Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

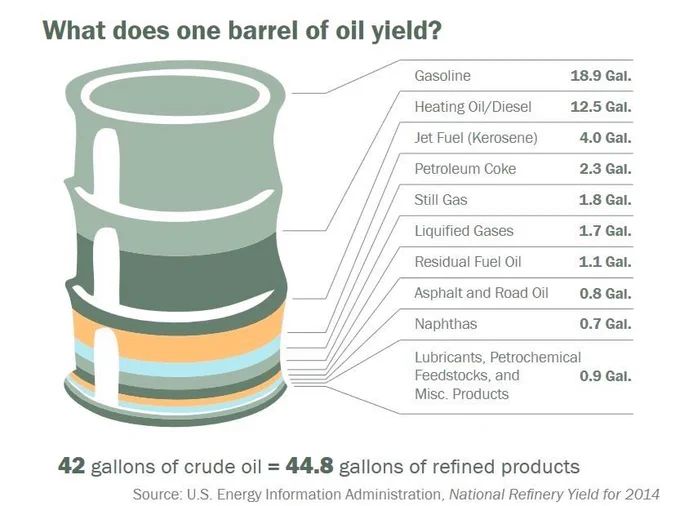

A potential black swan which could follow this week-end attack: both Saudi & Iran oil supply going down?

Source chart: Bloomberg

What could be the impact on oil markets of the sudden war between Israel and Hamas (and the risks it could escalate)?

What could be the impact on oil markets of the sudden war between Israel and Hamas (and the risks it could escalate)? Some analysts see upside risk to à150 - others (e.g GS) are more mitigated. Reduced probability of Saudi-Israeli normalization and associated boost to Saudi production. The Wall Street Journal reported on Friday afternoon (before the attacks) that “Saudi Arabia has told the White House it would be willing to boost oil production early next year if crude prices are high—a move aimed at winning goodwill in Congress for a deal in which the kingdom would recognize Israel and in return get a defence pact with Washington, Saudi and U.S. officials said.” In GS view, the escalating conflict in Gaza reduces the likelihood of a near-term normalization in Saudi-Israeli relations. Source: www.zerohedge.com, WSJ, GS, Alpine Macro

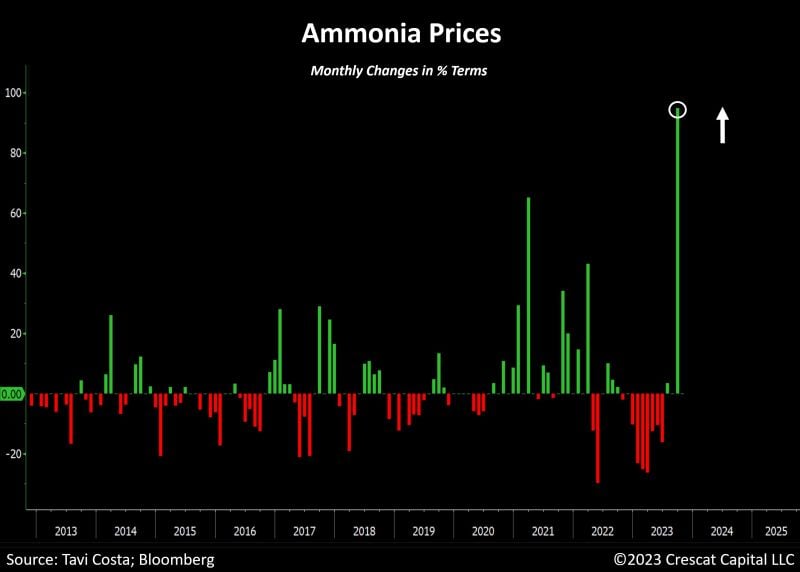

Chart by Tavi Costa -> Ammonia prices just had the steepest monthly increase on record.

