Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

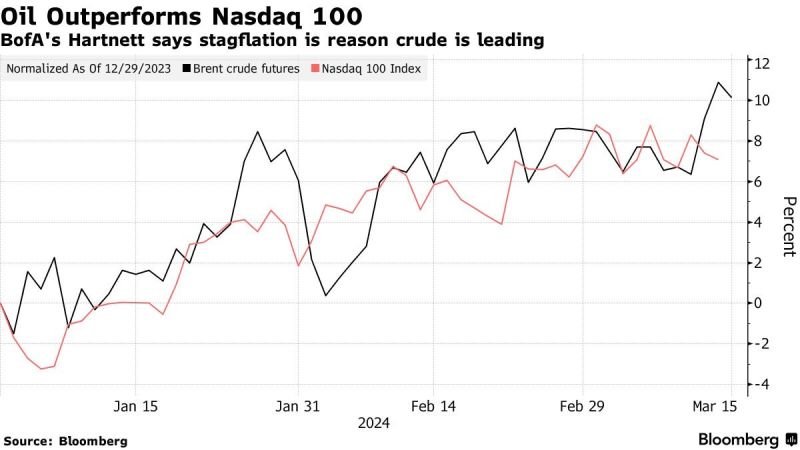

Believe it or not oil is outperforming the NASDAQ this year

Source: Bloomberg

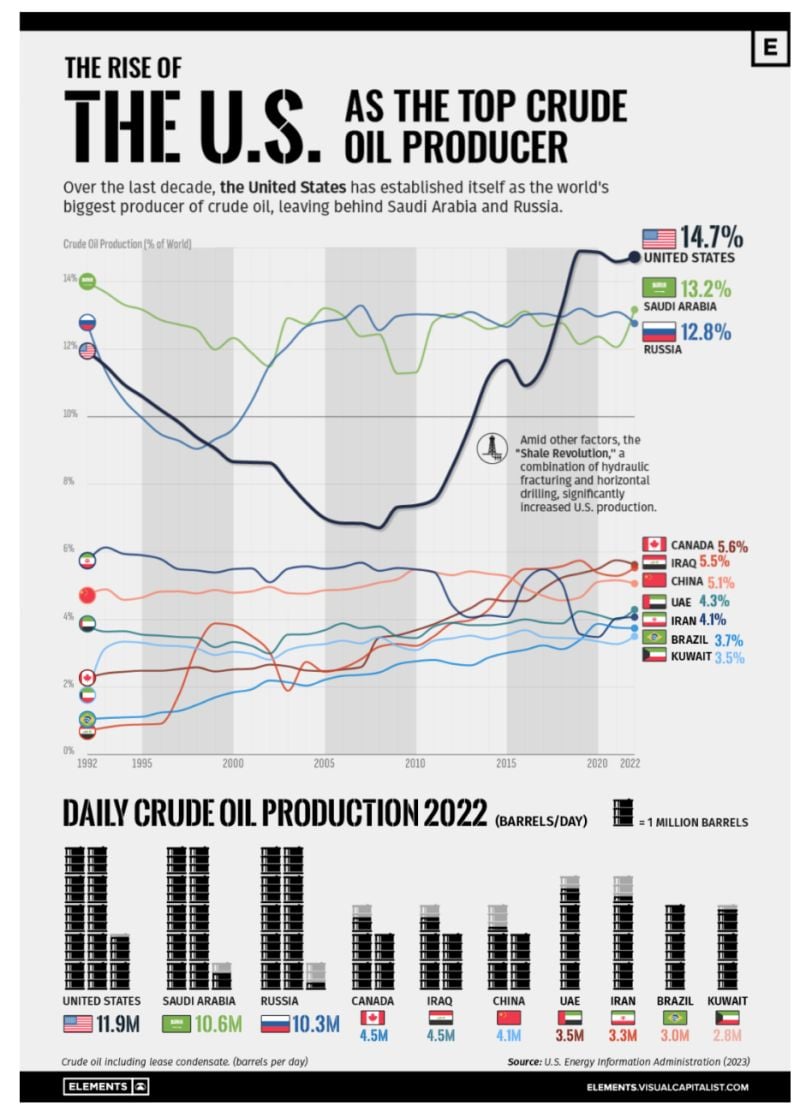

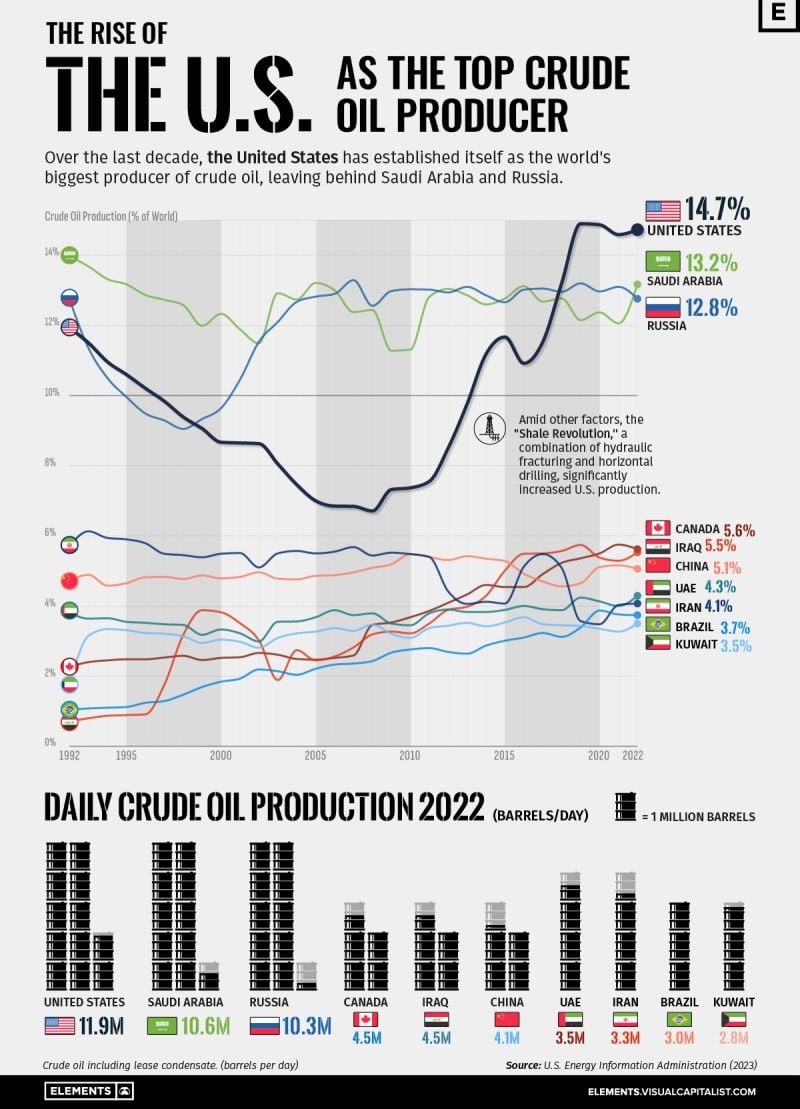

Visualizing the Rise of the U.S. as Top Crude Oil Producer - by Elements & Visual Capitalist

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia. This infographic illustrates the rise of the U.S. as the biggest oil producer, based on data from the U.S. Energy Information Administration (EIA).

The US is pumping more oil than any country in history

