season may lead to piling on more debt

About 25% of Americans are still paying off holiday debt from 2022, according to WalletHub’s November holiday shopping survey. But those already carrying a balance could find themselves sinking further into the red if they don’t get a handle on their credit card debt. “If you’re in a hole, stop digging,” Ted Rossman, Bankrate’s senior industry analyst, tells CNBC Make It. One reason you may want to avoid racking up more debt is that higher interest rates are making it more expensive to pay down. As of November, the average credit card interest rate has risen from around 16% to nearly 21% since the Federal Reserve began raising interest rates in March 2020 in an effort to combat inflation, according to Bankrate. A higher interest rate means it could take longer and be more expensive to pay down your credit card debt. Source: make it, www.zerohedge.com

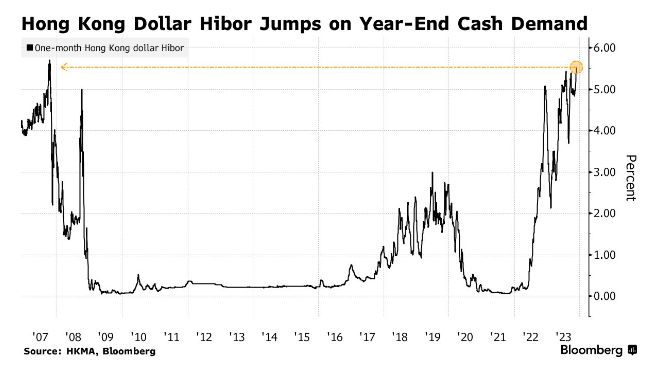

Hong Kong local bank rate (HIBOR) jumped to its highest level in 16 years

Source: Barchart, Bloomberg

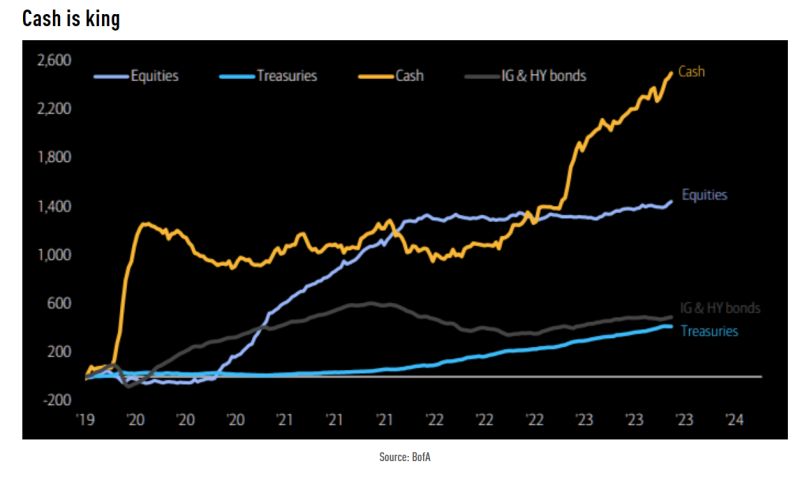

Nothing new, but imagine the huge cash pile starts feeling the equities FOMO...

Source: BofA, TME

10 Accounting KPIs everyone should know

By Compounding Quality / Chris Quinn

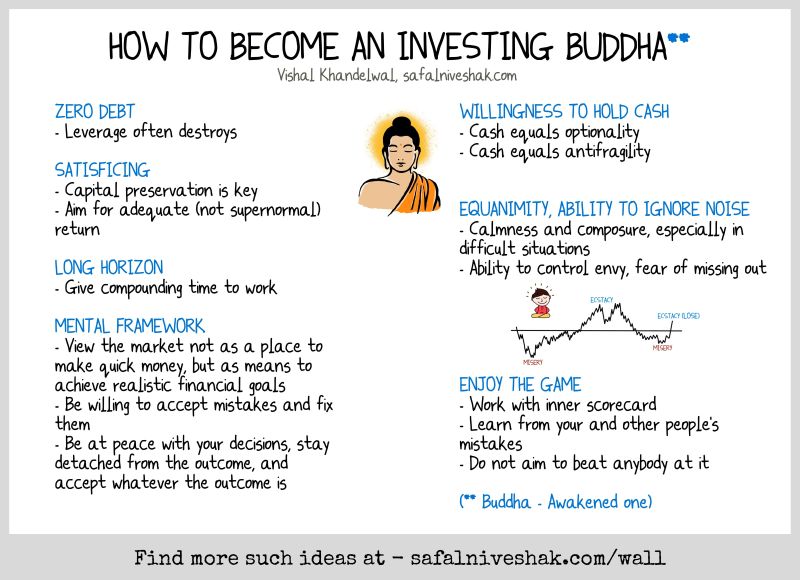

How to become an investing Budha

Source: Vishal Khandelwal, Safal Niveshak

According to an FT article published on Tuesday, Blackstone is to close a fund that offers investors exposure to a range of hedge funds and other trading strategies

This comes after assets fell nearly 90 per cent in four years amid lacklustre returns. The US alternative asset manager has told investors it will wind down the Blackstone Diversified Multi-Strategy fund by the end of the year, the group told the Financial Times. The so-called Ucits fund is governed by EU rules that make it easier for non-specialist investors to buy. Multi-strategy Ucits funds such as this are in part an attempt by managers to capitalise on the success of giant hashtag#hedgefunds such as Citadel and Millennium, which employ teams of traders across a wide range of strategies and which were among the biggest hedge fund winners from the coronavirus pandemic. The fund’s closure, which has not previously been reported, demonstrates how hard it can be to capture and package that success for a wide audience. Source: Financial Times

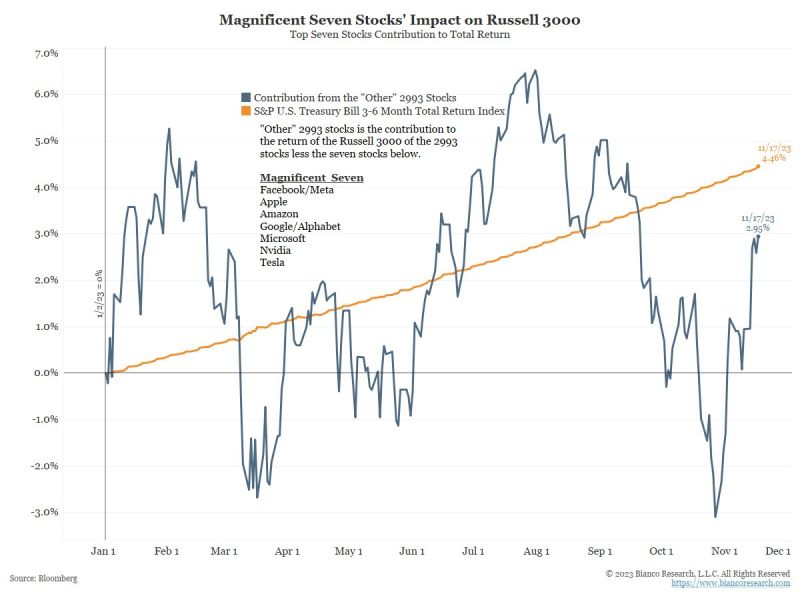

US stocks (Russell 3000) less the Mag 7 is up only +2.95% this year. It is thus underperforming cash for the second straight year.

Source: Jim Bianco

Investing with intelligence

Our latest research, commentary and market outlooks