Commodity cycles typically follow a rotational pattern, and these price spikes are not isolated incidents.Oil recently rallied, gasoline prices increased, natural gas started to rise, and now ammonia looks to be initiating its move. This is an inflationary era and an unmistakable one. Source: Tavi Costa, Bloomberg

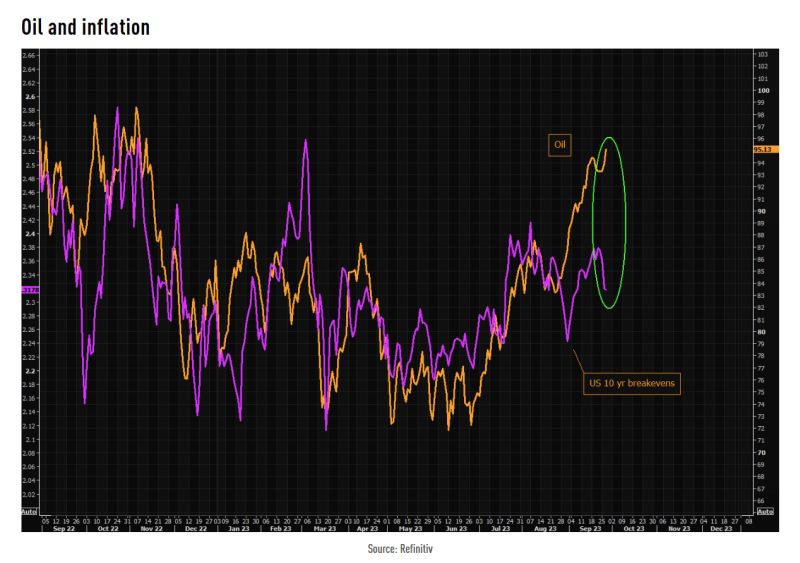

Looks like oil prices and bond yields have decoupled

Although the oil price has crashed sharply in the past 2 days, US 10y yields have fallen only slightly. Source: HolgerZ, Bloomberg

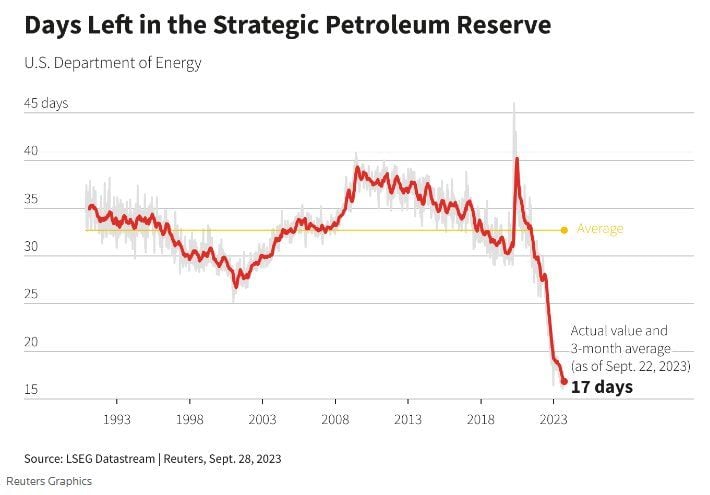

According to Reuters, the US currently has just 17 days of supply left in the Strategic Petroleum Reserves (SPR)

This is roughly half the historical average of ~33 days dating back to 1990. Meanwhile, oil prices are still almost 30% above the target price the US is set to refill… Source: The Kobeissi Letter

The gap between oil and 10 year breakevens is huge...

Does it mean that the market sees higher oil prices as a "growth killer" and thus disinflationary at some stage? Source chart: TME, Refinitiv

Oil is up 30% this quarter but is there more to come?

As tweeted by The Kobeissi Letter, Russia and 3OPEC are now cutting a massive 4 million barrels per day of crude oil production. This is the highest level of production cuts outside of recessions over the last two decades. As Saudi Arabia and Russia extend production cuts of 1.3 million barrels per day, supply is going to remain limited for a while. OPEC has proven multiple times over the last three years that they are committed to higher oil prices. Source: The Kobeissi Letter, JP Morgan

Investing with intelligence

Our latest research, commentary and market outlooks