US crude production has surpassed every record in history for six years in a row, the US Energy Information Administration wrote on Monday. Its latest peak reached in 2023 is unlikely to be broken by any near-term competitor, it said.Including condensate, last year's US crude production averaged 12.9 million barrels per day, eclipsing the 2019 global record of 12.3 million barrels per day.A monthly record also occurred in December, at over 13.3 million b/d. Source: business insider

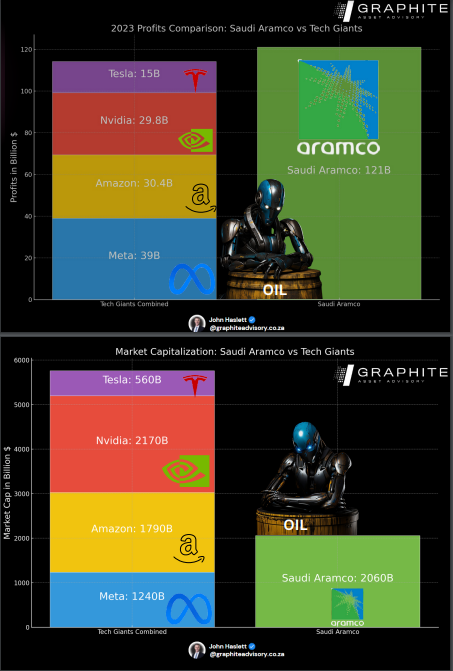

Great visual on Saudi Aramco

By Graphite Asset Advisory / John Haslett, CA(SA), FRM

Saudi Arabia, de facto leader of the Organization for the Petroleum Exporting Countries, will extend its voluntary crude production cut of 1 million barrels per day until the end of the second quarter

-> the state-owned Saudi Press Agency said Sunday, citing a source from the country’s Ministry of Energy. Riyadh’s crude production will be approximately 9 million barrels per day until the end of June, the announcement said..$ Russia will trim its production and export supplies by a combined 471,000 barrels per day until the end of June, Russian Deputy Prime Minister Alexander Novak said Source: CNBC https://lnkd.in/eJWWckDe

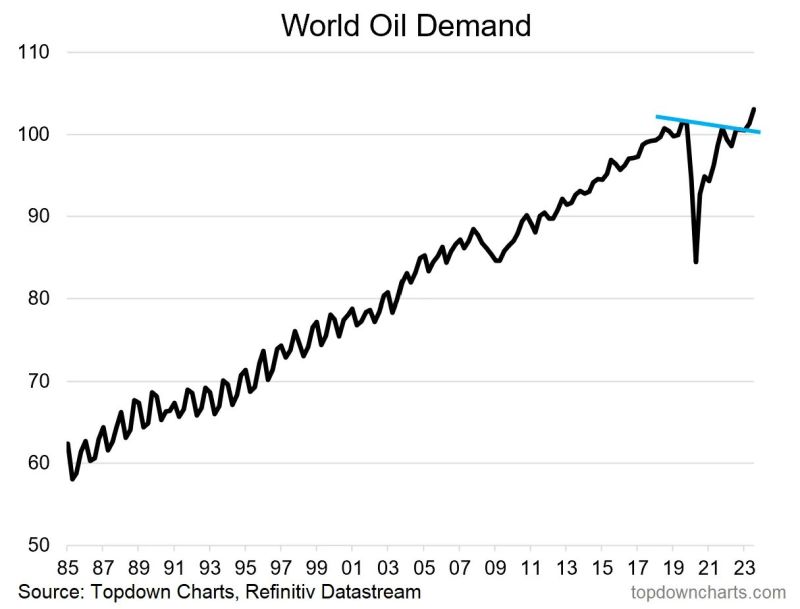

World oil demand is breaking out to new all-time highs.

Source: Topdown charts

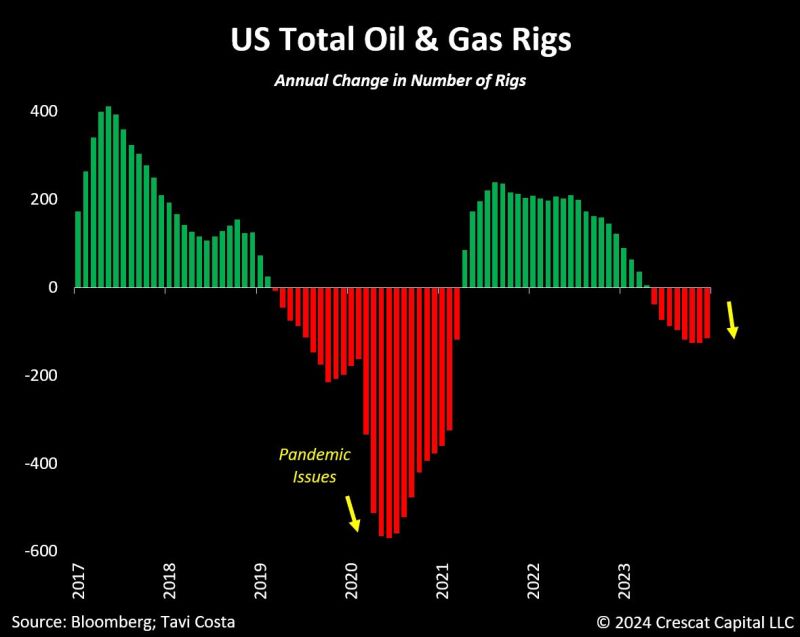

Oil rigs are now contracting the most since the pandemic issues.

As highlighted by Tavi Costa -> US GDP is nearly 30% higher than pre-pandemic levels, while oil production remains at approximately the same level as it was in early 2020 Source: Bloomberg, Crescat Capital

Visualizing the Rise of the U.S. as Top Crude Oil Producer 🛢️

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks