Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

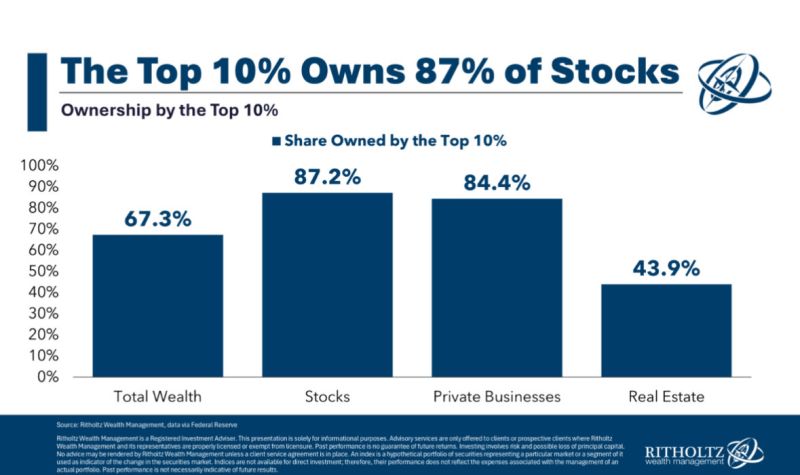

The "K-shaped" economy in one chart...

The top 10% of American households own 87% of all stocks, nearly 85% of all private businesses and 44% of Real Estate Another way of looking at this: The bottom 90% increasingly don’t matter in official economic data Source: Amy Nixon @texasrunnerDFW

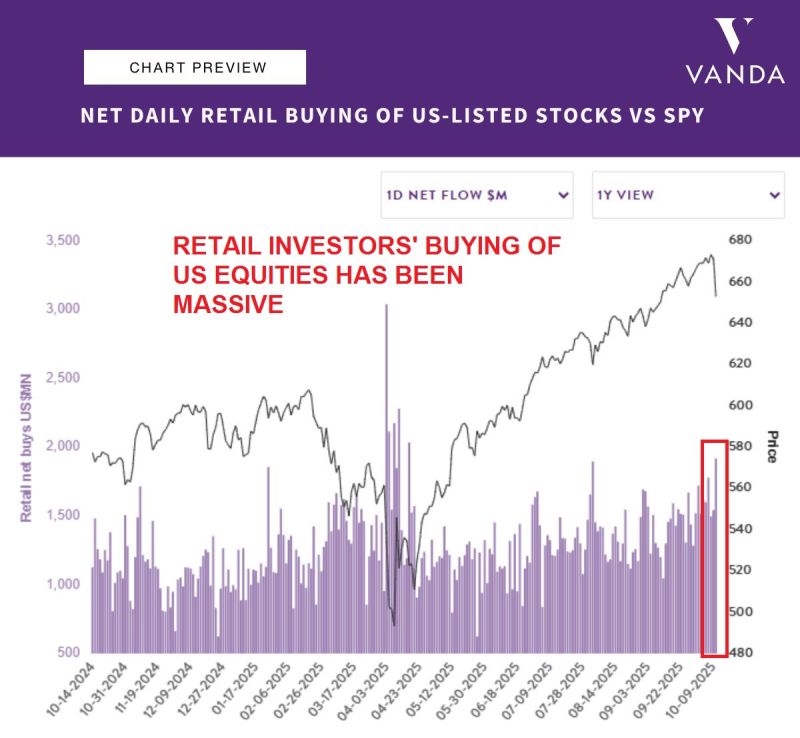

Retail investors bought nearly $2 BILLION of US stocks on Friday, Oct 10, following the market pullback.

This marks the BIGGEST buying day since the April 2025 sell-off and one of the largest on record. Mom-and-pop investors are still buying the dip. Source: Global Markets Investor, Vanda

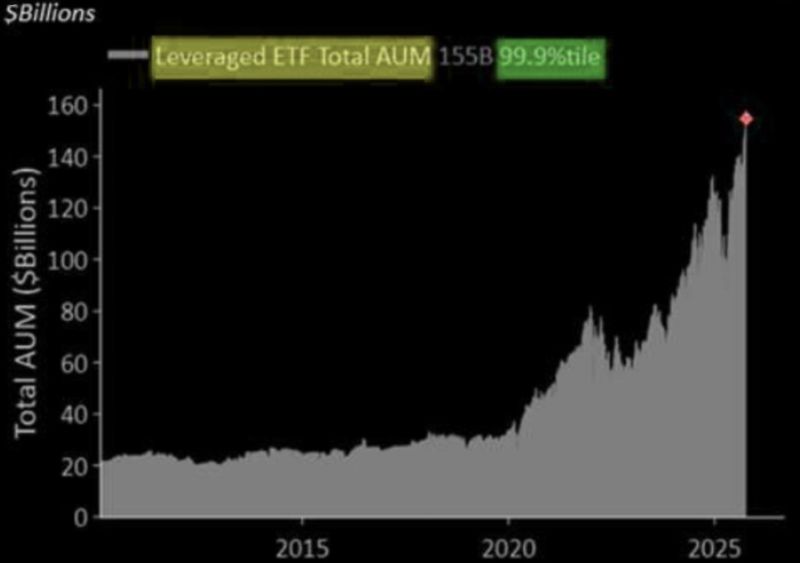

Leveraged ETFs now have almost $160 Billion in assets, a new all-time high 🚨🚨

Source: Barchart

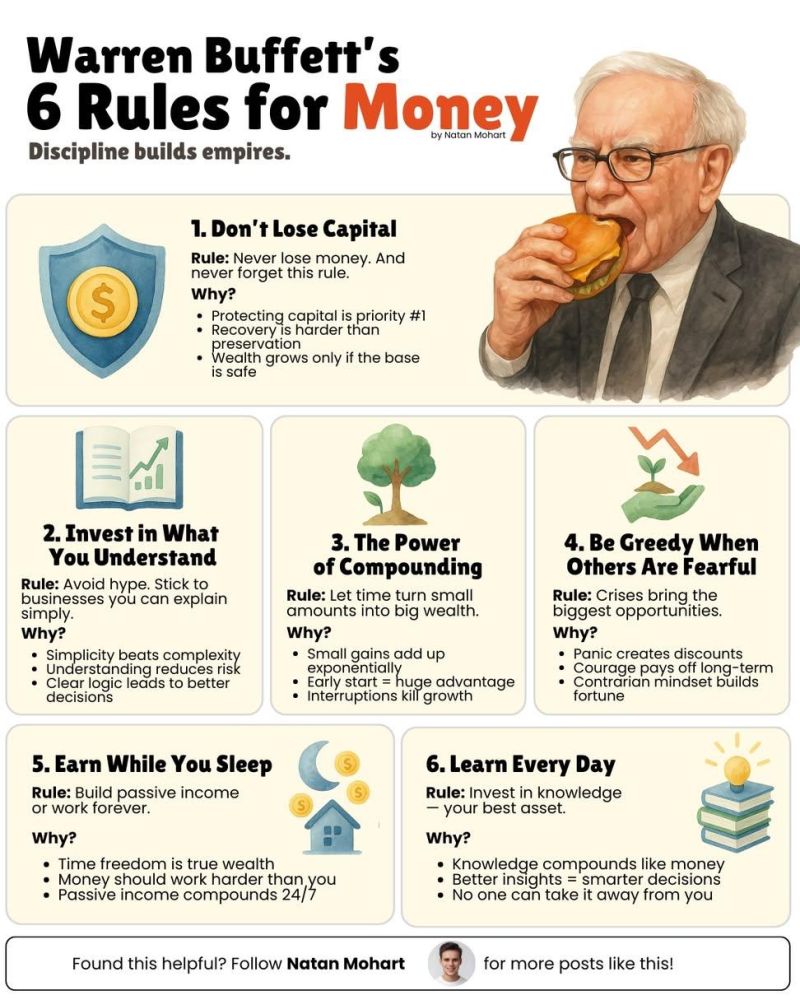

Warren Buffett's 6 rules for money

Source: Investment Books (Dhaval) @InvestmentBook1

Warren Buffett's Financial Statement Checklist

Source: Compounding Dividends @CompoundingW on X

Are you waiting for a Bear Market to invest?

This is a great idea in theory, but historically only 20% of future Bear Markets brought prices below prevailing levels. Source: Charlie Bilello

Stocks just saw the largest weekly inflow all year from retail investors

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks